| Home | About Us | Resources | Archive | Free Reports | Market Window |

|

Steve's note: Yesterday, we shared an essay from my colleague, Porter Stansberry, dealing with major upheaval in the U.S. government. Longtime readers know I am bullish on U.S. stocks. But since Porter's perspective is so valuable, I'm sharing a second essay from him today. He believes big changes are coming that could transform how companies make money in America... resulting in huge profits for smart investors.

We're Nearing the Biggest Change in the U.S. Economy Since 1971By

Wednesday, April 5, 2017

I think I might have gone too far...

Recently, I've been writing about a "secret war" in Washington, D.C. And I've been describing a very high-level source, without naming him. I'm even broadcasting a meeting with this mysterious "Metropolitan Man."

And you don't even know who he is yet.

I can understand how this probably sounds: Self-serving. Promotional. Even crazy. After all, most people haven't been reading our work for years or decades. Most subscribers don't remember when I predicted (accurately) that Fannie and Freddie would go to zero.

They didn't read my work back in 2007, long before the crisis, when I explained exactly why General Motors would go bankrupt. They never saw my famous satiric letters "from the Chairman of General Motors" where I wrote the truth about what was really happening in the heavily indebted, old carmaker.

All of that sounded "crazy," too. But it saved some of our subscribers from a financial disaster that would have erased their life savings...

I'd like the opportunity to backtrack...

I'm not going to mention anything about secret sources or expensive meetings. I'm not going to make any kind of "get rich quick" promise that you'll think is exaggerated.

I'm just going to tell you about the facts we have right now. And I'm going show you why they're so important – especially for investors.

You see... I know that our ability to tell interesting stories garners a lot of attention. But I also know that kind of writing alone won't keep anyone happy for long.

For our business to succeed, our readers have to trust us, and they have to profit from our work.

That's why, in addition to the "carnival barking," I make sure you're getting the information I'd want if our roles were reversed.

And right now, we're on the cusp of the biggest change in the American economy since 1971 (when the gold-exchange standard collapsed).

Whether you attend our meeting about this coming massive change, or listen to it, or do neither, I want you to know why this is so important... and how it's going to change virtually everything about how our economy works – who wins, who loses, and how we're all taxed.

This isn't about politics. It's about economics.

Let's start 23 years ago, when a young congressional aide completely disrupted testimony before the Gold Commission...

The commission routinely studies the feasibility and the attractiveness of returning the dollar to some kind of gold standard. It has never gone anywhere because no politician whose country's currency is universally accepted (like ours) would ever willingly give up his printing press. So these meetings normally aren't worth attending or listening to. But this one was different...

At this meeting, a 24-year-old congressional aide began asking a series of scintillating economic questions. Questions that went directly to the heart of some of the most compelling academic work that had ever been done on the U.S. tax code and its impact on our economy and trade patterns.

People who were there still remember the series of questions that were asked by this particular young congressional staff member. "He was clearly far better informed and much more intelligent than any of the actual congressmen in the room... "

Today, that young 24-year-old is now 47 years old. And he's no longer a congressional aide. He's the speaker of the House of Representatives, the primary lawmaking body of the United States. He's also the leader of the majority party, giving him potentially awesome powers to make new laws or reform old ones.

His name is Paul Ryan.

Ryan's main economic goal is to reverse the current U.S. tax policies that make it harder for our firms to compete in overseas markets. He also wants to end the perverse incentives of our tax code that continue to warp our economy in ways that make it more vulnerable to financial manipulation.

(Ironically, Larry Summers at M.I.T. did some of the best academic work on these topics in the 1970s. But now that these ideas don't jibe with his current politics, good luck getting him to answer a question about that honestly.)

Let's look at three important ways the current U.S. trade and tax regime hurts our economy.

First, the current tax regime favors debt over equity...

Companies are allowed to expense the total amount they spend on interest. This is a huge incentive for them to use Wall Street's big investment banks to borrow as much money as possible. It reduces their cost of capital. This explains why, since 2000, nearly all of the net debt issued by Wall Street has gone toward mergers and acquisitions or share buybacks.

Managers have a huge tax incentive to leverage their balance sheets as much as they can. But those actions are bound to cause problems when interest rates reverse.

Most investors still don't realize how big or dangerous the corporate-debt bubble has become...

As of the second quarter of 2016, investment-grade corporations were spending $119 billion annually on interest expenses – the most since 2000, just before the big tech-debt bust of 2001. The difference today is that interest rates are much, much lower. And that means the debt balances are vastly higher. In total, U.S. corporate debt has soared from less than $3 trillion to almost $7 trillion in just the last decade. Worse, a higher percentage of this debt is rated "junk" than ever before.

Thus, American companies are now more exposed to either rising default rates or rising interest rates than they've ever been before.

This trend has been great for Wall Street. But it's not great for America.

Ryan knows these debts (and the incentives that created them) threaten our economy far more than any other factor today. By eliminating this tax preference for debt funding, we can stop rewarding public company executives for taking huge balance-sheet risks with America's biggest companies. You don't have to be in favor of taxes (and I'm not) to see that the tax code should NOT reward managers for doing the wrong things with their balance sheets.

Another huge distortion in the current tax regime is how different kinds of capital investments are expensed...

Some items – like computers and software – can be fully expensed in the year they're purchased. They're treated like a routine cost of doing business. But longer-term corporate investments can only be expensed over many years. Inflation robs companies of the real value of these tax credits, providing a perverse incentive to not make big, long-term investments.

Allowing companies to reflect their actual expenses (including all investments) in the year they are incurred would provide corporate America with an important tax break. Politically, that's not going to play well in the pages of the New York Times. But the reason for doing so is vitally important if we want our economy to grow over the long term... There is no other proven way of increasing productivity (and thus, wealth). We must make far more and far larger long-term investments in American productive capacity. And we shouldn't have a tax policy that makes this harder to achieve, instead of easier.

Finally, the current trade and tax regime makes it logical for every company to store as much of its value as possible overseas...

... and only import what they plan to sell in America – nothing else.

Why does every important American software maker (including Apple and Microsoft) have its international headquarters in Ireland?

By keeping their core intellectual property in Ireland, these companies can pay far, far less in taxes. Meanwhile, they can import that intellectual property back into the U.S. (after manufacturing in China) for free. This allows them to pay a tiny fraction of the taxes they would otherwise have to pay. And it also keeps a lot of their employment and capital outside of the U.S. (Microsoft, for example, just spent around $250 million building a new campus in Ireland.)

Similar strategies are being employed at some level by almost every U.S. multinational company.

This is completely insane.

Lower wages don't drive U.S. companies to manufacture overseas. The difference in wage rates is almost irrelevant compared with the costs of setting up infrastructure, supply chains, and transportation costs. The only reason most U.S. companies are setting up manufacturing and research and development overseas is to avoid U.S. taxes and regulation.

Changing just these three components of the U.S. tax code could be done on a revenue-neutral, zero-cost basis...

And these three changes alone would drive U.S. gross domestic product growth from around 1% to well over 3.5% – something we haven't seen for more than eight years.

These changes could help alleviate all of the government's other entitlement funding problems, as increases to wages and salaries would power funding for those programs. These changes would also see a big increase to investment income – in the form of dividends – to benefit retired investors.

These are the primary planks of the House Republican tax-reform plan, which Ryan wrote and has the support of nearly every Republican congressman.

Considering the Republican majority in the Senate and the Republican-led White House, there's no reason this tax reform can't get passed. It may even be passed on a bipartisan basis, because these reforms would be great for the hard-hit manufacturing states like Michigan, Ohio, and Pennsylvania.

There's only one problem...

Most of the people working in and around the government hate these ideas. That's because many of the "swamp people" – the career bureaucrats and lobbyists who live in D.C. – derive a lot of power from the current law.

Think about how many law firms and lobbyists exist to help American corporations hide taxable income overseas. Think about how many Goldman Sachs investment bankers have pitched a bond offering by explaining how the tax treatment will lower a company's cost of capital. And think about how many thousands of lawyers, accountants, and lawmakers all around the world have benefited as most Fortune 500 companies moved offshore with their manufacturing.

These reforms are the "gun to the head" of the so-called "Deep State" that controls D.C. and normally controls the agenda in D.C., too.

Make no mistake, the swamp people, or the Deep State, or whatever you want to call them, are going to do whatever it takes – including breaking the law – to try and sabotage this reform.

Fairfax County is in Northern Virginia. It's a D.C. suburb where a huge number of the swamp people live. It's a place where incomes and home prices never go down. The area has boomed as the government has grown and grown since the 1960s. Fairfax County voted for Hillary over Trump by the widest margin of any presidential election in the modern era – 63% in favor of Hillary.

Fairfax isn't alone. Some of the wealthiest counties in the country surround D.C. It's no surprise: the swamp people have done well. Their communities haven't seen a recession, and the government hasn't downsized. Normally, wealthy suburban areas tend to vote Republican. But not around D.C. They all voted for Hillary.

Even within Trump's own administration, we're hearing voices speak out against this kind of major tax reform – especially the two guys from Goldman.

Don't forget, Gary Cohn is a registered Democrat and was the second in command at Goldman for a decade. Steve Mnuchin is not only a second-generation Goldmanite, he has also been on George Soros' payroll. (For you conspiracy theorists, Mnuchin was also initiated into Skull and Bones at Yale.) These guys are the Deep State... And Trump put them in the two most senior economic roles in his cabinet.

And of course, various companies are taking sides, too, based on whether these changes would be good for them... which brings us to my next point...

A lot of companies' entire business models are based upon the current tax and trade regime.

Take railroad Kansas City Southern (KSU), for instance. A lot of its traffic is made up of automobiles manufactured in Mexico and shipped back into the U.S. From a high of around $125 a share, the stock has already fallen back toward $85. But there's no doubt in my mind that the stock would go much, much lower if this kind of major tax reform passed.

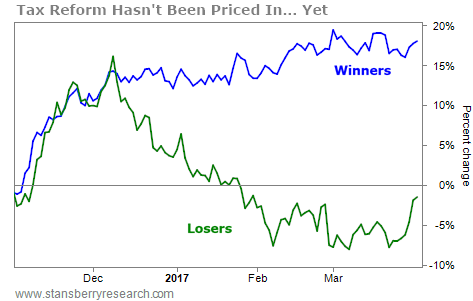

In fact, my research team has compiled a list of about 20 stocks that have the most to lose or the most to gain from these kinds of reforms. You can see the stocks we've been studying below.

The blue line shows the average performance of the tax-reform "winners." The green line shows the returns of the tax-reform "losers."

What we see is that the tax-reform winners have taken off a bit since Trump's election. They're up about 18% on average. But with the uncertainty that still surrounds this bill (especially after the health-reform bill failed to pass), the losers haven't moved much... yet.

What this tells me is that plenty of uncertainty continues to surround what will be in the tax-reform bill and how it will affect our economy. And that's a huge opportunity for us.

The latest information we have out of sources in D.C. is that there is a 70% chance that a major tax reform will pass this year...

It will probably happen in the fourth quarter, for tactical reasons I'll describe in detail at our meeting tonight. That likelihood is down from 99% just a few weeks ago. However, within the next several days, we'll receive a brand-new indicator that could – depending on how it goes – raise the likelihood back to 99% (or even higher).

As you can see, there are still a lot of moving parts here. And hopefully you are starting to understand why this is so important to our country and dozens (or hundreds) of major corporations.

Now... I did what I promised to do. I told you what I would want to know if our roles were reversed.

But here's what the straight talk can't communicate...

This is far more important than politics or what tax rate U.S. corporations pay. This is an underlying battle... a virtual war.

On the one hand are people like Paul Ryan, who know how most of the country is struggling and how hundreds or thousands of corporations could go bankrupt if super-low economic growth rates persist.

I've warned about the problems looming in the market for corporate credit for the last 18 months. Trump's tax reform, if it spurs the economy as much as most economists think, could be the answer to this huge problem. It would allow companies to grow out of their debt burden and give them an incentive to pay off their debts, instead of adding to them.

In short, Trump tax reform means that the "Trump Trade" – the big rally in stocks since the election – will continue.

On the other hand are the swamp people and the Goldmanites. They are incredibly powerful. And lately, they've become reckless and desperate. They're driving the Russian-tampering storylines. They fear Trump's presidency and his majority in both houses. They know he could wipe out everything they've spent the last 40 years building. They don't care about what happens to the rest of the country. They only care about Fairfax County.

This is the most important political debate and potential economic reform in the U.S. since I was born in 1972...

This debate – about tax and trade reform – will determine the economic fate of our country for the next few decades.

We're either heading into a new era of growth (and potentially a lot of inflation), or we're sliding back into a depression caused by a mountain of bad corporate debt.

We think we know what's going to happen. And we want to tell you everything we know. That's why we've convinced the best-placed source we could have in D.C. to come forward.

Sure, we call him the "Metropolitan Man" but the truth is, he's the ultimate swamp person. He has lived in the highest circles of power in D.C. for almost 40 years. No one anywhere knows more about what's really happening and why.

In fact, it was the Metropolitan Man who first met Paul Ryan more than two decades ago at the Gold Commission hearing. And the Metropolitan Man has helped Ryan develop these ideas.

If you want to position your portfolio (or your business) to prosper in the midst of these radical changes happening in D.C., I urge you to attend our live webinar and listen carefully to our meeting (for $19.95).

As I always say, there is no such thing as teaching, there is only learning...

Either you're willing to spend $19.95 to hear directly from one of the most powerful and longest-serving senior leaders in D.C... or you aren't.

If you do, you'll learn more about which investments you should be making now to profit as the biggest economic reforms in our lifetime occur.

Or... you can keep reading the paper and see whatever the Democrats want you to believe.

Make the right choice.

Regards,

Porter Stansberry

Further Reading:

"A secret civil war is being waged right now in Washington D.C..." Yesterday, Porter covered a recent high-security leak and what it means for our country. He believes the outcome of this struggle will determine the fate of our economy for decades... and the "Deep State" is right at the center of it. Get the full story here.

Last year, the "Metropolitan Man" spoke with Porter about why gold could be a smart bet for investors – especially during certain economic upheavals. But even in normal market conditions, owning gold in the right way can lower your portfolio's volatility and boost your overall returns. Learn all the details in Porter's essay, right here.

Market NotesBIG POLICY REFORM LEADS TO AN EMERGING MARKET BOOM Today's chart highlights the success of an emerging market stock...

Over the past few years, investors had given up on Argentina. The anti-business, socialist policies of the country's former president sent its economy into a tailspin. But when we last checked in on Argentina, the situation was improving...

The more business-friendly Mauricio Macri took over as president. He quickly made big changes in the country, cutting taxes on agricultural exports and personal income. He also settled the country's long-standing debts with foreign creditors. These reforms are boosting Argentina's economy and drawing foreign investors to its stocks. It's a great example of how emerging markets can take off...

For proof, we'll look at shares of Cresud (CRESY). This real estate business is Argentina's largest cattle raiser and owner of private farmland. Since Macri took office, shares are up more than 80%... And they just hit a new multiyear high. As Steve wrote recently, "when emerging markets are hot, you simply HAVE to be on board"...

|

Recent Articles

|