| Home | About Us | Resources | Archive | Free Reports | Market Window |

|

Editor's note: Today, we're wrapping up our weeklong series on the elite class of stocks we believe every individual investor should own. In this last essay, we're revealing the greatest power in all of investing. If you want to learn how to generate huge amounts of income without worrying about the stock market, read on...

A Worry-Free Way to Supplement Your Income in the Stock MarketBy

Friday, August 23, 2013

Now that stocks and real estate have soared over the past few years, a lot of bright people expect a big market decline to hit any day now.

It makes sense to expect a correction. The S&P 500 is up nearly 50% in the past few years.

But if that decline arrives, there's an exclusive group of investors who couldn't care less...

These are the few folks who have "graduated" into a higher class of investor.

Let me explain...

Few people belong to this exclusive group because most folks are obsessed with short-term gratification. They pore over tiny market movements, news releases, CNBC clips, and other things that are meaningless in the "big picture."

These people are always busy trying to get the market to do something for them... instead of using the greatest power in all of investing.

That power is TIME. And used properly, time causes extraordinary things to happen to your portfolio. Time allows you to generate huge amounts of income. Used properly, time makes it so you don't care about the moods of the stock market.

The investors who don't care about market corrections are the ones who have learned how to buy "World Dominating Dividend Growers" at good prices and hold them for years.

World Dominating Dividend Growers are the world's biggest and best dividend-paying businesses. They are names you see every day... like Johnson & Johnson and Coca-Cola. Investors who buy these stocks at cheap prices and hold them for years enjoy the phenomenon of wealth creation.

Here's how it works...

An investor who bought dividend-machine cigarette-maker Altria back in May 2009 at $17 per share is now earning more than a 10% yield on his purchase price.

Now... do you think that guy cares about a 10% or 20% stock-market correction?

Do you think he cares about another 5% decline in home prices?

No way.

He's comfortable knowing that no matter what the stock market does, folks are still going to smoke cigarettes tomorrow. He knows another Flash Crash could come around and he would still get that 10% yield on his shares. They could shut the market down for a year and he'd still get his money.

That's extraordinary peace of mind most investors will never enjoy... because they're obsessed with short-term gratification.

The obsession with short-term gratification causes people to "miss the boat" on the incredible income power of World Dominating Dividend Growers. Most World Dominating Dividend Growers don't pay out huge current yields. They pay current yields of around 3%-4%... and then "grow" their way to pay shareholders 10% and 20% yields.

These yields end up as the safest, largest income streams you'll find anywhere.

Here's how my colleague Dan Ferris explains it...

If you're earning a 25% (and growing) yield on a stock, do you care if the share price falls 20%? Heck no! Silver is down 8%? Oil is up $4 a barrel? Interest rates are up a quarter of a percent? This or that guru is predicting a stock-market decline? Big deal.

No matter what the day-to-day hype stories are, the "biggies" of the corporate world – companies like Johnson & Johnson and Coca-Cola – will still be No. 1 in their industries.

They'll still have giant, insurmountable competitive advantages. They'll still have thick profit margins. They'll still generate huge cash flows. They'll still direct a portion of those cash flows to shareholders through ever-increasing dividends.

For most folks, short-term trading takes up too much time. It causes too much stress. It causes sleepless nights. It generates high fees. It drains mental energy. But if you own a World Dominating Dividend Grower portfolio, you won't worry about much.

All you need is TIME.

Think of it like planting a money tree. It's small today, but over time, it will grow to be a worry-free bonanza.

Good investing,

Brian Hunt

Further Reading:

Lean how to put time – and the power of compound returns – to work for you in this two-part series from Doc Eifrig:

The Easiest Way to Make $1 Million in the Stock Market

"You're probably not interested in what I have to say," Doc writes. "It's not sexy. It's not a quick fix. But by embracing this strategy, you'll be on the road to riches... Retire Early with This Safe Stock System

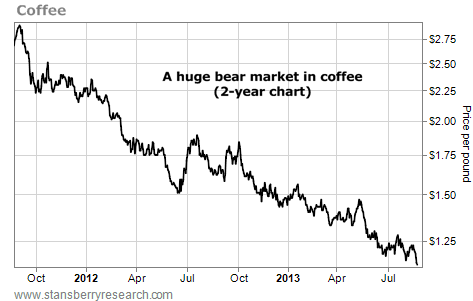

Doc's sister started with little, used his "secret" strategy, and saw it grow to millions of dollars. Market NotesTHE GREAT BEAR MARKET IN COFFEE Of all the members of the struggling commodity complex, few are faring worse than coffee.

Back in June, we noted how contrary to what most folks believe, raw-material prices haven't climbed much in the past eight years. In fact, the benchmark commodity index (the CRB) is currently at the same level as it was in 2005. It's also down 20% from its 2011 high.

One major laggard of the group is coffee. Due to a glut coming from the world's largest grower, Brazil, coffee prices have declined more than 50% in the past two years. Just this week, prices struck their lowest low in four years.

In the chart below, you can see this terrible, steady bear market... and look to enjoy buying cheaper coffee.

|

In The Daily Crux

Recent Articles

|