| Home | About Us | Resources | Archive | Free Reports | Market Window |

Rick Rule: 'This Is What a Bottom Feels Like'By

Friday, July 25, 2014

"The situation is in place for a dramatic recovery," Rick Rule told the audience.

I'm here in Vancouver – the heart of the resource-mining industry – attending the Sprott Natural Resource Symposium. It's a collection of the "best of the best" in the small-cap resource space.

I'm here for a simple reason... while major stock markets around the world have soared over the past few years, small resource companies have absolutely crashed. Falling well more than 50% as a whole.

But today, that means opportunity. Many of the brightest minds here expect the bottom is in, and prices have nowhere to go but higher.

Let me explain...

Rick Rule leads a pack of smart industry pros in Vancouver. Rick's a multi-decade investor in the small-cap mining sector and the Chairman of Sprott U.S. Holdings – an arm of Sprott Inc., which manages $7.6 billion.

During his keynote presentation, he explained why he's excited about today's opportunity...

"A market down 75% is precisely 75% more valuable and 75% less risky."

What surprised me is that Rick wasn't a cheerleader. He simply explained the rational opportunity in the resource sector today. His big theme was simple...

"A bull market is coming. Don't waste it."

Of course, Rick takes a contrarian approach to investing. And right now, things are bad. Folks just aren't interested in resource investing...

Attendance at this year's Vancouver conference is at its lowest in years. And it has been in steady decline since the glut began in 2011. But at least they're still in business...

"The current challenged metals market has led us to make the difficult decision to suspend our events..."

That's from the Metals and Minerals Investment Conference website. Metals and Minerals is one of the largest resource-based conference groups, with events in New York and San Francisco.

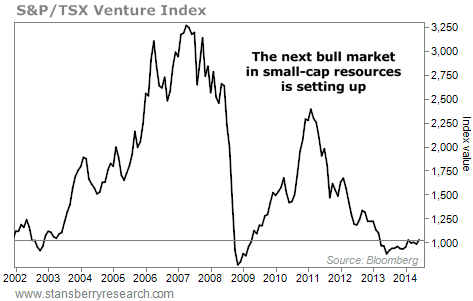

The cause of all of this bad sentiment is simple. Small-cap mining stocks have crashed... If we take a look at the S&P/TSX Venture Index – where most small resource companies reside – the opportunity becomes obvious...

As you can see, this index of small resource companies has crashed over the past three years. It's now sitting near 2002 and 2008 lows... where the last two great bull markets began. Importantly, the index has been rising over the last year. The index is up 17% since last June and 9% so far this year.

In short, no one is interested in small-cap resources. Major conference circuits have been canceled and the overall market is down 50%-plus over the last few years. Yet, the market is UP recently.

According to Rick Rule, today's opportunity is enormous. According to him, "expectations are so low that we can't help but succeed."

Yes, it'll likely be a bumpy ride. But if you have the stomach for it, small-cap resources seem to be poised to move higher.

With U.S. stocks reaching all-time highs, the best opportunities are in beaten and forgotten places. Resources fit that mold perfectly today. Don't miss the opportunity.

Good investing,

Brett Eversole

Further Reading:

Buying beaten-down natural resources is a proven, time-tested way to make money in the stock market. And Porter Stansberry calls one resource investment "the single greatest contrarian opportunity today."

In this classic interview, Rick Rule shows readers how to master the giant "boom and bust" cycles in natural resources... and make life-changing profits. If you're going to trade in the resource sector, this interview is a must-read.

Market NotesDAN WROTE IT, DID YOU BUY IT? (PART II) On Tuesday, we showed you the recent performance of Microsoft – a longtime recommendation of our friend and colleague Dan Ferris. Today, we take a look at another one of Dan's big winners...

Like Microsoft, Intel (INTC) was left for dead by many investors. Most claimed the personal computer was going the way of the Dodo bird... and Intel, which specializes in computer chips, was destined to go extinct along with it. But Dan, editor of the outstanding Extreme Value newsletter, knew better...

Since 2009, Dan has touted Intel's competitive advantages, consistently thick profit margins, propensity to reward shareholders, and consistent earnings growth. Just like Microsoft, Dan was more adamant about Intel than anyone we knew.

As you can see in the chart below, Dan was right on the money... again. Intel shares have more than doubled since Dan's original recommendation, including a gain of more than 50% over the past 12 months. Intel's eminent demise has been greatly exaggerated.

|

Recent Articles

|