| Home | About Us | Resources | Archive | Free Reports | Market Window |

|

Editor's note: Today, we're wrapping up our three-part bond series from Stansberry Research founder Porter Stansberry. On Monday, Porter introduced you to what he says will be "the greatest legal transfer of wealth in history." Yesterday, he shed more light on this debt-clearing "super cycle." Below, in his final segment, he'll show you the best way to make money during this time...

How to Make the Biggest Gains During the Coming CrisisBy

Wednesday, November 11, 2015

If you've been following my series this week, you know we're approaching a period of vast credit default...

Far, far, far too much money – mind-boggling amounts – has been borrowed by people and countries that are not creditworthy. These debts are going bad. The chain reaction is starting. And nobody knows exactly what will happen next because the world has never seen so much bad debt before.

This will be the greatest legal transfer of wealth in history...

While the next two or three years are going to be terrible for most investors... they can be great for you.

As I'll show you today, buying bonds for pennies on the dollar is the absolute best way to make a fortune in the markets.

For most individuals... investing in bonds is a new (and probably uncomfortable) idea. So let me explain a few basics...

When a corporation needs money to pay bills, expand, or upgrade equipment, it can fund these activities with the cash coming in the door, by issuing stock (also called "equity"), or by borrowing the money by issuing debt. This is also called "issuing bonds."

As an owner of a company's common stock, you share in the company's future profits. If you own stock in a company that grows its profits by a factor of 10 over a few years, chances are good that your stock will be worth a lot more than your original purchase price.

As a bondholder, you have no claim on the company's profits. You are simply loaning money at a set rate for a predetermined period of time. You are entitled to get your money back, plus interest payments, according to the bond agreement.

Most people find it incredibly difficult to consistently select stocks that grow their profits (and stockholders' equity) over a long period of time. For every huge success like Apple, Starbucks, or Home Depot, there are scores of bankrupt dreams. And when a company goes bankrupt, the stockholders can lose every cent they have in the company.

This is why we love being bondholders. In the event the company gets into trouble, the bondholders are at the head of the line when it comes to paying bills and creditors. And in the event of an all-out bankruptcy, the assets of the company are sold and the proceeds are paid to the secured creditors and bondholders.

This legal right to be paid is the bedrock of my bond-investing philosophy. As bondholders, we don't have to guess who has the best widget or which style of clothing people will like from year to year. We just loan money. We simply have to tear through a company's books and determine if it can pay us off in the time period in which our bonds are "in play."

So how does it lead to big gains?

Just like stocks, bonds trade in a public market that is heavily influenced by emotion.

And just like in stocks, emotion can cause bonds to trade for less than their true value. Professionals call this true value the "intrinsic value."

When investors become concerned about a business or industry, they're willing to pay less for the debt obligation of that business... just like they're willing to pay less for a dollar's worth of earnings of that business.

Let's say company ABC borrowed $5 million three years ago by issuing 5,000 bonds worth $1,000 each. (Most bonds are issued at $1,000 per bond. This original issue price is called the "face value.")

The company agreed to pay its creditors 8% interest for five years. That's an interest payment of $80 per bond each year. The amount borrowed, the interest rate, and the life of the bond can vary greatly. But we're keeping it super simple for our example.

Now... let's say ABC is struggling due to new competition or an industry downturn. The bonds ABC issued that originally had a value of $1,000 will fall. Investors aren't as rosy about the company's prospects... so they're only willing to pay $800 per bond.

Here's where it gets profitable for you...

We do a thorough analysis of ABC. We know the company will generate enough cash to pay the interest it owes to its creditors. (Remember, the creditors are first in line to get paid. Shareholders could see their cash dividend disappear.) We buy ABC's bonds for $800 per bond. That 8% interest on the original value must be paid.

Since we bought the bonds for $800, our $80 in annual interest payments gives us a yield of 10% per year. Now come the capital gains...

ABC has to pay off all of the $5 million it borrowed in two years. (Remember, the bonds were issued three years ago.) It is contractually obligated to pay $1,000 to the holder of each bond.

Since we took advantage of the pessimism toward ABC and did a thorough analysis of its ability to pay its debt, we are rewarded with a 45% gain on our original purchase price. We paid $800 for the bond, earned $80 in interest each year for two years ($160 total interest), and we make a capital gain of $200.

Here's how the math works out:

We make $360 off our investment of $800 – a 45% gain in two years. After the credit bubble I've described ends... the bonds of many companies that hold high-quality assets are going to be selling for 80... 70... even 50 cents on the dollar.

By studying all of the bonds carefully and by knowing what the collateral is on these deals, we can safely buy distressed debt. And we're very likely to get great deals at very low prices because institutions will be forced to sell these assets to fund the redemption requests of a panicking public.

This kind of mass liquidation happens regularly when a bunch of debt goes bad. It's part of what helped us find such great opportunities last time (in 2009) and I'm sure we'll see it again this time, too.

In our old bond letter, True Income, we had an amazing run during the last crisis. It earned huge returns for investors who were wise enough to follow our lead in 2008, 2009, and 2010 buying bonds for pennies on the dollar while other investors panicked.

Investing in bonds is different from investing in stocks. It requires a little extra work to place a trade. And you must be patient. But as you'll see, the rewards can be outstanding. You can make high-double- and triple-digit returns without having to worry about what the overall stock market is doing. You know when you'll get paid. And what the exact returns will be.

We made more money buying distressed bonds during the last crisis than most people ever make in stocks. And we're going to do it again over the next three years.

Regards,

Porter Stansberry

Further Reading:

If you haven't read the first two installments of Porter's bond series, make sure to check them out here:

"Investors who are patient and liquid will have an opportunity to buy exceptional assets at great bargains."

"Over the next few years, trillions of dollars' worth of businesses, land, resources, and intellectual property are going to exchange hands – legally, but unwillingly."

Market NotesTHIS 'SPENDING STOCK' JUST HIT A NEW HIGH Today, we check in on the state of the U.S. economy by taking a look at an important "spending stock"...

Over the years, we've highlighted many companies that give us a good sense of what's going on in the market. One classic spending stock we've featured is cruise line Carnival. When the economy is doing well, people are more willing to shell out plenty of money to cruise around the world. They're also more willing to take luxurious ski trips...

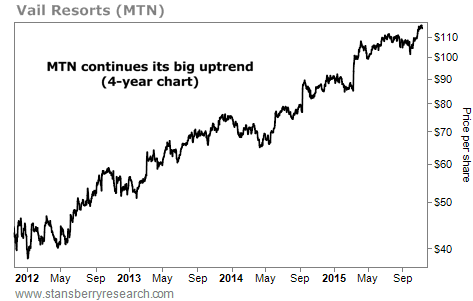

Vail Resorts (MTN) is a $4 billion business that runs four popular ski resorts in Colorado, Utah, Wyoming, and even Australia. It also owns upscale resort hotels throughout the world. It's a prime example of a spending stock... an "I want this" – rather than an "I need this" – purchase.

As you can see from the chart below, people haven't stopped spending money and taking ski vacations. The company is up nearly 170% over the past four years... and shares just hit a new all-time high. When spending stocks like MTN are soaring, we can confidently say "things can't be all that bad."

|

Recent Articles

|