| Home | About Us | Resources | Archive | Free Reports | Market Window |

A Multiyear Buying Opportunity in Emerging MarketsBy

Monday, February 1, 2016

When emerging markets get going, they can really soar.

The MSCI Emerging Markets Index climbed 526% from September 2001 to October 2007. For reference, the S&P 500 only climbed 77% over the same period.

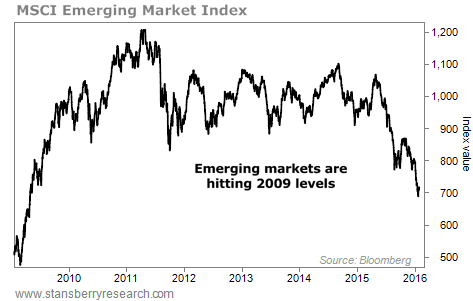

The problem is that these incredible highs are often followed by incredible lows. And that's exactly what we're seeing today, as emerging markets hit their lowest level since 2009.

The good news is that this dramatic fall could be setting the stage for triple-digit returns.

Here are the details...

After soaring out of the financial crisis, emerging markets flatlined from 2010 to 2014.

But last year – and the start of 2016 – have led to a big decline. And the MSCI Emerging Markets Index is now hitting 2009 levels. Take a look...

Right now, emerging markets are in freefall. They're down 32% since April of last year...

They've also fallen every year since 2013. And history shows this kind of crash could spell big gains in the coming months and years.

You see, emerging-market stocks have only been down two or more consecutive years a handful of times going back to 1987. After that kind of fall, they tend to produce BIG returns over the next few years.

The table below shows the details...

As you can see, emerging markets outperform a typical buy-and-hold strategy after falling for two consecutive years. History shows we could see 16% gains over the next year... and triple-digit gains are possible over the next five years. These gains are much larger than the typical one-year and five-year returns for emerging markets.

Of course, we're also in our third "down" year. That's a first for emerging markets. And there's no reason we couldn't see a fourth "down" year from here. So, as always, we'll be watching the trend closely.

When emerging markets do break out, it'll be a multiyear buying opportunity.

Good investing,

Brett Eversole and Rick Crawford

Further Reading:

A multiyear rally could also be underway in mining stocks. As Steve told readers earlier this month... "The mining sector has absolutely crashed. And history says triple-digit returns are likely over the next couple of years. That's enough to have me interested." Get the details here.

Steve also says now is the time to buy a house in the U.S. "January is the best time of the year to buy a home," he writes. "It's the seasonal bottom for home prices in the U.S. And the biggest gains for 2016 will likely occur over the next five months." Read more here.

Market NotesNEW HIGHS OF NOTE LAST WEEK

McDonald's (MCD)... burgers

Campbell Soup (CPB)... soup

J.M. Smucker Company (SJM)... jelly

McCormick (MKC)... spices

Facebook (FB)... social media

American Water Works (AWK)... water utility

NiSource (NI)... natural gas utility

NEW LOWS OF NOTE LAST WEEK

McKesson (MCK)... medical distributor

Abbott Laboratories (ABT)... Big Pharma

Novartis (NVS)... Big Pharma

Deutsche Bank (DB)... European bank

BB&T (BBT)... bank

M&T Bank (MTB)... bank

Sony (SNE)... electronics

Harley-Davidson (HOG)... motorcycles

Honda Motors (HMC)... carmaker

Boeing (BA)... airplanes

U.S. Steel (X)... steel producer

Mosaic (MOS)... fertilizer

Potash (POT)... fertilizer

|

Recent Articles

|