| Home | About Us | Resources | Archive | Free Reports | Market Window |

|

Steve's note: Today, my colleague Dave Eifrig is hosting a free training webinar on how to collect thousands of dollars of extra income per month. Below, he explains what makes this unconventional approach to the options market so successful... and how it can help you profit in any type of market.

72 Winning Trades in a Row... Here's HowBy

Wednesday, March 22, 2017

We just closed out our 72nd consecutive winning position...

I know that claim – 72 wins in a row – sounds far-fetched... But it's exactly what we've achieved in my trading advisory, Retirement Trader.

Not only that, but since 2010, we have been able to close 335 winners out of 356 total closed positions (a 94.1% win rate)...

All thanks to an unconventional approach to the options market.

In Retirement Trader, we sell stock options – we sell puts or covered calls. If you're not familiar with this idea, I urge you to learn more about it. You can read more here and here.

You see, lots of folks who sell options are focusing on the wrong ideas... And they'd find a lot more success if they followed my "common sense" strategy...

When most people buy or sell stock options, they focus on what the Volatility Index (the "VIX") is doing. The VIX is a widely followed indicator that measures the price of options on the broad market. It rises and falls with investor fear levels.

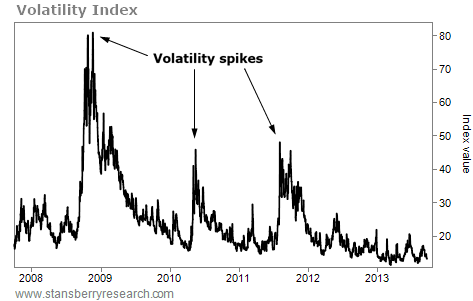

To see some examples of VIX behavior, check out the six-year VIX chart below. As you can see, the VIX spiked during the 2008 credit crisis. It spiked during the 2010 "Flash Crash." It spiked during the 2011 European debt scare.

When the VIX is low, options are considered cheap. When the VIX is high, options are considered expensive. So lots of folks wait to see the VIX hit an elevated level before they sell options. But that's not what we do in Retirement Trader. Our unconventional approach doesn't require a high VIX level to make great money. In fact, most of our money has been made when the VIX was at historically low levels.

That's because our approach is based FAR MORE on great companies trading at cheap prices. Instead of focusing on what "the market" is doing, we focus on trading great companies like Coca-Cola (KO), McDonald's (MCD), and Wal-Mart (WMT). These companies have great brand names, stable sales growth, and they pay steady dividends.

Why is focusing on great companies so important? Why has it allowed us to produce such an incredible track record?

It's just basic common sense...

Great companies like Coke and McDonald's are much more stable than "hot tip" companies. They don't represent all-or-nothing bets on a specific drug... or a specific natural resource deposit.

For example, I doubt a new technology will come along and make enjoying a soda obsolete. And I doubt some new technology will come along and make cheeseburgers a thing of the past.

By focusing on companies that dominate their industries, our option trades are much more reliable than almost any kind of option trade you can imagine. By trading options around these companies, we're able to leverage our gains... but still enjoy a tremendous level of safety.

The VIX has spent the past several months below the 20 level. For a lot of folks, that means there aren't great opportunities to sell options right now. But in Retirement Trader, we've made dozens of trades on blue-chip companies like Coke and McDonald's. So far, we're averaging 16.4% annualized returns.

If you've been trading options for a while and you're not enjoying the success you'd like, consider focusing your trading on blue-chip stocks. Consider selling options on them.

The VIX will always rise and fall... But blue-chip stocks will remain stable. Trading on their brand names and stability with options has allowed us to profit on 72 consecutive closed positions. It could produce the same success for you.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig

Further Reading:

This week, Dave shared how his unique options-trading strategy can lower your risk while boosting your returns in the stock market. Catch up on his other two essays in this series right here:

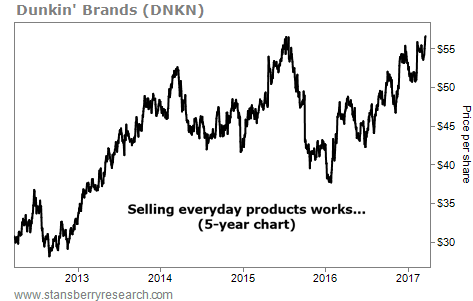

Market NotesA BUSINESS AS RELIABLE AS YOUR MORNING COFFEE Today's chart highlights one of our favorite strategies at work... buying companies that sell simple products.

You don't need to sell flashy, innovative products to have a successful business. "Boring" products like cigarettes, soda, beer, toothpaste, and cleaning supplies are always in demand. These staples are the cornerstones of steady, profitable businesses that generate good cash flows for investors. For example, let's look at the coffee business...

Dunkin' Brands (DNKN) is a world leader in the coffee and baked-goods businesses. Today, it has more than 11,300 restaurants worldwide. These kinds of products can stay popular for decades... They generate billions of dollars in revenues, and they don't require additional spending from the company.

Dunkin' shares have soared this year. As you can see in the chart below, they're up around 50% from their January 2016 lows, and they just hit a new all-time high. Selling coffee and donuts is a simple business that's not going away anytime soon...

|

Recent Articles

|