| Home | About Us | Resources | Archive | Free Reports | Market Window |

The Worst Commodities Bust in Generations Is Over... Time to Buy!By

Thursday, June 23, 2016

In June 2008, the main index of commodity prices stood at 10,600.

In January of this year, it fell below 1,900 – an 82% fall in less than eight years.

It's the worst eight-year return – by far – in the history of the GSCI Commodities Total Return Index (which goes back a half century).

Think about this for a second...

This isn't some speculative stock that's down 82%... This is the entire universe of commodity prices... like oil and gas... and wheat and cattle.

What has happened in the past after big falls in commodity prices?

It turns out, big gains happen...

Take a look at the GSCI Commodities Total Return Index over the past 20 years...

_6MPRSUMS3V.png) Commodity prices are prone to booms and busts. Importantly, after each of these big busts, commodity prices jumped impressively... After each big bust, the median gain in commodity prices was 110%, and the median holding period was two years.

So there we have it. There's our blueprint: 110% gains in two years.

Ah, but could we do even better? It's possible...

You see, this hasn't been your garden-variety, 18-month fall in prices. This has been something greater... This is an 82% loss over eight years.

After such a sustained loss, investors have given up on commodities to a degree that I have never seen in my 20-plus years in this business. Investors have given up on inflation... and the fear of inflation is typically a massive driver of commodity prices.

The thing is, you can't do that... You can't assume inflation is dead...

My friend, we live in a world of zero-percent interest. And we live in a world where governments have nothing holding them back from printing money.

I think of these two things as "latent power" for an asset-price boom. Zero-percent interest rates are like a lit match... looking for a new fuse.

They have already lit up stock prices. And the same is true for real estate.

But commodity prices? They fell to 1991 prices earlier this year.

This is an ideal setup... We have an asset price that has crashed (commodities)... and we have a lit fuse in the form of zero-percent interest rates. Meanwhile, as you can see at the far right in the chart above, the uptrend has finally appeared.

It's time to get in!

Stocks and real estate have boomed. Commodities haven't.

Their time is now. Take advantage of it...

Good investing,

Steve

Further Reading:

Just a few weeks ago, Steve wrote about another extreme affecting the markets today. According to this "contrarian investing" signal, there could be massive potential upside ahead. If you've been wondering about whether to get back into stocks, read this: NOBODY Is in Stocks Now... BIG UPSIDE AHEAD.

We live in a world with zero-percent interest rates... and negative rates are beginning to spread across the globe. But it's not too late to protect your wealth... Steve explains why owning gold is a sound strategy for investors today right here: Exactly Why Gold Is Up and Will Keep Going Up.

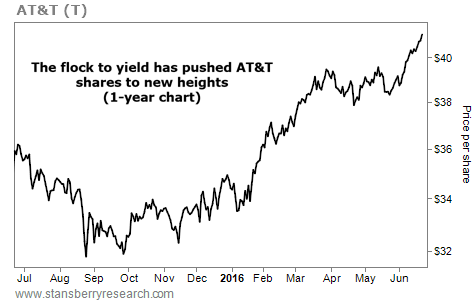

Market NotesNEW HIGHS FOR THIS 'TOLL BRIDGE' One of the market's blue chips is breaking out...

We're talking about $250 billion telecommunications giant AT&T (T). As the world's largest telecom company by sales, AT&T controls nearly one-third of the wireless market and nearly half of the home-phone and Internet markets in North America.

AT&T acts as a "toll bridge" of sorts. It has built a connection between its 120 million customers and content providers, and collects payouts for the use of its infrastructure. Last year, it generated record revenues and gross profits.

Like fellow blue chip Johnson & Johnson, AT&T is also a member of the elite Dividend Aristocrats, having raised its dividend every year for more than three decades. And with interest rates hovering around zero percent, investors have flocked to AT&T shares. They just hit levels not seen since 2008, and are up 17% over the last year alone. It's a bull market in this "toll bridge"...

|

Recent Articles

|