| Home | About Us | Resources | Archive | Free Reports | Market Window |

Three Things I Wish I Had Understood About Money Long AgoBy

Wednesday, August 23, 2017

Although experience may be the best teacher, it's also the most expensive – especially in matters of money.

It's far cheaper (if not always as effective) to learn from others' experience, insight, and errors.

What follows are three essential money lessons that I wish I had understood long ago. If these might help you (or someone you know at an earlier stage in his financial journey)... well, that's time well spent.

1. What will this expense be "worth" years from now?

My friend and colleague Peter Churchouse has a fantastic story that illustrates what I mean. Here it is in his own words:

However, there's another side of this story. He explains...

It's easy to take this to the extreme. You'll drive yourself crazy if you constantly consider the possible future value of anything you spend money on ("Shall I get this cappuccino... or put my future child through college?") But it's worth considering that some big expenses carry an enormous potential opportunity cost. 2. What money is... and isn't.

Everyone must decide on the meaning and role of money in his or her life. And the sooner you figure out what that is, the better. For me:

What money isn't to me...

Everyone's journey to understanding the meaning of money is different. But if I could, I'd go back in time to tell my younger self these things. 3. The power of compounding – over long periods of time.

Compounding is a simple idea... In short, it means reinvesting returns instead of spending them. Over time, the original investment gets bigger and bigger as more returns are reinvested.

It's like a snowball rolling down a hill. The further it rolls... the bigger it gets.

For example, if I invest $10,000 with an annual interest rate of 5%... after 12 months, I'd get $500 in interest. But instead of spending that $500, I reinvest it on the same terms... And now I'm earning 5% on $10,500. So 12 months later, I'd earn $525 in interest, which I again reinvest... and on it goes.

In the short term, that doesn't sound like a lot. But now look at the magic of compounding over several decades... and the more decades, the better.

Let's say I started investing when I was 25 years old with an annual investment of $20,000 (and I reinvested the interest each time). Assuming compounding at 5% growth per year, at age 65, I'd be sitting on a nest egg of about $2.5 million.

But if instead I'd started at 35, I'd only have about $1.4 million when I retired – that's $1.1 million less – because compounding has had less time to work its magic. That's a huge difference.

So when it comes to compounding... time is the secret to success. Starting as soon as possible and reinvesting interest over several decades can build life-changing wealth.

Good investing,

Kim Iskyan

Further Reading:

Compound interest is the most powerful secret to getting truly rich in the markets. "I know it works," Dave Eifrig writes, "because both my sister and father used it to grow wealthy." Read more here: The Easiest Way to Make $1 Million in the Stock Market.

You must judge whether certain investments are "worth it" over the long run. Learn how Steve assesses every potential deal here: Is That a Legitimate Shot at a 200% Gain? Or Just a Headache?

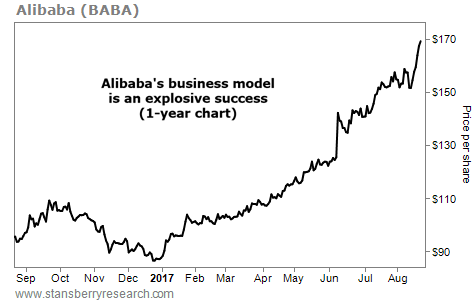

Market NotesTHIS 'MIDDLEMAN' RETAILER IS SOARING Today's chart highlights a massive online retailer...

No, we're not talking about Amazon (AMZN)... We're talking about China's version, Alibaba (BABA). Alibaba.com is a global marketplace for wholesale goods. That means it connects global importers with Chinese exporters. And it does a lot of connecting... Alibaba saw nearly $550 billion in online transactions during its 2017 fiscal year.

The real difference between Alibaba and Amazon isn't the company's wholesale focus – Alibaba owns other websites that cater to individuals, too. The difference is that Alibaba is just a middleman, like eBay (EBAY) or Etsy... The company connects buyers and sellers, but doesn't have to warehouse the inventory. That's a good strategy for generating big profits...

Last quarter, Alibaba's sales and profits jumped 56% and 90%, respectively. The company reported a huge 29% profit margin. And as you can see below, its shares are on a tear this year. They've nearly doubled since January... and recently hit a new all-time high. As the global boom in online shopping continues, Alibaba will thrive...

|

Recent Articles

|