| Home | About Us | Resources | Archive | Free Reports | Market Window |

Why You Should "Buy Uncertainty" in EuropeBy

Tuesday, August 4, 2015

I'm going to let you in on a major moneymaking secret...

It's one of the best I know. It has consistently made me money in all types of markets and all types of investments. If you get it right, it almost always works.

Here it is: BUY UNCERTAINTY.

Let me explain...

Buying uncertainty isn't all there is to it. That on its own can actually be dangerous... The ideal setup is when uncertainty is CLEARLY changing to certainty.

It could be the passing of a law, a weather event, or a political change. The possible setups are endless. You just need uncertainty clearly changing to certainty.

You can see exactly what I mean by looking at European stocks last month... The situation in Greece simply moved from uncertain to "less uncertain" when Greece submitted a bailout plan, and European stocks moved up 5% in a day. Take a look:

The gains won't stop here. The situation in Europe will continue to move from "uncertainty" to "certainty" as the terms of Greece's bailout unfold – and that should be great for European stocks. Meanwhile, European stocks are a great deal right now... If you've missed the stock boom in the U.S. since 2009, you are in luck with Europe... You get another chance at it.

You see, the U.S. is further along in its recovery than Europe is. So the zero-interest-rate policy in the U.S. will be going away at some point soon. But that's not the case in Europe.

Interest rates will stay near zero in Europe for a while... and that should fuel a U.S.-style boom in European stocks and property.

Also, importantly, European stocks are not nearly as expensive as U.S. stocks...

The Euro STOXX 50 Index – the Dow Jones of Europe that holds 50 of the area's strongest companies – is a good value, particularly in our zero-interest-rate world. The table below shows its valuations versus the S&P 500's...

The Euro STOXX 50 is made up of household names including Daimler (Mercedes-Benz), Bayer (aspirin), Total (a French oil and gas company), and Anheuser-Busch InBev (yes, the beer brewer is not American). A crisis in Greece isn't going to dramatically affect the sales of Mercedes-Benz cars or Busch beer. Meanwhile, this crisis has created plenty of UNCERTAINTY in Europe, and that gives us a window of opportunity.

We have one of the great setups that I like to see... Europe is going from uncertainty to certainty. That should continue over the coming months. And it makes European stocks a great opportunity today.

Good investing,

Steve

Further Reading:

Find more of Steve's recent research here:

"These four things will do more for building your net worth than just about any stock recommendation I can give..."

"You ought to hold way more cash than you think..."

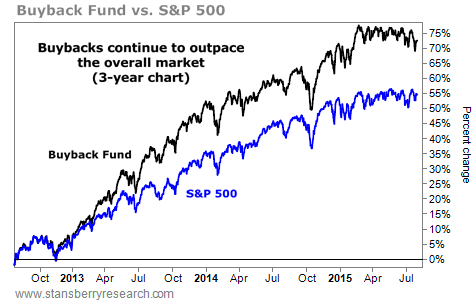

Market NotesTHE SHAREHOLDER-FRIENDLY INVESTMENT THAT BEATS THE MARKET Today's chart shows the huge upside in hidden, tax-free dividends...

Regular DailyWealth readers know we love companies that consistently raise their dividends. It's one of the best (and easiest) ways to grow your wealth in the stock market. But it isn't the only way for a company to reward shareholders...

Back in September 2012, Steve wrote about the power of companies buying back their own shares. This reduces the number of shares outstanding. It's like taking a pizza and cutting it into six slices instead of eight... Each slice is larger than before.

You can see how over time, the PowerShares Buyback Achievers Fund – which holds a basket of companies performing major buybacks – continually beats the return of the broad stock market. Over the last three years, the buyback fund is up more than 70% versus a gain of around 55% in the S&P 500.

|

Recent Articles

|