| Home | About Us | Resources | Archive | Free Reports | Market Window |

Exactly What I Want to See in a Trade, Part IIBy

Tuesday, October 4, 2016

I'm glad you want to hear more about finding good ideas...

Yesterday, I shared an example of how I size up a potentially profitable opportunity.

Readers wanted more... So let's take a look at another investing idea today...

You probably know by now that I look for three things in an investment – I want to see an investment that's 1) cheap, 2) hated, and 3) in the start of an uptrend.

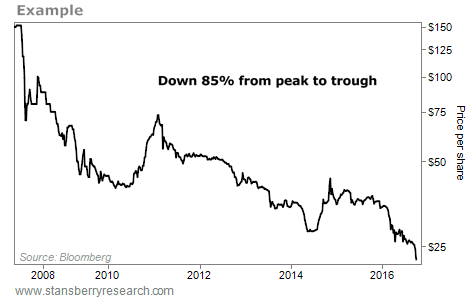

The investing idea we're looking at today is cheap... It's down about 85% since 2007 (from around $140 to around $20). Take a look...

After an 85% crash, you can imagine that this investment is also extremely hated by investors... And this hate is what gets me interested. You see, if you want to make triple-digit returns, you can't buy what everyone already loves... The biggest gains happen when things go from "bad" to "less bad."

And in today's example, things are BAD...

"It has never been a worse time," a CEO in this industry said in a Reuters news story this week. "At the moment, nobody feels the need to buy and the price is lower every day," he continued.

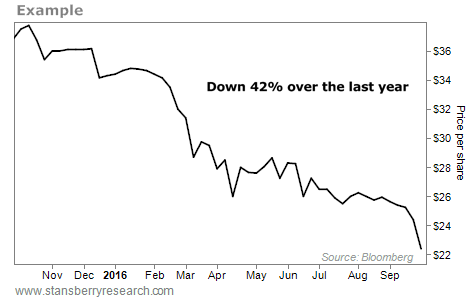

He's right... Over the last year alone, the price of this investment has fallen 42%...

So this idea is clearly cheap and hated. But is it in an uptrend? Obviously not. It's hitting new lows every day.

This idea ticks the first two boxes. But because we don't have an uptrend, the idea simply goes on the "watch list." It'll be a trade someday... but not today.

What is this idea? It is uranium.

Legendary resource investor Rick Rule made the long-term case for uranium at our Stansberry Conference in Las Vegas two weeks ago. He said...

That's the long-term story. But the short-term story is crazy... You would think that if you're losing $40 for every pound you produce, you would cut back production. But the opposite has happened... thanks to Kazakhstan. Quoting Reuters...

In short, "At today's prices, [the uranium] industry is not sustainable," another industry executive told Reuters. (You can read the full story here.) Uranium is incredibly cheap and incredibly hated. There's a great long-term case for it, as Rick Rule explained. But in the short run, things can get worse before they get better.

In the meantime, I will watch for the uptrend – the price action – to confirm this idea before any data in the market will confirm it. That's why it's so important.

After an 85% fall since 2007 and a 42% fall in the last year alone, we are not there yet. There is no uptrend in sight.

Today's essay wasn't about uranium, though. It's not about giving you a fish... It's about teaching you how to fish...

It's about showing you how I look for an idea... the thought process I use to decide when to enter a trade.

I hope you can use this thinking to know when to enter a trade... and when to stay on the sidelines.

Good investing,

Steve

Further Reading:

Yesterday, Steve walked readers through his first example outlining exactly what he looks for in a trading opportunity. "Within two minutes, I knew everything I needed to know," he said. For more details on how to quickly size up an investment idea, read his essay here: Exactly What I Want to See in a Trade.

If you're developing your thought process on how to invest, there's a simple way to avoid making expensive mistakes. Just ask yourself these three questions before you buy... and keep your emotions from leading you into the worst investment pitfalls out here. Learn more here.

Market NotesTHE POWER OF INVESTING IN ADDICTIVE PRODUCTS Some people call it "investing in vice." We simply call it smart investing...

Selling addictive products is a great business. Customers keep coming back for more... So companies that sell cigarettes, sugar, and caffeine enjoy steady sales and profits. This often makes for excellent long-term investments.

For proof, we turn to Dunkin' Brands Group (DNKN). The coffee and donut giant has more than 11,500 Dunkin' Donuts locations in nearly 60 countries. It also owns and operates the Baskin-Robbins ice cream brand. Few things are as addictive as caffeine and sugar.

Last week, DNKN shares touched a new 52-week high. They're up more than 22% from their June lows – and more than 26% this year. As long as people continue to drink their morning coffee, DNKN shares should continue to rise...

|

Recent Articles

|