| Home | About Us | Resources | Archive | Free Reports | Market Window |

Here's Why You Should Own Fewer StocksBy

Friday, June 17, 2016

Concentrated Investing is hot off the presses.

The basic idea behind the book is that owning a portfolio of 10 to 15 stocks leads to better results than a widely diversified one.

The book includes profiles of investors who ran such concentrated portfolios. Below are my notes on a few favorites: Lou Simpson, John Maynard Keynes, and Claude Shannon.

Lou Simpson: How an Investor Should Act

Simpson ran GEICO's investment portfolio from 1979 to 2010. His record is extraordinary: 20% annually, compared with 13.5% for the market. His five key strategies are:

On the last one, Simpson writes: "Companies that meet our criteria are difficult to find. When we think he have found one, we make a large commitment." Simpson's focus increased over time. In 1982, he had 33 stocks in a $280 million portfolio. He kept cutting back the number of stocks he owned, even as the size of his portfolio grew. By 1995, he had just 10 stocks in a $1.1 billion portfolio.

But he did not just buy and hold. Simpson would add to a holding if it fell (and thus became more attractive). He would trim it back if it got pricey. Simpson didn't sell because the stock price fell. He based his buy and sell decisions on valuation.

Another important aspect of Simpson's record: He did not trade much. There was very little turnover. He said you only need one, two, or three good ideas a year once you're fully vested. "We do a lot of thinking and not a lot of acting. A lot of investors do a lot of acting and not a lot of thinking."

John Maynard Keynes: Successful Through the Great Depression

Keynes is famous as an economist, but early in his career he speculated on currencies and commodities. This risky approach cost him all of his money in the early 1920s. And he nearly lost it all again after the Great Crash of 1929.

After this, he changed his approach. He began to think about stocks as businesses with an underlying value apart from the quoted stock price. He began to hold on to stocks longer. Typically, five years. He often continued to buy them if they fell lower.

He also came to love focusing his portfolio on fewer names:

He made his reputation as a money manager running King's College's endowment. His Chest Fund sometimes had half of its money in just five stocks. In 1933, he had two-thirds of his portfolio in South African mining stocks. His results were spectacular. The Chest Fund (1927-1945) grew fivefold while the U.K. market fell 15% and the U.S. market fell 21%. He offered up the best summary of his own approach in 1938:

Claude Shannon: The Power of Rebalancing Shannon was a brilliant mathematician who made breakthroughs in a number of fields. He might also be the greatest investor you've never heard of.

From the late 1950s to 1986, he earned 28% annually. That's good enough to turn every $1,000 into $1.6 million. What I want to highlight here, though, is an investing method he wrote about later called "Shannon's Demon."

It goes like this: Imagine a portfolio of $10,000 with 50% in cash and 50% in one stock. The idea is that you will always keep this portfolio at 50/50 by rebalancing every day.

So, let's say the stock falls by half after the first day. Now you have $7,500. You have the $5,000 in cash and $2,500 in the stock. You rebalance. Now you have $3,750 in cash and $3,750 in that stock.

The next day, the stock doubles. Now you have $11,250. Your portfolio is up $1,250, even though the stock is at the same level it was when you started. You rebalance again. The stock gets cut in half... If you repeat this pattern, your portfolio will be worth $1.1 million at the end of 80 days.

The assumptions are not realistic, but they make an important point. As the authors of Concentrated Investing point out:

Most investors do the opposite. In Bonner Private Portfolio, we use rebalancing strategies to enhance our return. We add to our favorites when the market gives a chance to own them cheaper. We trim them back when the market gives us a good price. And we focus on position size. Regards,

Chris Mayer

Further Reading:

Chris recently read another book about a legendary investor's strategy for making big, safe gains in the market. Learn more about his investment philosophy here.

Last month, value investor Dan Ferris shared his list of "must reads" for any serious investor. "You want to build a foundation of basic stock market knowledge, but with tens of thousands of titles out there, where do you start?" he writes. Get the details here: A World-Class Investment Education for $82.51.

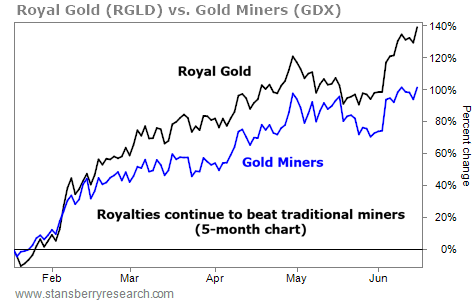

Market NotesTHE GOLD STOCK THAT BEATS ALL GOLD STOCKS Today, we take a look at one of our favorite business models in the world...

Regular DailyWealth readers know we're big fans of precious metals royalty companies. Porter has called them "the absolute best way to invest in almost any industry or trend," and for good reason. Rather than betting the company on a single mine, royalty firms finance early stage mining projects and collect money when these projects work out.

One of our favorite names in the sector is Royal Gold (RGLD). The $4 billion royalty firm owns stakes in nearly 40 mines currently in production, and in another two dozen or so that are currently in development.

As you can see from the following chart, while the big gold-miners fund GDX (blue line) is up around 100% over the last five months, Royal Gold (black line) has outperformed handily. It's yet more proof that royalty companies are the safest ways to invest in gold stocks today...

|

Recent Articles

|