| Home | About Us | Resources | Archive | Free Reports | Market Window |

Still Worried About the Economy? Read ThisBy

Wednesday, May 4, 2016

The typical American consumer's wallet is healthier than it has been in a long time...

But you probably don't believe me.

Virtually everywhere you turn, the mainstream financial media are wringing their hands and agonizing over all the things that could send the markets or the economy into a tailspin. For example, could a sharp jump in interest rates or a return to high energy prices (however unlikely) cause big problems?

They all are certain that crisis and ruination are around the bend.

Please take a moment and breathe. Yes, the bull market has run for a long time. (A little more than seven years.) And no, no one can guarantee when the economy might enter a protracted downturn. Stocks started the year on a sour note and have been volatile ever since. But emotions aside... right now, the strongest signal of economic growth is telling us a different story...

Nothing gives you a better sense of an economy's health than job growth and employment. You can talk about consumer confidence measures or retail spending or whatever you'd like, but there's no stronger signal than employers reaching out to hire folks. In terms of the economy, each of those hires represents a new consumer with disposable income.

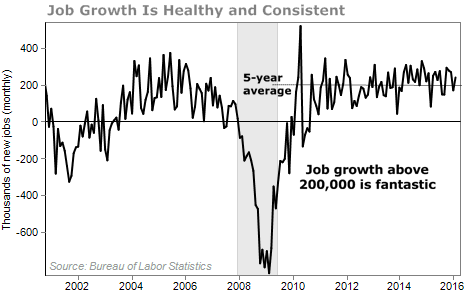

In March, the Bureau of Labor Statistics (BLS) released a stellar jobs report. Expectations were for jobs to grow by about 190,000 in February. Instead, the economy added 242,000 jobs – a blowout result.

One number only means so much. It's the trend that matters. But this makes for a record 65 months in a row of positive job growth. There are kids in kindergarten who have never seen a month with a decline in jobs (not that they've been paying attention).

For a healthy economy, we want to see job growth in the neighborhood of 200,000 per month. That's what makes last month's number look so good. But better than that, we've averaged 203,000 going back to October 2010...

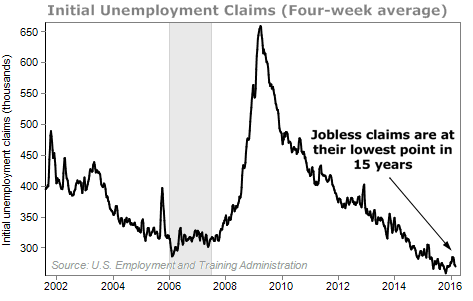

And not only are more folks working, but folks are working more... The length of the workweek has been expanding consistently since the end of the financial crisis. At the depths of the recession, the average workweek was 33.7 hours. Now, it's up to 34.4 hours. That's good – it means less of the employed are stuck in part-time jobs. And the number of people who lose their jobs and file unemployment claims each month is at an extremely low level...

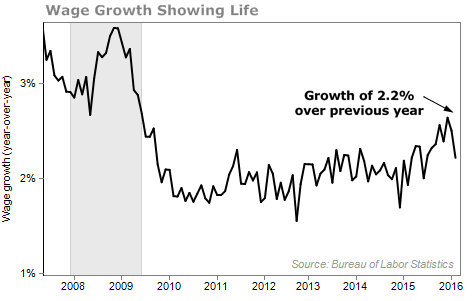

Wage growth has been slow, but it's starting to show up now. This February, workers earned 2.2% more than they did last February...  More jobs and rising wages mean more things to buy. Don't forget, as well, that the plummet in energy prices has put billions into the pockets of consumers. Estimates put the savings at about $700 per household, per year. So if you're worried today, don't be. The typical American consumer has a healthier wallet than he has had in a long time.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig

Further Reading:

"If you want to grow your wealth meaningfully over time," Doc writes, "there are three principles you must understand." Get the details here.

While the market sloshes back and forth, Doc has found a way to safely generate double-digit gains on blue-chip stocks like Microsoft. Learn more here: Earn Safe 15%-Plus Income With 'Digital Utilities'.

Market NotesTHIS BEVERAGE COMPANY IS RALLYING AGAIN Today, we're taking a look at a business that is in the midst of an incredible run higher...

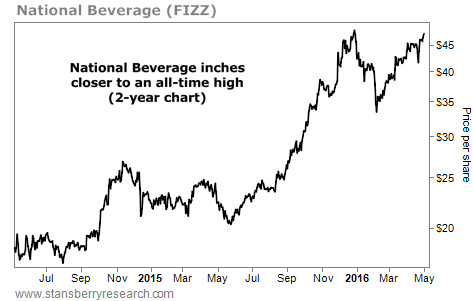

National Beverage (FIZZ) makes and distributes several flavored-drink brands. The $2.2 billion company is best-known for sparkling-water LaCroix, sodas Faygo and Shasta, and various generic store-named products. Simply put, the firm has something for everyone.

From late July 2014 through December of last year, FIZZ shares soared about 170%. The small-cap Russell 2000 Index was flat over the same time frame, while soda giants Coca-Cola (KO) and PepsiCo (PEP) averaged 10% gains. But when National Beverage released earnings that fell short of expectations, investors panicked, pushing shares down nearly 30% over the next six weeks.

As you can see in the chart below, though, shares have since bounced back and erased almost all of those losses. The stock is up more than 40% from its February low – easily beating the Russell 2000's 17% climb in that time frame – and it's once again trading near an all-time high.

|

Recent Articles

|