| Home | About Us | Resources | Archive | Free Reports | Market Window |

The World's Cheapest Stocks Are Set to SoarBy

Thursday, October 31, 2013

After all the big gains in stocks lately, where can you find cheap stocks now?

They're not easy to find...

The U.S. stock market is up 24% in 2013. So you might need to consider stocks outside the U.S.

Ah, but that doesn't do it, either... Japan's Nikkei Index is up 33% over the last year. And Europe's blue-chip index – the Euro Stoxx 50 – is up 36% in the past two years.

After all these big gains, finding truly cheap opportunities is getting harder. However, there is one place that hasn't run away from us yet...

If you're willing to step outside your comfort zone, you have an opportunity to buy a beaten-down stock market that's poised to soar.

Let me explain...

I tapped our massive True Wealth Systems databases to find the world's cheapest stock markets. And it turns out, the real value out there is in emerging markets...

But I dug deeper. I sized up emerging markets on three different measures – book value, earnings, and dividend yield – to determine which countries offer the best value, based on their own history.

Take a look at what I found... It turns out that Russian stocks are the cheapest now relative to their history based on book value, earnings, and dividend yield:

Russian stocks are crazy-cheap compared to their history. Based on earnings, they trade at a 35% discount to their historical price-to-earnings (P/E) ratio... and that's not even the crazy part. Russia's RTS Index trades for just 4.5 times next year's earnings, as I write. That's cheaper than any major stock market on earth.

There's no question... Russia is dirt-cheap compared to both its own history and the rest of the globe.

And importantly, Russian stocks have been trending higher over the last few months. The Market Vectors Russia Fund (RSX) is on the verge of breaking out of its two-year trading range. Take a look:

As you can see, Russian stocks are up big since the middle of this year. RSX is up 22% since bottoming in June.

And a breakout of the current trading range could lead to even bigger returns. From current prices, I wouldn't be surprised to see RSX double in value over the next couple years.

Today, emerging markets are cheap, and they're beginning to exit their multiyear bear market. Russia is the cheapest of the cheap. And I believe it's just getting going.

The opportunity to buy an entire stock market at today's ultra-cheap value doesn't come around often.

While it might seem uncomfortable to invest in Russia, with this incredible value and a new uptrend in place, it's a risk worth taking today. And shares of RSX are the easiest way to invest.

Good investing,

Brett Eversole

Further Reading:

"Emerging markets are now cheap, hated, and seem to be just starting an uptrend," Steve Sjuggerud writes. "I see exactly what I want to see to invest..." And he says there's one emerging-markets fund that could double investors' money. Get all the details here: What the 100%-a-Year Man Says Today.

This week, Brett showed readers a safe, simple way to supercharge your gains in the U.S. stock-market boom. "You won't hear about it on CNBC," he writes. "This idea I'll share with you today gets no press in the mainstream financial media. But you'd be foolish not to put it to work today." Learn how here.

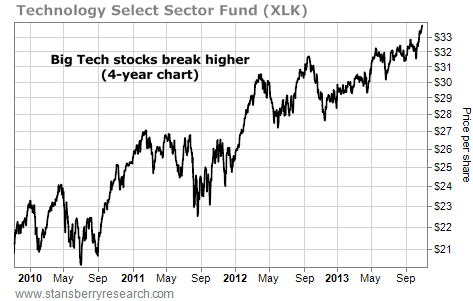

Market NotesBIG CHEAP TECH BREAKS HIGHER... BUT IT'S STILL CHEAP The market is waking up to our "Big Cheap Tech" idea...

Regular readers know our "Big Cheap Tech" label covers the biggest and best companies in the technology sector. These businesses have thick profit margins, generate huge amounts of cash, and pay growing dividend streams to shareholders. We're talking about companies like Microsoft, Intel, and Apple.

For years after the tech bubble burst in the early 2000s, investors simply weren't interested in owning them... which has made these stocks cheap. After accounting for their massive cash hoards, they're averaging less than 10 times forward earnings. And now, investors are buying...

The Big Tech sector fund XLK is a "one click" way to own all of the big names in tech. Apple, Google, and Microsoft are the fund's top holdings... XLK is up 17% this year and it just hit a multiyear high. The trend in Big Cheap Tech is clear... and it's UP.

|

In The Daily Crux

Recent Articles

|

|||||||||||||||||||||||||||||||||