| Home | About Us | Resources | Archive | Free Reports | Market Window |

How This Ratio Can Dramatically Increase Your Income Every YearBy

Thursday, May 18, 2017

Most people who call themselves "investors" really aren't.

The average "investor" is really a trader. He buys a stock with the hope that at some point in the future, he'll find someone who'll buy it for more than he paid. He's trying to time the market. "Buy low and sell high," right?

More often, however, people can't stand the uncertainty. Watching the market flip and flop all over the place leads to bad decisions. People buy high and sell low.

But there's an easier way...

Many investors overlook the fact that your true wealth is your income.

I'll bet you have some idea of the total balance of your brokerage account – even without looking it up. But you probably can't quote the annual dividends your portfolio generates.

That's a blind spot many investors have. And it's a mistake. You shouldn't measure your wealth by the balance of your bank account, but by the income it generates.

Income is what you live on. Income is what gives you the freedom to enjoy your days, take vacations, or provide for your family and others.

When you buy 100 shares of a stock that pays $1 a year in dividends, you've just set yourself up for $100 a year in income. With a little bit of investing acumen, that income stream should rise.

And a dividend is even more than just an income stream... Dividends are vital to the overall returns of your portfolio. According to studies, dividends have accounted for about 43% of the performance of stocks in the S&P 500 since 1926.

That means if stocks return 7% a year, about 3% of that is dividends. That makes for a big chunk of returns.

That difference grows over time (an effect called "compounding"). An investor who collected and reinvested dividends from 1940 to today would have earned 10 times as much as an investor who collected the capital gains on stocks alone.

Simply put, paying dividends is exactly what the stock market is about.

After all, a dividend can't be faked. Companies can employ a range of accounting tricks to beef up earnings. They can come up with new grand "strategic plans" to paint a bright picture for the company's future. At times, some even engage in outright fraud.

But a dividend comes as real cash, straight from a real bank account. It can't be faked, cajoled, or conjured. Only companies with sound financial footing and real profits can pay dividends. By focusing on dividends, you'll immediately ignore many of the junk stocks out there in the market.

And by focusing on one specific number, you can make sure that the company is likely to keep paying out its dividend...

It's called the "dividend-payout ratio." This is the percentage of earnings the company pays out as dividends, usually on an annual basis. You can find dividend-payout ratios for most stocks on Yahoo Finance under "Statistics."

You're looking for sustainability in a dividend-payout ratio...

For example, a dividend-payout ratio of more than 100% is, by definition, not sustainable. At that pace, the company will eventually run out of money. Usually, a dividend-payout ratio of more than 100% is due to an accounting quirk that has reduced the company's earnings on paper for a quarter or two. Less often, it may indicate a special dividend was paid in the last year.

Of course, a dividend-payout ratio that's too low suggests the company isn't returning much money to shareholders.

As a rule of thumb, payout ratios in the range of 30% to 60% suggest that the company pays a generous dividend that still leaves some breathing room in the case of short-term market fluctuations.

It's also helpful to read statements from management to find its "targeted" dividend-payout ratio. When management announces a target and hits it consistently, it shows the company has the earning power to stay on track.

If a dividend-payout ratio makes you leery, it's a sign to dig deeper.

The dividend-payout ratio can tell you a lot about an investment – including whether the company delivers consistent payouts. And that's vital for anyone investing in income.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig

Further Reading:

"Picking a stock, bond, or fund isn't an exact science," Dave explains. "Often, it means letting some facts and data go." One simple, time-tested strategy can help you pay attention to what counts – and avoid getting stuck. Read more here: How to Escape the Trap of Knowing Too Much.

"When you see someone who seems to live too well for the job he has, he doesn't have a secret skill. He often has a secret pile of debt," Dave writes. But you can save money without giving up the things you love. Learn more here: The Rich Do Have a Secret.

Market NotesTHIS CAPITAL-EFFICIENT HOMEBUILDER IS SOARING Today, we revisit one of the most powerful concepts of investing: owning capital-efficient businesses...

Porter Stansberry has written about the benefits of capital efficiency many times over the years (you can learn more here and here). These companies generate high returns on capital without ongoing expenditures on things like machinery, maintenance, or research and development. And their strong customer loyalty means they can gradually raise prices when they need to... which allows them to return more money to shareholders.

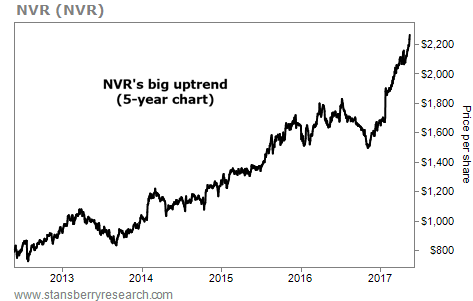

One of Porter's favorite examples is homebuilder NVR (NVR). NVR is the most capital-efficient homebuilder in America. It stayed profitable throughout the housing crisis. Even if you had bought NVR at the worst possible time (at its peak in 2005, just before the crisis began), you still would have nearly doubled your money in 10 years. It's a classic example of how capital efficiency builds a "moat" around a business.

As you can see below, NVR's success is continuing today. Shares are up 36% this year. Longer term, the stock has soared nearly 200% over the past five years. You can see why Porter has called capital efficiency "the single greatest investment secret ever discovered"...

|

Recent Articles

|