| Home | About Us | Resources | Archive | Free Reports | Market Window |

|

Editor's note: Today's essay is extremely important... The credit crisis Stansberry Research founder Porter Stansberry has been warning about is underway... and there's not much time left to prepare. Regular DailyWealth readers know that editor Steve Sjuggerud believes stocks still have upside from today's levels. While that may indeed be true, it's critical for you to be ready when we officially enter a bear market...

This Is Your Last Chance to Take ActionBy

Friday, January 29, 2016

This is it, my friends.

This is your last chance to get over your "frozen by uncertainty" phase, and to realize that the coming huge debt and commodity crisis is real, and it's happening now. You must take action to stop the damage to your savings so that you can position yourself to profit from the eventual recovery.

If you haven't paid attention to any of my warnings yet, please stop whatever else you're doing and read today's essay very, very carefully.

Given the damage that has already occurred in the markets and the spike in interest rates on corporate debt, I have no doubt that 2016 will mark the emergence of a huge trend of rising debt defaults, falling equity valuations, and commodity liquidation...

What's coming is going to be bad – much, much worse than anyone expects...

The problem is twofold. First, the feds didn't allow the last default cycle in 2009 to continue. Its massive intervention short-circuited the market's natural cycle. As a result, about two times more bad debt is out there as there would have been otherwise. And the Fed's actions caused junk-bond issuance to reach mindboggling levels: A record amount of debt was issued to noninvestment-grade U.S. corporations in 2011, 2013, and 2014. The bigger the credit bubble, the bigger the inevitable bust.

Some will call what's coming a "bear market." Some will call it a crisis. Others will call it a credit collapse and the continuation of the problems that started back in 2008. I call it the greatest legal transfer of wealth in history.

Lots of foolish investors took the cheap money that the central banks were offering and made horrible investments – especially in commodities and emerging markets. These bad decisions are now going to be liquidated. We've been predicting this event for months... and now it's starting to unfold.

Hopefully you've been raising cash over the last six to eight months and are prepared to buy when incredible, once-in-a-decade opportunities emerge. But if you haven't begun to build your cash stockpile, don't panic. You still have plenty of time. Since the market peaked in May, the average stock in the S&P 500 is only down around 15%. A lot more downside lies ahead of us. I think we'll eventually see the average stock in the S&P 500 decline more than 30%.

Massive amounts of corporate debt from around the world have started to go bad. The ramifications to economic growth, commodities prices, mutual-fund investors, and stock market values are only now becoming apparent.

I have a solution – something to help you get up to speed on how to handle a bear market. You can turn this situation from a crisis into an opportunity. It isn't hard. It just takes a little knowledge and action. We can help with the knowledge part. Here's my offer...

Our team is currently working on a bear market "lifeboat." Consisting of seven important modules, this lifeboat will teach you, step by step, exactly how to position your portfolio for the coming bear market.

There's nothing else you will have to buy to prepare your portfolio for a bear market. Here is a preview of the seven modules:

1. Convert at least 50% of your portfolio into cash and gold. We can show you exactly what type of cash instruments to buy, and how to make sure that your cash is 100% safe. Likewise, with your gold allocation (at least 10%, to hedge your exposure to the U.S. dollar), we will show you where to get the best prices on bullion, which rare coins to buy, and which junior mining stocks and royalty companies to own. It will take a range of vehicles to capture the huge move in gold we're about to see.

2. Scale into distressed-credit opportunities with up to 10% of your portfolio. You can expand this allocation to 20% or even 25% once interest rates have peaked. We'll give you access to our current bond recommendations and tell you everything we know about how to find opportunities in distressed debt. Maybe you couldn't afford to purchase this research for $5,000 when we offered it last year, but now is your chance to get the same education and access to some of our initial recommendations.

3. Purchase distressed equities with up to 10% of your portfolio. These are the "trophy assets" you've always wanted to own. The best insurance companies, the highest-quality capital-efficient businesses... stocks like Coca-Cola, Hershey, Disney, and American Express. As the bear market progresses, these high-quality assets and businesses will go on sale. You'll want to buy them when you have the right opportunity. We can show you exactly how to set up your watch lists and time your entry prices.

4. Invest in "special situations" with up to 10% of your portfolio. What has happened with fast-casual restaurant chain Chipotle over the past six months is a classic "special situation." It's a well-run, high-quality business with shares that are down almost 40% because of a food-safety scare that has been totally overblown and is a nonissue to the vast majority of Chipotle's customers. There's no doubt that this business will rebound this year – despite the bear market.

We can show you how to make other investors pay for 100% of your special-situation investments. Trust me, you've never seen anything like this method of identifying special situations. Again, we'll show you everything we know about it – and there's nothing else to buy. You'll get access to all of our current special-situation investment recommendations.

5. Sell 10%-20% of your portfolio short, where you profit as stock prices decline. As you might imagine, our short-sell recommendations have been performing well lately. But only a fraction of our short-selling ideas make it into our newsletter. In our short-selling module, we'll not only teach you our keys to successful short-selling and give you our entire watch list of short-selling candidates... We'll also tell you the 12 stocks that every investor must avoid this year. Even if you never actually short a stock yourself, knowing our short-sell candidates will at least keep you from buying the wrong stocks.

6. Keep 10%-20% of your portfolio long stocks. There are always some stocks that buck the bearish trend. We can show you exactly what to look for and give you half a dozen stocks we're confident will end the year higher – despite the bear market. Income from these dividends will also help provide you with the income you'll need to weather the storm.

7. Put it all together. In our last module, we will present you with a completely "bulletproof" bear-market portfolio that has been set up using all of the information and recommendations we've offered. If you don't want to figure out any details on your own, you could just take this portfolio to your broker and have him set it up for you. But that isn't the point...

The goal is to give you the knowledge you'll need to survive and prosper during this tough period. We'll provide detailed annotations across the entire model portfolio, showing you the reasons and the strategy behind each of our selections. Reading this will be like sitting in a private room with my whole staff looking over your entire portfolio.

All of the information and recommendations you need will be included in these modules.

We could charge almost anything for this kind of comprehensive information. I know investors who would pay me $100,000 for this kind of research without even blinking at the price. We normally charge at least $15,000 for complete access to our work, across multiple publications and markets. But like I said... We're putting these seven modules together because we genuinely want to help as many people as possible. So we decided from the beginning that we were going to make this program completely affordable for all readers.

Right now, it costs you just $29 per module. That's less than the cost of a decent lunch. (And probably less than two tickets to see "Star Wars.")

But please keep in mind: Because this offer is 100% education-oriented, and these modules will contain so much of our most valuable information, we will not offer any refunds. You have to be willing to risk $29 to be a part of this program. However, if you decide it's not for you, you may cancel at any time. Pay for only as many modules as you want (or can use). You'll be billed $29 each week. To pay as you go, click here.

The bear market we've predicted for a long time is almost here. It isn't too late to get yourself positioned to survive and even prosper... but you must take action now.

Regards,

Porter Stansberry

Further Reading:

In November, Porter warned DailyWealth readers about this debt crisis – and what you can do to prepare and prosper – in a special three-part series. You can catch up on each installment right here:

Market NotesTHIS PANTRY STAPLE CONTINUES TO OUTPERFORM Today's featured company proves that "selling the basics" is still working, even during this rough start to 2016.

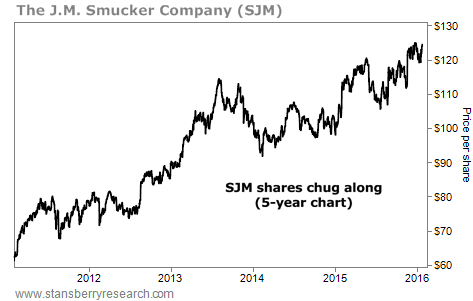

As longtime readers know, we're fans of simple businesses. These companies sell the everyday products people buy without thinking twice. They have a strong brand loyalty with customers. As a result, they have a history of beating the market and often make for steady, reliable investments. We've shown you many examples of this idea at work over the years. Here's another one to add to the list: The J.M. Smucker Company (SJM).

Chances are you have a number of Smucker's products in your pantry right now. Beyond its popular jams and jellies, the company sells many everyday brands that you may not have realized, such as Jif peanut butter, Folgers coffee, Pillsbury baking products, and even Crisco vegetable shortening.

As you can see from the chart below, shares are in a steady, long-term uptrend. The stock is up more than 100% over the past five years. And it just touched a fresh 52-week high while most other stocks have started the year in the red. It's further proof that selling the basics works.

|

Recent Articles

|