| Home | About Us | Resources | Archive | Free Reports | Market Window |

How the Bernanke Asset Bubble EndsBy

Tuesday, June 4, 2013

Yasushi Mieno made it his personal mission to prick the largest bubble in financial history.

He succeeded.

You may not know his name... but you need to understand his story. It will help you understand exactly when to get out of this incredible stock-market and real-estate boom before it busts.

Let me explain...

Stocks continue to soar – up 16% so far this year. U.S. home prices are up 12% in the last 12 months.

Longtime readers understand why asset prices are moving higher. It's the Bernanke Asset Bubble.

Remember, this is the simple idea that asset prices – like stocks and real estate – can soar to unimaginable heights, thanks to the Federal Reserve's commitment to printing money and keeping interest rates at zero for years.

Of course, this won't end well. But we need to hold on as long as possible. Based on history, we need to hang on until we see the next Mieno...

Mieno took over Japan's central bank on December 17, 1989. At the time, Japan was in an insane stock-market and property bubble...

To give you an idea of how extreme Japan's asset bubble was, the real estate grounds of the Imperial Palace in Tokyo were supposedly worth more than the entire real-estate value of California.

Mieno thought Japan's asset bubble had gotten ridiculous. So he made it his personal mission to prick Japan's bubble in stocks and real estate.

Just one week after taking office – on Christmas Day 1989 – he raised interest rates. Four days later, Japan's benchmark stock index – the Nikkei – reached its all-time peak. It then started falling.

But the property market didn't fall...

So Mieno raised rates again. And again... and again. He raised them a total of six times until they reached 6% in August 1990.

That did the trick. Property prices started to collapse, too.

Japan has never recovered... Property prices and stock prices are still dramatically lower today – 23 years later – than they were in 1990.

So will the same thing happen in the U.S.? When is it time to start worrying that the current boom will end?

In the past, I've answered those questions with a number... The boom will end "when inflation rises above 5%."

But we also need to look out for the next Mieno in the U.S. – the next government official who is powerful enough to change things... and decides that stocks and real estate must come down.

Just as Fed Chairman Ben Bernanke has single-handedly pumped up the U.S. stock market and real-estate market today, Mieno single-handedly brought down Japan's stock and property markets in 1990.

Bernanke is our Bubble Man. His policies are putting money in our pockets through the stock and real-estate markets.

But who is the next Mieno? Who is the person who will take it all away from us?

I try to have the answers for you here in DailyWealth – or at least give you my best guess – but I don't know yet.

I CAN tell you he or she likely won't get here before 2015. As I've explained before, the Bernanke Asset Bubble will continue at least that long.

And until the next Mieno arrives, we have the opportunity to make a lot of money...

Good investing,

Steve

Further Reading:

Last year, Steve explained why 5% inflation is the number to watch... and included one of the most important charts we published all year. If you want to know when it's "time to get worried," click here.

The Bernanke Asset Bubble isn't just playing out in the U.S. It's gone global... Asset prices are up around the world. And it's not over yet. Steve believes this is a "once-in-a-lifetime opportunity." Read more here.

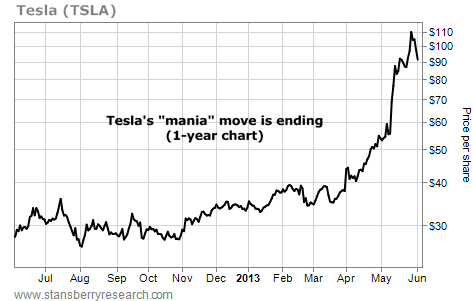

Market NotesTHE NEXT MOVE FOR THIS "MANIA" STOCK IS DOWN One of the wildest stock stories of the year just reached an ugly new chapter...

The story is Tesla Motors (NASDAQ: TSLA). Tesla makes expensive sports cars that run on electricity. Electric cars appeal to environmentally conscious and economically ignorant buyers. After all, most of the electricity produced in America comes from coal and natural gas. In other words, Teslas end up burning hydrocarbons... just not the kind you find at the gas station.

For much of the past few years, Tesla stock treaded water around $30 per share. But this April, Tesla said it expected to earn a profit in the coming quarter. Shares moved 42% higher on the news... and then the hype surrounding electric cars helped it enter a "mania" move. In just two months, the stock gained 189%.

But as you can see from the chart below, this mania move is ending. Tesla shares peaked at $110 last week. They're down to $91 now. The short-term hype surrounding Tesla is ending... and the ride back down will be painful.

|

In The Daily Crux

Recent Articles

|