| Home | About Us | Resources | Archive | Free Reports | Market Window |

The Low-Risk Way to Make 30% a Year in StocksBy

Wednesday, February 22, 2017

My team and I recently made a critical breakthrough... And it reinforces what I've been saying for years.

You don't need to take big risks to make big money in the stock market.

You don't have to find the needle in a haystack. You don't have to get extremely lucky by picking the right tech stock.

In my Investment Advisory, we're business junkies. We love great businesses. And usually, the kinds of businesses with staying power aren't exciting or glamorous.

Last week, I told DailyWealth readers about my latest project to investigate the stocks that returned an incredible 1,000% or more over the past 20 years.

My team and I found a way to identify these stocks – the small, under-the-radar companies that have huge growth potential.

Today, I'll explain one of the secret ingredients to boosting boring investments and making double-digit annual returns, without taking on more risk...

Regular readers know "capital efficiency" is one of our key metrics to finding successful businesses.

When we say "capital efficiency," we're measuring how easy it is for companies to grow revenues without heavy reinvestment. That's how you find great, healthy investments. These are the companies that will keep growing and will never go out of business. It's the one sure way to get rich in the market.

My colleague Bryan Beach puts it this way: When you think about capital efficiency, think about what you would want to see if you were the company's owner.

In other words, when you have a business that's growing like crazy but you aren't making more money, you wouldn't be excited to own that business. You've probably had to hire more people and deal with more problems. If cash isn't left at the end of the day for the owners, what's the point?

Personally, I look at it in a bigger-picture way... like a seesaw. On one end of the seesaw, you have growth. On the other end, you have profitability.

Think about my own company, Stansberry Research. If we wanted to spend $100 million on advertising, we could grow our business and sales tremendously, but it won't lead to more profits. Or we could cut back our marketing budget to almost zero and live off the renewal income and the incremental sales, and we could report a great, profitable year. It's really difficult to do both at the same time. And the businesses that can do that are exceedingly rare.

One of our big tests is whether a company can grow its revenues by 25% or 30% and still be capital efficient. When a company can make $0.25 or $0.30 in cash on every dollar of revenue AND continue to grow, you've found an extraordinary business.

Now here's the really surprising thing about all this. Like I said, these are unique, unusual businesses. But more often than not... they're boring.

When we investigated the stellar performers of the past two decades, the results we turned up weren't necessarily the high-flying tech stocks. Most of them fit the same boring industry categories we've been writing about for years...

You find these stocks with the same process that we put all of our best recommendations through in my Investment Advisory. For instance, chocolatier Hershey (HSY) and insurance firm W.R. Berkley (WRB) were great investments because they had tremendous growth and were incredibly capital efficient.

But with our new system – the kind we're using in Stansberry Venture Value – you see even better growth (and therefore, even bigger returns) buying the exact same kinds of stocks. Instead of making 6%-8% a year, these stocks can return 20%-30% a year.

Consistent, double-digit returns every year... without taking more risk... without crossing your fingers and hoping you picked the next big winner. The same reliable types of companies we recommend in my Investment Advisory... but with the ability to deliver 20% or 30% a year on your portfolio.

Regards,

Porter Stansberry

Further Reading:

"Focusing on small-cap value stocks can dramatically increase your returns... And you don't have to take big risks to do it." Last week, Porter shared the origins of his new "10x Project" and outlined what the best small-cap stocks have in common. Read the essay here: The Secret to Finding the Market's Next 1,000%-Plus Winner.

"Investing in small companies is harder than it looks," Dave Eifrig writes. "And yet... small-cap stocks consistently outperform large caps over time." The right small-cap strategy can help you tap into one of the biggest advantages you have as an individual investor. Learn more here: How 'Going Small' Can Add Huge Returns to Your Retirement.

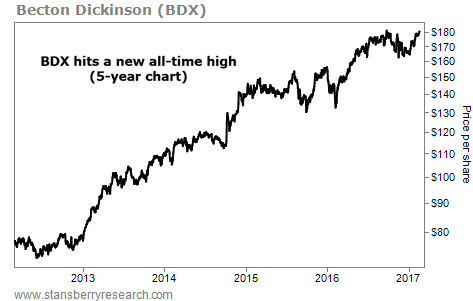

Market NotesANOTHER 'WORLD DOMINATOR' HITTING NEW HIGHS Today's chart highlights another one of the best businesses on the planet...

We're talking about "World Dominators" – a phrase our colleague Dan Ferris uses to refer to companies with huge, global brands and long-term, steady growth. These businesses often hold the top position in their industry, like Internet "plumber" Cisco (CSCO).

Another World Dominator is breaking out: Becton Dickinson (BDX). The medical-technology company has cornered the market for needles and syringes. Odds are good you've come into contact with the company's products dozens of times in your life and never realized it.

Like other World Dominators, Becton Dickinson earns big cash profits, has a strong balance sheet, and an impressive history of rewarding shareholders through growing dividends. And as you can see from the chart below, BDX shares are climbing. The stock just struck a fresh all-time high. Next time you're looking for a new investment, consider an industry leader like Becton Dickinson...

|

Recent Articles

|