| Home | About Us | Resources | Archive | Free Reports | Market Window |

Big, Safe, Government-Guaranteed DividendsBy

Tuesday, June 26, 2012

If I don't pay my Car & Driver subscription, life goes on... But if I don't pay my energy bill, the utility company will threaten to cut my electricity off.

Car & Driver magazine could go out of business if people like me don't write them a check. But that's no skin off my back. Meanwhile, my utility company has monopoly power over me... I write them a monthly check – or else they'll turn off my power!

We all write monthly checks to these utility companies. There is no way to get out of it. The thing is, right now, we can actually receive big checks from these government-controlled monopolies, too... And now is a great time to do so...

In March, I told DailyWealth readers how much I like utilities as an investment today.

In short, utilities pay a hefty 4% dividend. And based on history, today's dividend yield creates an enormous "spread" over the 10-year U.S. Treasury rate. Historically, utility stocks soar when the spread gets this high. But there's another reason I'm interested in utilities today...

You see, utility stocks are the ultimate providers of the "basics." They provide services we can't live without.

Because of this, the government keeps its nose in their business. Utilities deal with heavy government regulation... regulation that keeps profits steady, year in and year out.

Steady profits make for "boring" businesses. But they're perfect for folks sick of the market's constant ups and downs over the past few years.

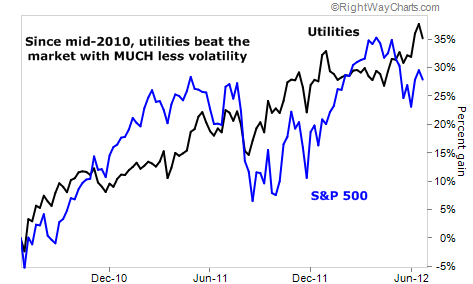

You can see what I mean in the chart below. It's a two-year comparison of the utilities sector and the S&P 500 – an index containing the largest 500 U.S.-listed companies.

You can see that while the blue line (stocks) was bouncing all over the place, the black line (utilities) was climbing steadily from the lower left of the chart to the upper right.

Sure, utilities dropped at certain points – but much less than the overall stock market. For example, when panic took over the market last July, stocks fell 17% in two weeks. The utilities sector fell just 11%.

More importantly, utilities recovered almost immediately... The overall market trudged along its new bottom for the next five months.

Lower volatility ups the "sleep at night" factor for utilities. If you own the overall market, it's hard not to worry about manic price swings. But in boring utility stocks, you can rest easy.

What's most impressive... utilities are actually beating the market. Over the last two years, the big utilities fund (NYSE: XLU) is up 24%. The S&P 500 is only up 21%. Counting dividends, the difference is even more dramatic... a full 9% outperformance.

No matter what happens in the world economy, utility companies will continue to make safe, steady profits. We need their services. So we'll pay the bill, month after month.

Of course, utilities have had a good run. And they could be due for a breather. But they're still cheap based on the "spread" over Treasurys. And based on history, I believe they could climb another 50% in the next two years.

Whatever they do, it's likely to be a MUCH smoother ride than you'll have in stocks.

Good investing,

Brett Eversole

Further Reading:

Over the last year, Brett and Steve have predicted big, safe gains from utility stocks. "We have everything we want in this trade. It's the best value of our investment lifetimes. And we've got the uptrend," Steve writes. "It's time to buy." Read his argument here: Boring Utility Stocks Could Easily Double from Here.

And last October, Doc Eifrig introduced DailyWealth readers to what he calls "Digital Utilities." Learn how steady, annual income streams of 20% or more are possible here: How Digital Utilities Could Pay for Your Retirement.

Market NotesHOW BAD IS IT IN COMMODITIES? BAD To get an idea of how bad things are in the natural resource space, look no further than Brazil...

More than a year ago, we urged readers to stay cautious toward the commodity sector. Back then, commodities had enjoyed a huge rally... But as we noted, Brazilian stocks were "breaking down" to new lows.

Brazil is one of the ultimate destinations for investors who want exposure to commodities. Its state-operated oil company Petrobras has found a series of giant offshore oilfields in the past decade. Brazil is a major producer of agricultural commodities like soybeans, cattle, corn, coffee, and sugar. It's a major producer of iron ore. Much of this production heads to China, Brazil's largest trading partner.

As you can see in the two-year chart of the Brazil investment fund, our warning was well-timed. Brazil has been hammered since its 2011 peak. The rally that began early this year has reversed with a huge correction... The fund now sits at a 52-week low. China is slowing... which has hammered commodity-producer Brazil.

– Brian Hunt

|

In The Daily Crux

Recent Articles

|