| Home | About Us | Resources | Archive | Free Reports | Market Window |

Don't Bet Against Stocks Until This HappensBy

Thursday, November 19, 2015

Trying to make money as the market goes down is difficult... but under the right circumstances, it is possible...

For most people, it's not worth even attempting.

In short, making a bet that stocks will fall goes against the grain... Thanks to earnings and inflation, stocks have an inherent upward bias, particularly in the U.S.

The market does crash by 40%-plus from time to time. Stocks fell 57% from 2007 to 2009. And the stock market dropped 49% from 2000 to 2002. But these kinds of spectacular falls are the exception, not the rule. They're hard to time just right.

Today, I'll share with you when the time is right.

Let me explain...

If you've read my work for any amount of time, you know my investment prism – I want an investment that is 1) cheap, 2) hated, and 3) in the start of an uptrend. I always want to make investments that are good values... that most investors aren't interested in... and that are trending up in price.

That's the ideal setup for an investment to go up.

If you see the opposite setup, then you have a recipe for lower stock prices.

We need to look at both the trend AND value to find the best time to short stocks (to bet on lower prices).

The simplest way to think of opportunity in the stock market is to think of it in four different states... based on trend and value.

The easiest way to visualize this is the graphic below. Take a look...

This is simple. The market has four distinct states based on trend and value. (Thanks to our good friend Mebane Faber for coming up with the simple "four states of the market" principle.) Through testing dozens of different systems to determine what REALLY works, we found that each state of the market leads to significantly different returns. Here are the basic states and how we want to be invested in each:

There's only one state of the market in which you'd want to bet against stocks... And that's when they're expensive and falling in price. Today, stocks are somewhat expensive. But they've rebounded from their August lows and are NOT in a downtrend. That means we're not in the "red" mode right now... which means shorting stocks today is a bad idea.

Personally, I'm still bullish on stocks. And I believe we could see significant gains over the next 18 months in what I've been calling The Melt Up.

Stocks will certainly fall at some point. And when we finally fall into the red in the box above, we'll bet against some stocks for the first time in a very long time.

We're not there yet... But now you know the principle for success...

Don't bet against stocks until we're in "the red."

Good investing,

Steve

Further Reading:

On Tuesday, True Wealth Systems analysts Brett Eversole and Rick Crawford showed readers why stocks could soar 14% in the next year. "You might not believe it, but it's true," they write... "Based on history, when stocks go up, they tend to keep going up." Get the details here.

Last month, Steve noted another reason to stay in stocks. "This extreme alone isn't enough to make us incredibly bullish on stocks," he said. "But its message is powerful..." Learn more right here: This Rare Extreme Points to Higher Stock Prices.

Market NotesAN IMPORTANT NEW HIGH IN THE HOUSING SECTOR Today's chart offers further evidence that the housing boom is alive and well...

Regular DailyWealth readers have heard a lot about the housing market over the past couple years. It has been one of Steve's favorite opportunities... and he says there is still plenty of upside left today.

As you can imagine, a healthy housing sector is good for a variety of housing-related businesses. We've highlighted the long-term uptrends of paint company Sherwin-Williams, cabinet maker American Woodmark, and flooring business Mohawk Industries, among many others.

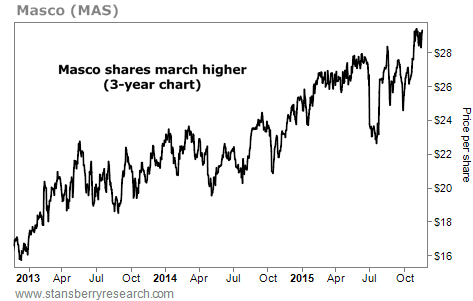

We can add another one to the list with home-improvement company Masco (MAS). Masco manufactures a wide range of building materials, such as faucets, bath and shower fixtures, cabinets and countertops, and other specialty products.

As you can see below, Masco shares have been soaring. They're up nearly 100% over the past three years... and they just struck a fresh 52-week high yesterday. It's clear that the housing boom is still underway...

|

Recent Articles

|