| Home | About Us | Resources | Archive | Free Reports | Market Window |

Why I Believe Stocks Should Rise 1,000 Points by 2015By

Tuesday, July 23, 2013

"Mom and Pop America are about to pour into stocks... pushing the market to new heights," I explained in March.

I called this coming move into stocks the "Great Migration." And I told you "if you understand this and position yourself correctly, you could make a ridiculous amount of money."

Since March, the S&P 500 and the Dow have broken out to new all-time highs. The Great Migration is happening right now.

The S&P 500 is up 11%. That's an annualized gain of nearly 32%. But this is just the beginning. You haven't missed it yet. And I still believe we're in for another 1,000-plus points worth of gains – that's 60% – by 2015...

The basis for this "crazy" claim comes from a simple idea about "value" in general... and "relative value" in particular. My belief is, even after a big move so far in 2013, U.S. stocks are still cheap.

The most classic measure of whether stocks are cheap or expensive is the price-to-earnings (P/E) ratio.

Since 1950, the S&P 500 has traded for an average P/E ratio of nearly 18. Right now, stocks are cheaper than that, at a P/E ratio of about 15.

So stocks are cheaper than average. But when you dig a little deeper, the story gets much better...

You see, when interest rates are high, people have other investment choices. They can put their money into CDs or bonds paying double-digit interest rates. So P/E ratios are typically low when interest rates are high.

But when interest rates are low – like today – CDs and bonds don't offer much competition for stocks. History shows us this is true. For example, when short-term interest rates have been low (defined as below 2.5%), the S&P 500 has historically traded for an average P/E ratio of nearly 22 – much higher than today.

If you think about that, it makes sense that stocks attract more money when interest rates are low... people need somewhere to put their money. Folks are starting to realize that right now, and they're pushing stock prices higher. That's the Great Migration.

Based on today's ultra-low rates, the fair value for the S&P 500 is well over 2,000. But again, the story gets better based on some simple math...

Let's assume that stocks trade up to a P/E of 20 in 2015 – not much above their average since 1950. And let's assume analysts' 2015 earnings estimates are right – they currently estimate earnings of 135.2. Then we'll see the S&P 500 at over 2,700...

That's more than a 1,000-point gain and a 60%-plus return!

These aren't pie-in-the-sky numbers. And this isn't me hoping for the best. This is what I believe is likely to happen, based on history. (I don't know anyone else as optimistic on stocks as I am, but that's fine with me. Remember, we've been right all along.)

Stocks had a great first half in 2013. And the Great Migration is clearly underway.

This is truly one of the best times in my career to buy stocks... We have a green light from Fed Chairman Ben Bernanke. And with ultra-low rates and room for the P/E ratio to go up, we have a real shot at a 1,000-point gain in stocks by the end of 2015.

Don't worry if you haven't bought stocks yet. You haven't missed it. But I suggest getting on it now. U.S. stocks are still an incredible opportunity.

Don't miss it!

Good investing,

Steve Sjuggerud

Further Reading:

While Steve is bullish on stocks through 2015, the market will inevitably undergo short-term corrections. You'll find Jeff Clark's words of caution in today's Growth Stock Wire here: Beware of Rising Interest Rates.

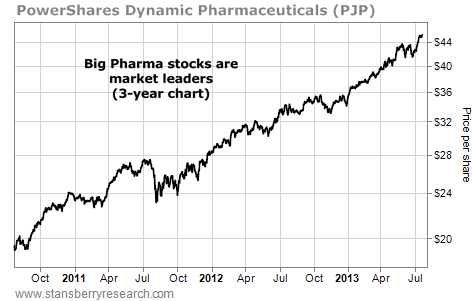

Market NotesDOC WAS REALLY, REALLY RIGHT! Today's chart is an update on our colleague Dr. David Eifrig's big call on Big Pharma. It shows he was really, really right...

Longtime readers are familiar with Doc's ideas on Big Pharma stocks, like Pfizer, Abbott Labs, and Eli Lilly. For years now, he has noted how aging Baby Boomers are driving pharmaceutical and medical-service consumption. Plus, government programs like "Obamacare" will drive increased demand for drugs.

An easy way to monitor (and invest in) Big Pharma stocks is the PowerShares Dynamic Pharmaceuticals Fund (PJP). This fund is a "one click" way to buy a diversified basket of drug stocks.

At the DailyWealth office, we keep tabs on over 50 investment funds that cover all kinds of sectors, commodities, and countries. Of all the funds we monitor, PJP is at the top when it comes to highest returns over the past three years... and it's up nearly 150%. Well done, Doc!

|

In The Daily Crux

Recent Articles

|