| Home | About Us | Resources | Archive | Free Reports | Market Window |

A NEAR-PERFECT Investing PortfolioBy

Tuesday, October 21, 2014

Everyone's scared...

After weeks of stomach-churning volatility, people are wondering...

What should I do with my money?

Most people will make the wrong choices, as their short-term emotions completely cloud their judgment.

Instead of worrying about today, you should take a look at the bigger picture...

What has worked over the long run?

Today, I'll share with you an incredibly simple portfolio. One that has been nearly infallible for four decades...

The numbers for this portfolio honestly seem too good to be true... So I asked my True Wealth Systems colleague Rick Crawford to verify and update them. He showed me that they ARE true.

Here's what he found:

This simple portfolio has made money in 40 out of the last 41 years. And in the one year that it lost money (2008), the loss was -0.6%. Keep in mind, the S&P 500 recorded a total loss of -37% the same year. So it's fair to call it the "Near Perfect" investing portfolio...

Not losing money is one thing... Making it is entirely another thing. And this portfolio delivers on both counts...

Using our True Wealth Systems databases, this system has delivered a compound annual gain of 10.3% – with dramatically less volatility than the stock market – going back over four decades.

The portfolio is incredibly simple, too... It's based on five different indexes, but you can mimic it using five low-cost exchange-traded funds (ETFs). And you only have to check on the portfolio on the first of each month.

Anyone can do it.

My friend Meb Faber (www.MebFaber.com) is the innovator of this portfolio. He calls it "Global Tactical Asset Allocation" or GTAA.

You make one decision for each of five ETFs at the beginning of the month – whether to buy it or not.

The five ETFs that you consider owning are:

That decision is not hard to make... No math is needed. It's based on one thing – whether the ETF is above its 10-month moving average. You can find out just by looking at this page. It charts each fund along with its simple moving average (SMA).

Meb answers a lot of questions about his system further down that page. (For the full details, see pages 15-34 here.)

Each month, you may be surprised which assets Meb's system tells you are buys. You may disagree some months. But you can't disagree with Meb's system's historical track record – which shows (barely) one losing year in the last 41 years.

If you are nervous about your investments these days... and don't know what do to... and if you're looking for a simple fix that works in just about every market environment, then check out Meb Faber's GTAA system...

Our True Wealth Systems computers have updated and confirmed Meb's numbers... This system has delivered 10.3% annualized gains over four decades... with much lower volatility than the stock market.

If you want to put your worried mind at ease, then consider putting some of your money to work in Meb's system...

Good investing,

Steve

Further Reading:

"The way I see it, this moment – right now – is the absolute perfect moment to be in as an investor," Steve writes. "It's a Goldilocks economy right now – not too hot, and not too cold... It's just right." Learn more here: Quit Your Complainin' – Instead, Take Advantage of This.

Last week, Amber Lee Mason described the stocks you want to own in a crisis... "These stocks generally fall less in a market panic... and recover more quickly." Find out what they are right here: The Safest Stocks in the World.

Market NotesA WELCOME BEAR MARKET As we wrote last week, the recent decline in crude oil has hammered oil stocks.

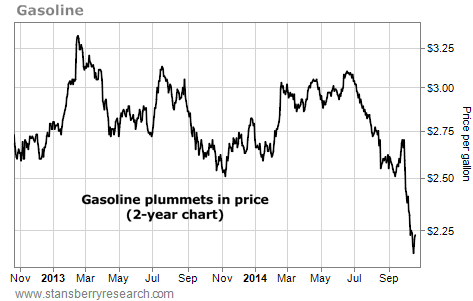

But it also brings good news for the average American. It has drastically lowered the price of gasoline. Today's chart displays what's going on.

Our chart displays the past two years' trading in the spot price of gasoline. As you can see, gasoline has traded in an area of $2.60-$3.10 per gallon for several years. This spring, gasoline was around $3 per gallon. But in the past few months, gasoline broke out of its trading range... to the downside.

Because of the falling oil price, gas has plummeted from $3.10 to $2.20 per gallon in just a few months... a 29% decrease. Because gasoline is a large expense for many families, this is a welcome decline... and a boost to the broad economy.

|

Recent Articles

|