| Home | About Us | Resources | Archive | Free Reports | Market Window |

Everything You Need to Know... In One ChartBy

Thursday, May 12, 2016

If I could boil down everything I believe into one simple message... what would that message be?

I needed to come up with an answer to this...

Last week, I spoke with group of twentysomethings. These folks were right out of school for the most part.

They weren't investing experts. I needed to get my message across – as simply and as clearly as possible.

"Let's say you have $1 million," I told them. "Now that you've made your million bucks, you want to retire. What are you going to do with your money so you don't run out?"

The obvious answer would be to live off the interest... right?

If you could live off 5% interest per year, then you'd have $50,000 a year for the rest of your life, and you'd never cut into your $1 million. "So far, so good," they thought.

"The thing is, interest rates today are about zero percent. So let me ask you a simple math question... What is zero percent of $1 million?"

They all answered "zero," of course – zero-percent interest on $1 million is nothing.

"OK, well what if you had more money saved? What if you had $10 million? What is zero percent of $10 million?"

Once again, they all answered "zero." That's when the light bulbs started going off in people's heads...

In a zero-percent-interest world, you can't live off interest. You have to do something with your money.

"That dilemma is what is driving nearly every investor on the planet today," I explained to them. "With interest rates at record lows, retirees and investors realize they have to do SOMETHING ELSE with their money other than earn no interest on it."

So... what are people doing with their money?

They are putting it into the stock market and real estate.

Global interest rates are near record lows. And that causes stock prices and house prices to keep hitting new highs.

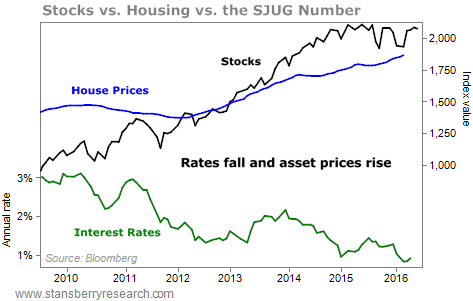

The simple chart below tells you everything you need to know...

Please, examine the chart and understand what it's telling you. It is just about everything you need to know in finance right now. Let me explain it for you:

Global interest rates are near record lows. This has caused house prices and stock prices to soar. (I define global interest rates as the average interest rate on 10-year government bonds in four major countries: the U.S., Germany, Japan, and the U.K.) Specifically:

This story has been in place for a few years now... Can it possibly continue? In short, yes...

We've had a number of good years in the stock market and the housing market recently. Because of this, most people think the good times have to end soon.

You have to keep the big picture in mind, though...

Retirees and investors everywhere are coming to the realization that you can't live on zero-percent interest. You have to do something with your money.

The lightbulb is going off in people's heads these days – out of necessity. People are putting money to work in the stock market and the real estate market, whether it's the right thing for them or not.

As long as global interest rates remain low, I expect that this will continue.

I could be wrong, of course. You'd be surprised at how high I think things could go... I expect house prices and stock prices will rise to unimaginable heights before it's all over.

I think that's the natural outcome of our zero-percent world. Take advantage of it...

Good investing,

Steve

Further Reading:

This month, Steve has shown DailyWealth readers why pessimistic and scared investors mean the bull market can march higher. And he recently shared a small group of stocks that could triple in a year.

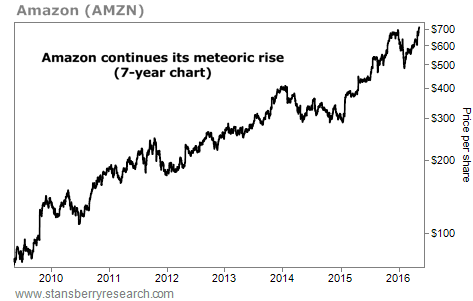

Market NotesTHIS RETAIL GIANT JUST HIT AN ALL-TIME HIGH Today, we take a look at the incredible long-term uptrend in the world's biggest online retailer...

If you've purchased anything from a movie to an exercise bike to groceries off the Internet within the last several years, chances are good that you have an Amazon account. Since 1995, the company has transformed from an online bookstore into a one-stop shop for just about everything you can imagine. Its Kindle e-book reader and Amazon Prime service have become wildly popular, adding to the company's growing bottom line.

Yesterday, shares of Amazon hit a fresh all-time high. Over the last seven years, the stock has climbed from around $74 a share to more than $715 a share – a gain of more than 800%. As you can see from the following chart, the bull market in Amazon is alive and well...

|

Recent Articles

|