| Home | About Us | Resources | Archive | Free Reports | Market Window |

How to Profit With Trades That Don't 'Agree'By

Tuesday, January 9, 2018

Trading is not like weaving a tapestry...

You don't start with a grand vision, then work diligently and single-mindedly to complete your design.

Instead, you start with a set of rules, which you can refine and change over time. Then, you place trades that meet your guidelines.

You don't know where the process will take you... But if you follow a strong set of rules, you'll typically make more money than you lose.

Along the way, you may find that you hold "contradictory" positions – positions which, if one goes up, the other almost certainly goes down.

Lots of folks have a hard time wrapping their heads around this idea. After all, why would you put your money into two ideas that go against each other? Isn't it more efficient to choose one side or the other?

Today, I'll show you when it makes sense to hold contradictory positions, and how to place these trades effectively...

Let's start by considering when it makes sense to place contradictory trades.

First, your trades may have different time frames...

For example, maybe you think that semiconductor giant Intel (INTC) is headed much higher... And you buy shares with the idea of holding them for at least a year.

But a couple of months later, Intel is up a lot – plus, you see signs that tech stocks have gone too far, too fast. So you sell short shares of a tech fund like the Technology Select Sector SPDR Fund (XLK) to profit as the sector pulls back. You only plan to hold this trade for a month or two.

Intel is a major holding in XLK. And the two often move in the same direction. So if your short XLK position does well, your long Intel position likely won't... for a stretch of time. On the surface, the two positions contradict.

You could sell Intel before shorting XLK to avoid that contradiction. But what if you're wrong? You could miss out on a lot more upside in what was supposed to be a long-term position in Intel.

Let's say XLK falls and Intel holds steady or rises. You may be able to book profits on the XLK short and make money with Intel at the same time. Sometimes two trades that seem to contradict can both work out.

The lesson: You don't want to close out of a long-term position so your portfolio "agrees" with a short-term trade.

In the Intel example, shorting XLK serves as a hedge. It reduces the risk to your overall portfolio. If both Intel and XLK drop, you at least make money on XLK. And once tech stocks have pulled back, you can get out of the XLK short and continue to hold Intel.

The best way to decide whether or not to place trades that "disagree" is by using your trade guidelines...

In DailyWealth Trader (DWT), one of our most important guidelines is to place trades with good reward-to-risk ratios. As long as two trades have good reward-to-risk ratios, we can place both of them individually... even if they don't agree.

Now, you probably won't set out to place contradictory trades... But you may be holding one position, then another that contradicts the first trade (and also meets your guidelines for a good trade) appears. And that's OK.

When you're wrong on a short-term trade, though, you want to be wrong quickly and only lose a little. That's why we often use tight stop losses for our shorter-term trades. This way, you improve your reward-to-risk ratio – and you won't let a short-term trade eat much into the profits of a longer-term trade.

Don't be fooled into thinking that your portfolio should represent a grand vision of the future, where everything in your portfolio will make you money as your vision plays out.

That's not how the real world works. And that idea opens you up to a lot of unnecessary risk.

Instead, figure out the trading rules that work best for you, and stick to them. Contradictory trades won't always work out perfectly. But over time, sticking with good trading rules will make you money.

Good trading,

Ben Morris

Further Reading:

"Hear the critics out. But don't sell based on opinions," Ben writes. Learn how to let your winners ride in this recent DailyWealth essay: Guilty Beyond a Reasonable Doubt?

Would you turn down a guaranteed 84% gain in 30 years? "That may sound attractive to you," Ben writes. But based on history, it's not... See why here: Investors Aren't Biting on This Deal... Here's What It Means.

Market NotesTHE NASDAQ IS SOARING ON THE BACKS OF THESE WINNERS... Today, we'll check in on four of the market's most popular stocks...

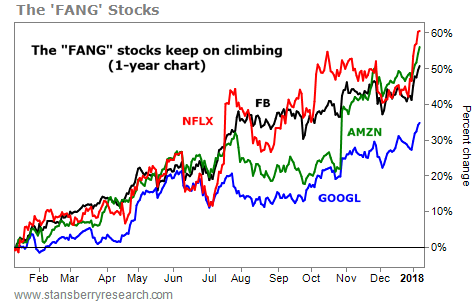

We're talking about Facebook (FB), Amazon (AMZN), Netflix (NFLX), and Google's parent company Alphabet (GOOGL) – the so-called "FANG" stocks. These high-flying tech giants have changed the way we shop, find and consume content, and interact with friends... And as we said back in May, they're some of the fastest-growing companies in the market. Now – about seven months later – not much has changed...

Last quarter, the FANG stocks reported big sales increases from the same time last year – between 24% and 47%. The results set new quarterly records for each company. More important, as these tech leaders continue to grow, so does their impact on the tech-heavy Nasdaq Composite Index... Today, the FANG stocks have a combined market cap of about $2 trillion. That's nearly 27% of the Nasdaq's total value... And it's up from 17% in our last update.

Yesterday, all four FANG stocks hit new all-time highs. As you can see below, they're up big over the past year. Don't expect the Nasdaq's big rally to stop if these stocks keep rocketing higher...

|

Recent Articles

|