| Home | About Us | Resources | Archive | Free Reports | Market Window |

How to Easily Sell Dollars and Buy China's CurrencyBy

Friday, January 24, 2014

"China's currency is going to crush the dollar," Porter Stansberry said on his weekly Stansberry Radio podcast earlier this month.

Porter says the Chinese are striving to make their currency the world's most dominant currency – much faster than you expect.

So you want to get some of your money out of U.S. dollars, and into China's currency.

But how? On Tuesday, I shared one of my favorite ways to trade the renminbi...

And today, I'll show you two more safe, easy ways...

Why would you want to do this? The main reasons are simple... The U.S. government is the world's largest debtor, with some $20 trillion in debt. Meanwhile, China is now the world's biggest gold buyer AND it's the world's biggest gold producer.

On the radio show, Porter made a bold prediction. He said that China currency would "become fully convertible" THIS YEAR. That means that it would be easily tradable, just like euros or British pounds. Nobody is expecting that this soon.

So, how can you own China's currency now?

Right now, "there are some synthetic ways to own China's currency," Porter explained. "Banks in Singapore offer it, and I think maybe Everbank has a yuan [also known as the renminbi] option. I don't know how they do it."

I wanted to find out. So I called my longtime friend Frank Trotter, the founder of Everbank World Markets.

"It's no problem," Frank told me. "People can hold Chinese currency in their Everbank accounts."

I asked him what the catch was.

He explained that there's no "catch" – but more of a technicality... Everbank can't physically deliver to you Chinese currency... When you want your money back, you get it in U.S. dollars, not in Chinese currency. This is what most people would want anyway.

To reiterate, as long as your money is in Chinese currency at Everbank, it will appreciate (or depreciate) against the U.S. dollar.

Your money is not locked up at all, as far as I understand it. It is in a simple money-market account (that's paying no interest). If you want your money tomorrow, it's yours. You just get paid out in U.S. dollars, not in Chinese currency.

If Porter is right, and China's currency becomes freely traded, then maybe Everbank can send you a check or wire your money to you in Chinese currency. But as of now, they can't.

Your deposits are backed by Everbank. There is no FDIC guarantee of your principal (because the currency can go up or down in the time you hold your money there). But Everbank is a safe and sound bank (according to BankRate.com's ratings) that is publicly traded.

You can find details on how to hold Chinese currency in your bank account at Everbank here.

Another way to get exposure to China's currency would be through an exchange-traded fund like the WisdomTree Chinese Yuan Strategy Fund (CYB). You can find more details on that fund here.

Whether Porter's bold prediction is right or wrong, you definitely should consider diversifying some of your cash OUTSIDE of U.S. dollars and into China's currency...

Good investing,

Steve

Further Reading:

"China's growth has been crazy," Steve writes. "And I wouldn't rule out that its economy could overtake – even double – the U.S. economy by 2050." Get all the details here: Triple-Digit Upside in this Safe, Simple Trade.

DailyWealth classic: Last year, Porter Stansberry reported that "China desperately wants to return to its status as one of the world's great powers... with one of the world's great currencies. And as befits a first-rate power, China's currency is on the path to being backed by gold..." Get all the details here: The Largest Gold-Accumulation Plan of All Time.

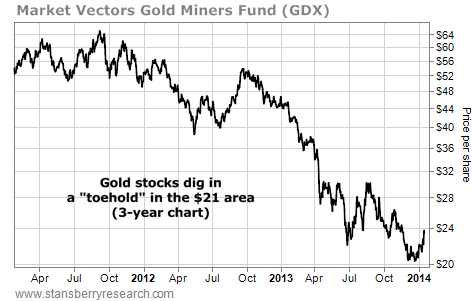

Market NotesANOTHER WAY TO TRADE GOLD On Wednesday, we noted that a tradable bottom was in for the gold market.

Of course, you can execute this trade by simply buying physical gold. You can also "juice" the trade by owning gold stocks.

Keep in mind, we don't see gold stocks as a good long-term investment... like we would an income-producing rental property or a blue-chip stock, like Coca-Cola. Gold stocks are more for traders. When it comes to them, we often say, "Rent, don't buy."

As you can see from the chart of the gold-stock fund GDX, gold stocks have suffered a huge decline over the past few years. But in just the past few months, GDX has dug in a "toehold" in the $21 area. Gold stocks are disliked by the public... and they are very cheap relative to gold. A "bad to less bad" rally is likely for the sector.

|

In The Daily Crux

Recent Articles

|