| Home | About Us | Resources | Archive | Free Reports | Market Window |

Headed to China Once Again...By

Friday, February 17, 2006

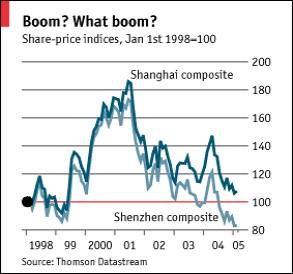

Next week, I’ll be writing to you from Shanghai, China as I check out the investment prospects there... My first trip to Shanghai to was just over a decade ago. On that trip, I was surprised to discover just how awful China’s securities markets really were. (More on that in a minute...) I haven’t put a penny there since... and it’s been the right call. For proof of how bad the stock market in China has been, the MSCI China Index is at about half its 1994 levels today. Back then, I learned you don’t want to put your money directly into locally traded Chinese companies. I learned the lowest-risk, highest-reward way to invest in China’s growth is to invest in non-locally traded companies that provide the things China can’t live without... companies like the world’s largest diversified commodity company, Australia’s BHP Billiton (ASX: BHP) This method has worked fantastically over the years... BHP just reported half-year earnings this week, and they were huge. In fact, they were the highest recorded half-year earnings in the history of business in Australia. The record results are significantly attributable to China, as sales of commodities to China jumped from 12.6% to 16.2% of BHP’s business. (BHP is a recommendation in my newsletter, True Wealth) Today I’d like to share a few moments from my first trip, so you can see how bad it was... and so we’ll have a frame of reference for next week’s discoveries, to see if much has changed... -When I visited the old stock exchange a decade ago on The Bund in Shanghai, I was told “No pictures please.” I assumed it was a security measure. After I went in, I wondered if I was told “no pictures” to keep the secret... that traders everywhere were asleep at their desks during trading hours. -I also visited with the largest Chinese-traded company at the time, valued at over a billion U.S. dollars. It didn’t take long to realize it was a sham. If the biggest company was a sham, what about all the rest? -Next stop was a Japanese brokerage firm’s “representative office” in Shanghai. We asked what Yamaichi Securities did in China, since they didn’t have a securities license yet. They did nothing, is as best as we could figure, though Yamaichi apparently needed a staff of about a dozen to accomplish all that nothing. A “representative office,” it turns out, is just the purgatory a foreign financial firm must go through if it ever hopes to do business in Chinese stocks. I don’t know if Yamaichi ever ended up doing business in China... the company went bankrupt in 1997. Have things gotten any better since the shady, lame days of a decade ago? Not at all, according to The Economist magazine from a year ago: “With the state able to rig the market as regulator and controlling shareholder and through government-linked brokers, [stock] prices soared, reaching 60 times earnings in the summer of 2001. At that point, the government got greedy and tried to sell its remaining holdings, a plan that started the current decline...

“The average A-share trades at a still-expensive 25 times earnings, even when precisely the same asset, listed in Hong Kong or New York, is priced at half that... Any Chinese enterprise that can do so seeks a foreign listing.” The government’s actions have been bad. The actions of brokers have been even worse... Brokerage firms stupidly guaranteed investors double-digit returns. Now, according to the latest issue of The Economist, out of the 130 or so local brokerage firms, “All but 10 or so are technically insolvent.” Investing locally in China has been hopeless for years... and may still be. The confusing thing is, while investing locally in China appears hopeless, foreign investors are willing to invest in any China story that seems even remotely plausible these days. How do we make sense of it? And where’s the best opportunity? Will this trip change my mind about investing locally in China? I’ll be trying to figure all these things out from Shanghai next week... until then, let’s stick with “backdoor” China plays like BHP. Good investing, Steve Market NotesGREAT NEWS FROM GERMANY

Stagnant economic growth… record high unemployment… business and consumer confidence in the toilet… As any headline of the past several years concerning Germany’s economy will tell you, things are bad in the land of giant beer mugs. In 2005, German unemployment hit a post-WWII high… and German economic growth lags far behind most of the world. This is all wonderful news to a contrarian investor… it’s the news that produces cheap stocks. As the chart of Germany’s benchmark DAX Index shows below, this news has already been discounted by the market… and it has the stage for a bull run. Up 43% in the past 16 months. The DAX (two-year chart): Let Germany be a lesson to all of us. Bull markets start when the headlines are bad… when things “can’t get any worse.” After all, when things cannot get worse, they can only get better. -------------------------------------- Editor’s Note: Tomorrow, be on the lookout for DailyWealth Weekend… our weekly wrap up of DailyWealth articles and insights. If you’ve spent the week crunched for time, DailyWealth Weekend will give you the fastest, easiest way to stay on top of the most important investment ideas in the market. |

Recent Articles

|