| Home | About Us | Resources | Archive | Free Reports | Market Window |

|

Steve's note: Longtime readers know I am bullish on U.S. stocks – and I expect the biggest gains are still ahead. But my friend and colleague, Porter Stansberry, is seeing warning signs in the market. Today, we're sharing his take on how "free money" economic policies have led to unsustainable business models – and how one sector could bring it all crashing down...

A Bubble in This Sector Could Trigger the Next Financial CrisisBy

Thursday, May 4, 2017

Today... something I don't think you've seen anywhere else before – the "butcher's bill" of our current economic policies.

We all know that printing money isn't a good economic policy.

If printing money worked for an economy, then Zimbabwe would be Switzerland and Argentina would be wealthier than the United States. Incredibly, the world's "smartest" and most powerful economic mandarins have all adopted debt monetization (aka quantitative easing) as their core economic lever.

Anyone with a shred of common sense... or any understanding of human nature (or history)... knows this won't work for long. After all, not paying debts is a lot easier and more fun than facing a sober and sound economic reality.

Alas, there is no Santa Claus.

And, sooner or later, global confidence in this gigantic paper-money swindle will disappear, like blowing out a candle.

The question is, what will trigger that "tipping point"?

I've got a few ideas...

I haven't seen any serious writing about the long-term damage caused by the world's largest economic areas adopting "free money" (zero-percent interest rate) policies. Capitalism without interest rates isn't a free market. It's a Bizarro World where everything about how a normal economy works gets turned upside down.

Let's look at the harm these policies have caused to actual large companies and see where this Alice-in-Wonderland kind of economy will take us.

Because we've ended up with something outrageous – for-profit companies that simply aren't interested in profits...

The first thing I've noticed about the world since 2010 is that we now have virtually unlimited amounts of capital available for any company who wants to borrow it.

That has led to a huge expansion in the amount of junk bonds outstanding – including companies like oil-exploration firms that haven't normally had access to large amounts of long-term credit. (We'll talk more about that in a minute...) But the impact has been even more significant for "investment grade" credit. Here, virtually unlimited amounts of credit have become available for almost nothing.

In theory, the costs of doing business are limited to capital and labor. Technology has greatly reduced the labor inputs for most businesses. With nearly free capital and greatly reduced labor inputs... the costs of producing a widget or providing a service have plummeted across our economy.

That sounds great, right? Lower costs should equal bigger profits. But of course, there's also competition. When everyone has access to unlimited capital... and technology limits the per-unit cost of labor... economic theory suggests there will be a race to zero. No one will be able to make a profit because there's no scarcity of capital, and therefore no ability to increase relative productivity.

And... what has happened?

The last several years have seen the rise of companies that are experts at exploiting technology to reduce labor costs. Free capital and zero per-unit marginal labor costs equals a whole new form of capitalism that's genuinely unlike anything the world has ever seen before.

These are companies with massive scale, massive sales growth... and virtually zero profits.

Amazon (AMZN) is the most famous example. In just the last three years, the Internet retailer's revenues have almost doubled (from $80 billion to $140 billion). Meanwhile, its profit margins haven't budged. They remain less than 2%. With this kind of scale and almost no profit, Amazon has been able to grow faster and faster, into all kinds of new businesses. The company doesn't have to worry about cash flows to power investments into new lines of business because, after all, capital is free.

So even though Amazon has only earned profits of $3 billion over the last three years, it has been able to invest $17 billion into growing its core business and building new businesses.

I've never seen a company of this size borrowing such a high multiple of its annual net income to spend on capital investments. And I'm pretty sure nobody else ever has either. Just think for a minute about this...

On revenues of $320 billion... Amazon has only earned $3 billion in net income. Meanwhile, it has spent $17 billion on investments in just the last three years. It borrowed $7.5 billion in the last two years to help finance these investments.

The result of these kinds of ongoing massive investments is a company with a market cap of close to $500 billion... that has a lifetime, total combined, retained earnings of less than $5 billion. And since it has never paid a dividend, those are the company's total lifetime earnings.

It's a for-profit company that doesn't intend to make a profit. And it doesn't have to, because there's unlimited amounts of additional investment capital, available essentially for free.

Sounds great... for consumers. But is it good for investors? Is it good for our economy?

It hasn't been good for IBM (IBM). In the face of competition from Amazon's Web Services business (its cloud offerings), IBM's revenues declined for 20 straight quarters. IBM can't shed per-unit labor costs because it's stuck with tens of thousands of legacy engineers.

It hasn't been good for the U.S. retail industry. Amazon can afford to build unlimited amounts of new warehouses and distribution space. Again, capital is free. But retailers can't possibly compete on per-unit labor costs. They've got to staff each store.

And it's not going to be good for U.S. media companies. By tying entertainment content to its "Amazon Prime" memberships, Amazon is pointing a gun directly at the head of every media/entertainment company in the U.S. Good luck competing with a $500 billion firm that doesn't have to bother with profits and has the world's best online technology.

But... is that good for our economy? What happens when investors realize, much to their chagrin, that Amazon isn't ever going to make any money? What will happen when investors realize that Amazon's core competitive advantage is that it will never make a profit?

What's the point of capitalism again?

I could show you dozens of companies whose entire business models are predicated on virtually free access to unlimited capital. Their only competitive advantage is a central bank that has lost its mind. My bet is that these firms won't last for long because the current policy is unsustainable.

Why is it unsustainable? What will cause it to collapse?

My bet is commodity prices.

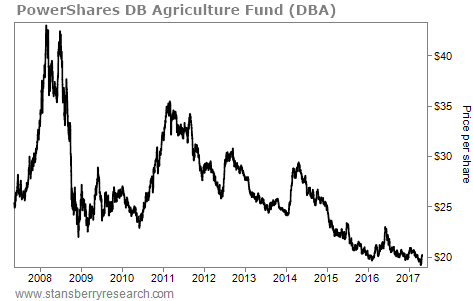

Take a look at the PowerShares DB Agriculture Fund (DBA)...

This exchange-traded fund ("ETF") owns commodity futures. Those are contracts to deliver real-world commodities, like hogs, soybeans, cattle, and cocoa. This ETF peaked in early 2008 at a little more than $40 a share... and has been in decline ever since. Farmers are great at driving down per-unit labor costs. Give them access to free capital, and supplies are going to boom – along with tractor sales.

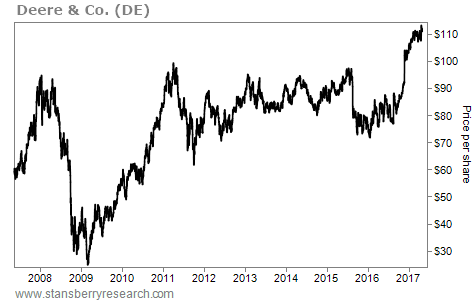

Now, look at a chart of Deere & Co. (DE) – tractor maker to the world. You'll notice its share price has more than quadrupled since the financial crisis, from $27 a share to $111 a share. Farmers have bought a lot of tractors in this cycle. And commodity prices are crashing as a result.  And here's the problem... Deere has been very effective at passing on the central banks' free money to its customers. The company now holds $24 billion in loans and leases (up from $17 billion in 2008). The company's market cap is only $34 billion. Do you think the management should be betting the company (founded in 1837) on the ability of farmers to repay $24 billion in tractor loans?

What could possibly go wrong?

Commodity prices and markets are where the central banks' policy of free money is going to crash on the rocks of reality. The real world can only consume so many soybeans... or burn so much oil. Real-world growth limits the uptake of this massive increase to capital. And it's in that transition that the financial risks lie.

I didn't even mention the oil markets.

The glut of oil is one of the primary signs of excess in our capital markets. By my estimation, close to 30% of all the "free money" lending the U.S. central bank financed between 2010 and 2014 ended up in the oil patch. The result has been an explosion in U.S. oil production.

To summarize the resulting overcapacity that developed, look no further than the days supply of crude oil in America.

Supply almost never exceeded 30 days – ever. Supplies hadn't crossed that threshold in almost 40 years. But since crossing over 30 days supply in early 2016, days supply has barely been below that level. And we set a new all-time high supply mark in March, when that reached 34.2 days.

Keep in mind, this huge buildup in crude inventory occurred after a landmark change in U.S. law to permit the export of crude oil.

Meanwhile, despite the obvious glut, the rotary-rig count continues to grow. Every day, we're drilling more and more. Why?

Because free money also means lots of speculation. Speculators have never bet more on higher future oil prices. Historically, betting on higher prices when OPEC cuts production has been a one-way trade – a guaranteed way to make money. My bet is that this won't prove to be true this time... a result that will shock oil traders and cost them billions.

But in the meantime, producers can finance more additional production today by selling production into the futures markets to these speculators.

The futures markets, when functioning normally, help smooth out prices between peak-demand seasons. But now, thanks to the central banks and the speculators they're financing, they're perpetuating an epic oil glut that will make the coming bust in oil prices even worse than in 2015... and potentially as bad as the 1930s.

Central banks' free-money policies have led to a massive bubble in commodity production and the credit structures that have financed these huge gains. This commodity bubble will blow up first... and lead to the next major financial crisis.

Good investing,

Porter Stansberry

Further Reading:

"No matter who is president, no matter which party is in power... the only thing our government can do about a credit crisis is make it worse," Porter warned readers last fall. This idea rests on two simple economic principles – but you'll never hear it from the mainstream media. Read more here: Why Trump's Plans Won't Save Us.

Porter believes the corporate-bond market is in a dangerous position today. And that means during the next credit-default cycle, losses could be much worse than ever before. "The bad news is, it has already begun," he writes. Learn one of the key places he sees this trend at work right here: You Don't Have to Be a Victim.

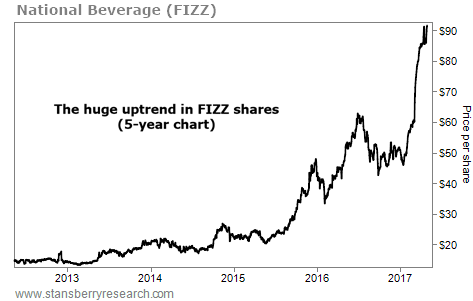

Market NotesIT'S A BULL MARKET IN SOFT DRINKS Today, we're checking in on one of the hottest stocks in the market...

National Beverage (FIZZ) is a $4.3 billion maker and distributor of several brands of soft drinks, including LaCroix sparkling water, Faygo and Shasta sodas, and generic, store-named brands. In other words, the company has something for everyone.

Unlike soda titans Coca-Cola (KO) or PepsiCo (PEP), National Beverage's soft drinks aren't iconic or prestigious. You probably walk past cans of the stuff in your grocery store without noticing them. But they've generated hundreds of millions of dollars in sales for decades. And the folks who pick up a six-pack every week will continue to do so a decade from now.

All of this has translated into big gains for FIZZ shares. They're up about 80% this year alone, and have soared more than nearly 550% over the last five years, recently touching a new all-time high. Though it isn't likely to unseat soda giants Coke or Pepsi any time soon, National Beverage's impressive run shows no signs of slowing down...

|

Recent Articles

|