| Home | About Us | Resources | Archive | Free Reports | Market Window |

I Know Exactly What the Fed's Next Move Will BeBy

Thursday, October 17, 2013

For rich people all around the world, Ben Bernanke has been a living saint.

As I showed you yesterday, the Federal Reserve chairman's policies have allowed the world's wealthiest capitalists to borrow unprecedented amounts of money… and buy world-class assets.

Meanwhile, the people whom Ben fleeced – the workers, the savers, the few Americans left with simple industry and thrift, the kind of folks who would never have believed the government would actively try to hurt them – have been wiped out. They've seen the real value of their wages, savings, and standard of living decline by huge amounts.

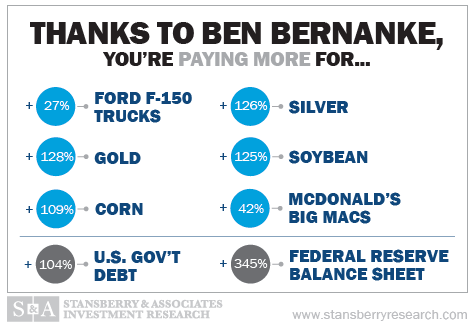

If you doubt me… consider the following graphic of indicators. They are real and "unadjusted" (unlike the U.S. government's various measures of inflation, which have "adjusted" so many times over the years that they're nearly meaningless).

These indicators show in simple, stark terms exactly what Bernanke did to our economy...

Most of our indicators are self-explanatory. They show how much the price of some basic goods have risen since Bernanke took over as Fed chairman. For comparison... we've also included how much the U.S. government's total obligations ("Fed Debt") have swollen. And we've included the increase in the Federal Reserve's balance sheet – our economy's monetary base.

It's clear... as the number of dollars increased, each one bought less and less...

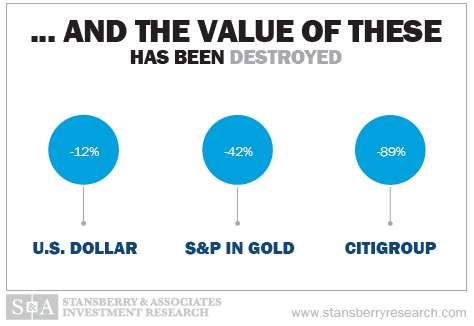

And as you can see from the next graphic, our assets are worth less, too...

The "S&P in Gold" is the change in the value of one share of the S&P 500, if you measured the stock index in gold ounces rather than dollars. We believe this is a better measure of the actual value of U.S. corporate assets because it measures their value in a sound currency (gold) rather than in paper.

And we included the share price of Citigroup. As head of the Federal Reserve, Bernanke's primary regulatory duty was to police the large banks and to protect their depositors. We think the near total destruction in equity value of what was the largest U.S. bank when he took over at the Fed speaks volumes about how well Bernanke did his job.

Bernanke gutted the dollar. He gutted the middle class. He gutted the savings of millions. And he greatly impoverished our country.

And yet... despite it all... Ben Bernanke is still being proclaimed a hero of the Republic.

"When faced with potential global economic meltdown, he has displayed tremendous courage and creativity," said President Obama at a White House news conference this week. "He took bold action that was needed to avert another Depression."

USA Today added: "Bernanke, a shy and self-effacing former Princeton professor, boldly led the U.S. economy through the worst financial crisis since the Great Depression."

And because there's nothing genuinely good to say about the guy, as is typical with worthless government officials leaving the scene... the plaudits quickly spill over into maudlin absurdity: "Guiding the economy was like brain surgery, and you needed an expert to do it," claimed Michael Gertler, a New York University professor of economics.

We know what to expect from the Federal Reserve…

Its policies will continue to support and promote the incredible profligacy of our country's government. These policies will, in the end, cause unbelievable harm to millions of Americans. They will devastate the average standard of living in our country and leave a great many people in abject poverty.

Regards,

Porter Stansberry

Further Reading:

"I believe the sovereign-debt bubble in the U.S. will end badly," Porter says. "But I also believe life will get tremendously better... and huge fortunes will be made... It's inevitable."

See how he reconciles these "contradictory" views here: The Next 25 Years Will Bring an Epic Crisis... and Vast Prosperity.

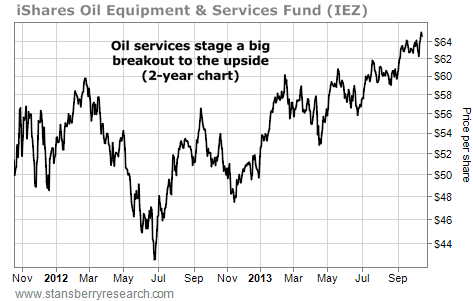

Market NotesIT'S A BULL MARKET IN OIL SERVICES After trading sideways for a good long time, oil services have "broken out" to the upside...

Regular DailyWealth readers are familiar with using "picks and shovels" to profit from sector and commodity booms. "Picks and shovels" providers don't bet the company on one project... they sell vital goods and services to an industry. For example, there are "picks and shovels" companies in the oil sector that sell goods and services to oil producers. They are called "oil services" companies.

One way to monitor (and own) oil-services companies is with the iShares Oil Equipment & Services Fund (IEZ). This fund provides investors with a "one click" way to own a basket of oil-services stocks.

For much of the past few years, IEZ has traded in a wide range between $44 and $60 per share. But in just the past few months, shares have staged a major upside breakout... and now sit at a multiyear high. High oil prices have oil producers spending lots of money... and it's a bull market in oil services.

|

In The Daily Crux

Recent Articles

|