| Home | About Us | Resources | Archive | Free Reports | Market Window |

Jim Rogers' Simple Path to Investment WealthBy

Tuesday, November 18, 2014

"Make sure your children and grandchildren speak Mandarin," legendary investor Jim Rogers told the crowd.

We were in the Dominican Republic... At the annual Stansberry Research Alliance Conference. Jim spoke avidly about China, as he has for years...

"The 19th century was England's. The 20th Century was the United States'. And the 21st century will be China's."

Jim expects China to dominate the global economy this century. And that makes speaking Mandarin a valuable skill. Jim's two young children are white, live in Singapore, and speak perfect Mandarin.

He's eating his own cooking, you might say.

Now, if you haven't heard of Jim Rogers, he's a true investment icon...

He worked alongside George Soros in the 1970s, running the Quantum Fund – one of the first hedge funds. To say they were successful would be a ridiculous understatement.

From 1970-1980, the Quantum Fund returned 4,200%... That's around 46% a year. The S&P 500 returned just 47% during the same period.

That brings us to China...

You see, Rogers believes his success came from finding what he knew would be successful in investing. Making a few big bets that would certainly pay off instead of many small bets.

In the most extreme case, you could make one investment every 10 years... a once-a-decade portfolio.

Jim explained this idea in his fantastic book, Street Smarts: Adventures on the Road and in the Markets. He wrote...

"If in 1970 you had bought commodities and held them for ten years, and in 1980 you sold your commodities and bought Japanese stocks, and then in 1990 you sold your Japanese stocks and bought technology stocks, and then sold those in 2000, you would be fabulously rich now."

Of course, this once-a-decade portfolio led to incredible returns. But it's easy to find returns in the rear-view mirror. That's not Jim's point. His point is this...

If you could only make 25 investments in your lifetime, you'd be a lot pickier about what you buy. You'd only buy things you were sure would work out. And you could likely beat the market buy making one investment a decade...

While Jim didn't come right out and say it, it's obvious he'd "buy" China today if he could only make one investment.

He's bullish on China for a few reasons... He believes China's low valuation is a key to long-term gains. He also loves to see the Chinese government pushing citizens into stocks (something Steve Sjuggerud wrote about in a recent DailyWealth).

Sure, there's likely to be ups and downs along the way. But he expects China to be the dominant economy of the 21st century. And with its stock market priced around half that of the U.S., he's interested.

Jim believes you can get rich by making one decision a decade. And today, China is at the top of his list for the once-a-decade portfolio.

We recommend making the trade with the DB X-trackers Harvest CSI 300 China A-Shares Fund (ASHR). This fund invests in local Chinese companies. And it's one of the best ways I know of to buy China today.

If you don't have money in China today, one of the world's best investors thinks you're making a mistake. Consider putting money to work in ASHR today.

Good investing,

Brett Eversole

Further Reading:

Most U.S. investors "hate" China right now... and that's exactly what interests Steve and Brett. Just last week, Steve explained why "hated" investments usually generate the biggest profits.

Steve says the picture for commodities at the moment appears terrible. "But moments like this are where the greatest opportunities are born." Learn more about commodity cycles – and why Steve thinks now is the time to buy – right here.

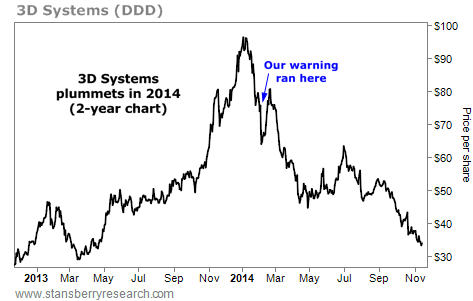

Market NotesAN UPDATE ON A POPULAR "STORY" STOCK Our warning to avoid "3D printing" stocks is proving to be a heck of an idea...

Back in January, we ran a warning on the market's top 3D-printing stock, 3D Systems (DDD). 3D printing is the printing of solid objects... rather than conventional "on paper" printing. The industry uses computers and special materials to "print" things like tools, guns, and toys.

Over the past few years, 3D printing has become one of the world's biggest tech stories. And with good stories come good stock rallies. Printer maker 3D Systems shot from $10 a share in late 2011 to $97 in early 2014. It's one of the biggest stock market winners in recent memory.

In our January warning, we noted that high-growth "story" stocks like 3D Systems often get far too popular with the investment public... and far too expensive. When growth rates slow, these stocks get slammed. Our note was well-timed. Since then, 3D Systems has suffered a huge fall from $76 to $35 (a 54% drop) and just hit a multiyear low. It's a good case study in avoiding popular investments.

|

Recent Articles

|