| Home | About Us | Resources | Archive | Free Reports | Market Window |

|

Steve's note: Yesterday, my friend and colleague Porter Stansberry discussed a potential threat to stocks. Regular readers know I still see plenty of upside ahead... But we both agree that no matter when this bull market ends, you can set yourself up to profit with less risk. Today, he explains three things that all investors should do – right now – to improve their performance.

And afterwards, read on for details about a special event tonight...

The Best, Safest, and Surest Way to Get Rich in StocksBy

Wednesday, January 24, 2018

If you read yesterday's essay, then you know I've done my best to show you the macro framework as I see it...

I hope you understand why it's particularly important this year. But honestly, it really shouldn't matter all that much to your investment strategy.

Why not?

Because you can't know if I will be right and a bear market will develop soon. And even if I'm 100% right, you could still easily make your biggest gains of this cycle in the final few months of the bull market.

In other words, even if there is a bear market, and even if the markets as a whole end up down for the year, you could still make a lot of money by simply following your trailing stop losses and hanging on as long as you can.

So while I think you should be aware of these macro risks... and while I believe they're even more important this year than they have been in more than a decade... it's far more important that you simply follow sound investing principles, rather than try to time the market.

Here are the three things you should do this year (and every year)...

I'm frequently astounded (and terrified) when I talk to individual investors and they start describing their strategies. A portly gentleman wearing overalls told me proudly at a Casey Research meeting about six years ago that he'd mortgaged his house to buy junior mining stocks. He wasn't worried about the pullback (which became a grinding, four-year bear market and probably wiped him out) because he was diversified across more than 30 different tiny companies. The best way, by far, to understand how much risk you're taking in your equity portfolio is to use TradeStops.com. Yes, we're investors in that business. If you subscribe to that software platform, I will probably make a small amount of money from the fees you pay. But I don't know of any other software system anywhere that allows you to easily (and automatically) enter your brokerage information and quickly receive an accurate assessment of the volatility of your actual portfolio.

TradeStops can tell you exactly how much risk you're taking, both with your portfolio as a whole and across all of your individual positions.

My bet? If you're managing your own portfolio, you're probably taking at least twice as much risk as the S&P 500 Index. That is, if a bear market strikes and stocks fall 20%, your portfolio will most likely fall more than 40%.

If you don't know how much risk you're taking, you're much less likely to guard against those losses. But if you do know how much risk you're taking and which positions are the riskiest of all, you can do a much, much better job of running your portfolio safely.

By the way, if you use a broker or an asset manager, it's even more important for you to have this tool and this information. Why? Because you'll have a much better sense for whether or not he's doing a good job... or just taking a lot of risk in a bull market. (Telling him where he's taking too much risk will also let him know you're not a knob.)

If you don't have TradeStops or you won't buy it, you can "spitball" this risk assessment by simply measuring the weighted average of the "beta" of your individual positions. A beta of "1" means that a stock has the same volatility as the market as a whole. A beta of "0.5" means a stock is half as volatile as the market. And a beta of "2" means it's twice as volatile as the market.

You can generally find the beta on any security by using widely available databases, like Yahoo Finance. (Careful, though... sometimes the data are glitchy. So if you see a number that doesn't make sense, check it using another source. Or... even better... just use TradeStops.)

Once you understand how much risk you're taking, I suggest rebalancing your portfolio so that you take less risk than the S&P 500. Remember... you want to be cautious when others are greedy.

You can lower your risk by selling down risky positions and building cash in your portfolio. You can also lower your risk by adding hedges that have a negative correlation to the stock market, like short selling positions.

In other words, whether you followed hard stops, trailing stops, or "smart" trailing stops (which are based on a stock's individual volatility profile)... the biggest improvement to portfolio performance came from using a position-sizing strategy that equalized the capital at risk in each position. This year, give yourself the best chance at success. Rebalance your portfolio so that you're risking the same amount of capital in each position. Again, you can do this with the click of a button by using TradeStops. You just link the software to your brokerage account, import your portfolio, then use the risk rebalancer to learn exactly how many shares of each position you should own. That way, you end up with the exact same amount of risk in each position.

This allows you to use wider stops on your riskier positions, because they will be far smaller positions than your safer stocks. And it lets you speculate in high-growth equities without taking on too much risk.

Again, if you don't have TradeStops or aren't willing to use it, you can approximate this approach by using each stock's beta to adjust your position size. If a stock has a beta that's less than one, then increase your position size until multiplying its beta by that factor will equal one. And do the inverse for stocks with betas that are greater than one. Doing so will give you a risk profile that's equal to the markets. If you want less risk, then standardize to a beta of 0.99 or less, depending on how much risk you want to take.

The important thing is to make sure that you're taking the same amount of risk in each position. Nothing else you can do this year is more likely to increase your portfolio's return.

And yet... I'm certain that more than 90% of readers will completely ignore this advice. So before you read on, ask yourself: are you really trying to become a better investor? Why not at least do the easiest thing, the thing that's most likely to help you, first?

While these "safe and boring" businesses may not excite you or make you a killing in the short term, they are the best way to build real wealth in the stock market. Over time, nothing beats this approach. And I can give you an important example of how powerful this idea is... The very worst time to buy stocks in my lifetime was November 2007.

That was the month when stocks hit their last high before the crisis of 2008. That was just before the S&P 500 went on to decline by nearly 50% over about 18 months. It was during that month – virtually the worst time in history to buy stocks – that I was researching a company that I knew would become the best recommendation I would ever make in my career.

And I said so at the time.

On December 7, 2007, I sent the following to the subscribers of my Stansberry's Investment Advisory newsletter, under the headline "Our Best 'No Risk' Opportunity Ever"...

I've referenced that famous issue many times over the years... But today is an important milestone. It has now been a little more than 10 years since I made that recommendation – which was to invest in chocolate maker Hershey (HSY). The company is one of the best examples in the world of a dominant, capital-efficient, noncyclical, consumer-franchise business. It rarely trades at an attractive price, but at the time, Wall Street was convinced that Hershey wouldn't be able to compete effectively in the global markets against Cadbury, and so all was lost.

We took advantage of this temporary dip in sentiment to establish a world-class, long-term investment. I begged my subscribers to put a meaningful amount of wealth into the company.

Of course, it's easy to promise that long-term capital appreciation is certain. It's much harder to deliver.

In this case, I forecast the total return would be around 15% annually for 10 years. I was wrong. The total return (assuming you reinvested your dividends at the time they were issued) was "only" 13.2% per year, or about 250% over the 10-year period. My apologies...

If you took my advice, you can console yourself with this: Compared with Hershey, the S&P 500 has grown 8.5% a year over the same period – and been about twice as volatile.

Assuming you put $100,000 into the shares when I first recommended them, you'd own 3,173 shares. The total value of your shares would now be just a little under $350,000. And here's the best part: Hershey would have paid you more than $77,000 in dividends during the last 10 years.

I want to make three points about our Hershey recommendation...

First, even though we recommended the stock at virtually the worst possible time in the history of the stock market, we've still done great. And we never stopped out of the stock. Why? Because we bought at the right price, and we bought a high-quality, simple business that we could easily understand and evaluate.

Most investors, especially at this stage in the market cycle, only pay attention to stuff that's promising to change the world. Those investments are always difficult. They're extremely volatile. And very, very few of them will produce returns in excess of Hershey's over the long term. Thus, if you're simply willing to be patient, you don't have to be daring to get rich in stocks.

Second, it took the stock almost five years to really deliver any capital gains. As late as 2011, Hershey's shares had hardly budged – up less than 20% from our original purchase.

My point is that when you buy a great, long-term investment, it shouldn't matter much whether you buy shares today or next week or next month. And that's good: Great long-term investments always offer you plenty of opportunity to buy more shares. Don't doubt your analysis as long as the company continues to deliver on its model. Just buy more. And wait.

Third, it's virtually impossible for other kinds of businesses to beat capital-efficient companies in the long term. If you don't understand why, let this be the year you finally uncover this secret fully. It will change your life forever.

Hershey doesn't have to spend much (hardly anything at all) to maintain its plants and grow. It's been making the same basic product for more than 100 years – a chocolate bar. There's no radical research and development required, and no new massive factory build every five years. Thus, as sales expand, more and more of the profits can be distributed to shareholders via dividends and share buybacks. Over time, this advantage compounds and becomes almost unbeatable.

In the letter where I recommended Hershey, I also criticized the corporate governance at Oracle (ORCL), which was (and still is) a popular technology company. Oracle makes some of the best corporate database software in the world. It has very good products that are high margin and "sexy." But I had no doubt that Hershey investors would make far more money over time. And I was right. Oracle – the sexy tech darling – is up about 150% in the period, or 100 percentage points less than Hershey's total return.

So remember: When you make long-term investments in high-quality businesses, don't let the macro factors scare you out of your position. As long as the company continues to execute according to its model, stick with the position.

That's the best, safest, and surest way to get rich in stocks.

Let 2018 be the year you begin to make only high-quality, capital-efficient, long-term investments.

In about 10 years, you'll think it's the best decision you've ever made.

Regards,

Porter Stansberry

Further Reading:

Yesterday, Porter pointed to an early warning sign in the markets. "Just as speculators enjoyed a one-way bet on the way up, they now have a one-way bet on the way down," he says... Learn more here: A Huge Rally and an Even Bigger Collapse.

"Don't let the mania prevent you from investing in a truly attractive situation," Dan Ferris writes. In this essay, he shares three steps investors can take to prepare for a potential decline. Read more here: You Don't Need to Predict a Market Crash... Here's Why.

Market NotesANOTHER WINNER IN THE HEALTH CARE SECTOR Today's chart highlights a leader in disease treatment...

Recently, we revisited our colleague Dave Eifrig's bullish call on health care stocks. For years now, he has said that the Baby Boomer generation will drive big gains in the sector. As time goes on, they'll need more medicine, testing, and visits to the doctor. And the winners of this big trend are meeting that demand...

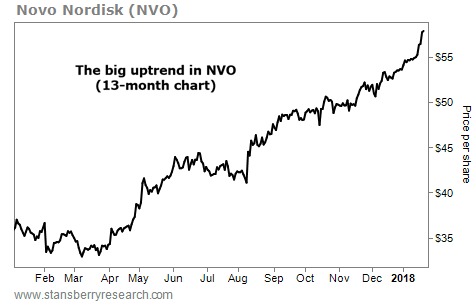

Today, we'll look at Novo Nordisk (NVO), the leading drugmaker to treat diabetes. As of 2015, more than 30 million Americans had diabetes... And according to the American Diabetes Association, the disease afflicts about 25% of seniors in the country. Treating this serious condition is crucial – and Novo Nordisk is making strides. Over the past year, the company won some key regulatory approvals for new drugs, including a fast-acting insulin treatment for adults.

As you can see below, these victories fueled a huge rally... Shares are up more than 60% since the start of last year, and they recently hit a fresh 52-week high. Diabetes is on the rise in America. And as the epidemic grows, more folks will rely on Novo Nordisk for treatment...

|

Recent Articles

|