| Home | About Us | Resources | Archive | Free Reports | Market Window |

|

The Weekend Edition is pulled from the daily Stansberry Digest. The Digest comes free with a subscription to any of our premium products.

We Have Officially Entered the 'Escher Economy'By

Saturday, June 10, 2017

I've been thinking about this a while... it's a term that describes the modern economy's fondness for central banks, paper money, huge debts, and financial bubbles. I call it the "Escher Economy."

I hope you'll read carefully. Remember... there's no such thing as teaching, only learning.

It was a surprising move.

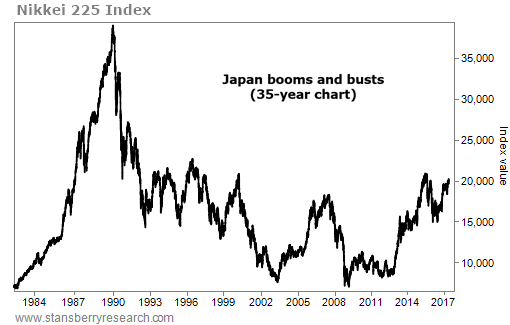

Japanese stocks have been a virtual graveyard for capital since the late 1980s. That's when Japan's big real estate and investment bubble collapsed. The Japanese "Dow" – the Nikkei 225 Index – briefly soared from around 10,000 to more than 40,000... and then collapsed.

Over the next 20 years, every rally in Japan was followed by yet another, bigger decline.

By 2009, the Japanese stock market was still down more than 60% from its peak...

Did Japan's economy suddenly come back to life?

No. Japan has consistently had the worst economy among the G20 countries. Economic growth hasn't been above 2% since 2012.

Was there some breakthrough in solving Japan's big demographic problems?

No. Japan's population is declining. Japan is expected to lose more than 20% of its population by 2050 – something that hasn't happened across an entire country since the Black Death of the mid-1300s. It's unlikely that this unprecedented demographic collapse will prove bullish for Japanese asset values.

So... why were investors suddenly interested in Japan?

John Law was the Scottish rogue and murderer who convinced France's King Louis XV to allow him to set up one of the world's first central banks, the Banque Générale, in 1716.

The bank brought paper money to France and allowed the king to finance his soaring debts. Having saved the king's bacon, Law convinced the king to give him a monopoly on trade with the new world – in Louisiana.

The combination of virtually limitless paper money and the hottest initial public offering in history saw Law pay off the entire French government's debt just by issuing another 300,000 shares of the Mississippi Company. The share price, which went public at 75 livres, eventually rose to 15,000 before the peak.

It was this bubble... the forerunner to every modern financial bubble... that saw the creation of the word "millionaire."

Naturally, Japan captured investors' attentions when it announced in 2012 that it would vastly increase the asset purchases of its central bank...

The bank wouldn't just buy Japanese government bonds... It would also buy equities. Lots of them: $30 billion or so per year. In an attempt to make sure these purchases weren't politicized, the bank explained it wouldn't buy stock directly (it wouldn't pick stocks). It would only buy via exchange-traded funds that allocate capital according to the structure of various preexisting indexes.

As you'd imagine, this policy has produced a boom. And it has attracted a lot of "hot money" from around the world.

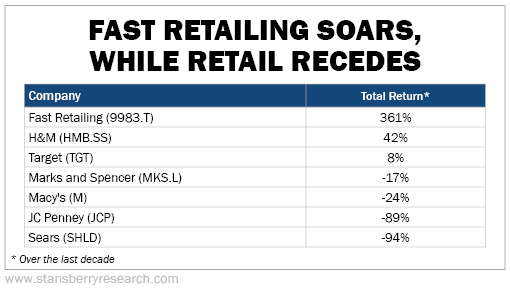

Look at Fast Retailing (9983.T), for example. If you've ever seen a pro golfer wearing a brand you can't pronounce (UNIQLO), you've seen the company's products. Golfer Adam Scott, for example, is sponsored by UNIQLO, among other major athletes.

You can think of Fast Retailing as something like the "Japanese Under Armour," a fast-growing sports-apparel business. But unlike Under Armour, which has just 29 stores, Fast Retailing continues to invest heavily in actual physical locations. It has opened more than 1,000 stores since 2012 and now operates more than 3,000 locations throughout Asia. That's almost twice as many locations as Target has in the U.S.

Since hitting a low in 2011 below 10,000 yen, the stock price has gone virtually straight up, to more than 60,000 yen at its recent peak. This soaring share price has helped the company gain access to billions in additional new capital. In 2016, Fast Retailing took on $2.4 billion in debt (moving its debt to equity leverage ratio from four times to 47 times) and the company's CEO has announced plans to spend another $11 billion on a huge global expansion, moving into the U.S. and European markets.

Is it the mystery of embroidered shirt patches nobody can pronounce? Is there something particularly unique about its Vietnamese-made shirts?

No, of course not. What's special about Fast Retailing, at least in the eyes of global investors, is its nominal share price. I'm not talking about the value of its total market capitalization, the sum total value of its shares. I mean the share price itself. Compared with its peers, Fast Retailing has a huge nominal share price, around 37,000 yen.

Why should nominal share price matter?

E-commerce giant Amazon (AMZN) and tech behemoth Alphabet (GOOGL) recently both saw their share price racing to $1,000. (Amazon won.) But they aren't the only companies that have deliberately let their nominal share prices soar.

A host of companies have super-expensive nominal share prices today, like travel company Priceline ($1,892), homebuilder NVR ($2,396), ag firm Seaboard ($4,158), auto-parts store AutoZone ($599), and robotics-surgery company Intuitive Surgical ($930).

Huge nominal share prices haven't always been popular. You might remember during the dot-com boom of the late 1990s, investors would pile into companies that were announcing a stock "split." That's when a company increases the number of shares outstanding, sometimes by 100%, by simply exchanging one of your shares for two new ones.

A share split doesn't change anything about the business. It doesn't make the company more valuable in any way. The nominal share price just falls in half as the company's shares outstanding double. But back then, investors believed that simply making the stock more affordable would lead more investors to buy it, which would push the total value of the stock higher.

Today, most people are investing through exchange-traded funds ("ETFs"). Most ETFs are structured according to various indexes. And several of the most popular indexes are "price-weighted," meaning that the capital is allocated according to nominal share price.

Investors aren't buying these stocks because the business is undervalued... or because they pay a good dividend... or because they're growing fast. They're buying simply because the nominal share price (which conveys zero information about the relative attractiveness of the investment) is a large number and thus is more likely to attract subsequent capital.

Said another way, the "greater fool" is more likely to buy a big nominal share price stock over any other stock.

Thus, the same kinds of management teams that used to split their stock to gain the attention of investors are now not splitting their shares for the exact same reason. And in Japan, that kind of investment rationale has been taken to an extreme. In Japan, the central bank is the "greater fool."

Japan's central bank – the Bank of Japan ("BoJ") – has been buying around 3 trillion yen ($30 billion) worth of stocks via ETFs each year, radically warping the equity market. The BoJ focused its buying on ETFs that were structured according to the Nikkei 225, which, like the Dow Jones Industrial Average, is a price-weighted index.

Again... in a price-weighted index, the larger the nominal share price, the larger the allocation in the index. Fast Retailing, with its huge share price, makes up about 8% of the Nikkei, a huge position relative to the total size of its company.

For comparison, consider that Fast Retailing makes up only 0.3% of the larger TOPIX Index, where allocations are made according to firms' total market values, not merely the nominal price of their shares. It didn't take long for investors to figure out how to take advantage of the policy.

It replaced Toyota in its recommended portfolio with... you guessed it, Fast Retailing, purely because of its huge weighting in the Nikkei 225.

The broker also recommended Softbank (9984.T) for the same reason. It wasn't an endorsement of the company's reckless acquisition strategy, which involves a tremendous amount of leverage and a $100 billion "sidecar" fund that will surely cause all kinds of conflicts of interest. (Softbank is truly one of the scariest companies in the world... but that's a topic for another time.) It was an endorsement of its nominal share price. You see, after Fast Retailing, Softbank is the second-highest-weighted stock in the Nikkei.

Sure enough, Softbank's shares have soared, thanks to the BoJ's investment scheme. Softbank's stock was "dead money" from the tech collapse until 2012. But once the BoJ ramped up its equity purchases, Softbank's stock has more than quadrupled, moving from around 2,000 yen to more than 9,000 yen...

That is, thanks to the size of the BoJ's investment campaign. As Jesper Koll, who runs WisdomTree Japan, explained to the Financial Times, "There was no other equity market in the world that covered this sort of fundamental downside protection."

There's little doubt these huge moves will continue. Last year, the BoJ announced it would double its purchases of shares, spending at least 6 trillion yen ($60 billion) on stocks.

John Law would be impressed.

But remember... About a year after the Mississippi Company went public, food prices began to soar. To stop the runaway inflation, Law had to raise interest rates.

That pricked the bubble in Mississippi's stock. Within a few weeks, the whole scheme collapsed. Food prices soared another 60%, the king outlawed gold, and shares of the Mississippi Company collapsed.

So I hope you will keep a careful eye on the markets, and especially on the outlook for inflation. It's coming. But in the meantime, the decision to use the awesome power of a central bank to invest in the stock market won't only hurt investors and "stock jockeys."

Our capital markets are supposed to be "efficient." That is, modern financial theory explains that by allowing capital to be allocated by the inputs of millions of investors, vast amounts of disparate information can be processed and capital can be allocated where it's needed most, so it can be used most efficiently.

But allocating capital according to nominal share price? And putting the most amount of capital into the stocks with the highest nominal share prices? That's not likely to be efficient at all. It seems utterly ridiculous, in fact. My bet is we'll see huge unintended consequences for allocating trillions in capital in such nonsensical ways. As proof, just watch Softbank.

Softbank's investment was for 72% of America's fourth-best wireless-telecom company. Immediately after the purchase, shares began to decline and eventually fell in half. During that time, Sprint has seen its network investment costs explode higher (reaching more than $9 billion last year) and has had to borrow more than $30 billion to remain competitive.

Meanwhile, a price war has broken out with the leading wireless-service vendor, Verizon (VZ), which has knocked off Sprint's flat-rate pricing model.

During the 2015/2016 correction in corporate bonds, Sprint's most recently issued debt fell to $0.75 on the dollar, indicating that most investors don't believe the company is likely to repay these obligations in full.

Dennis Saputo, a senior credit analyst at Moody's Investors Service, told the Wall Street Journal that Sprint hasn't made a profit since 2006 and will probably run out of money before mid-2018.

Likewise, our internal credit team has identified Sprint as one of the biggest credit risks in the U.S. capital markets, which is why the company is on our Stansberry's Big Trade Dirty Thirty list of the U.S. companies most likely to default on their debts.

If that happens, Softbank will likely lose all its $21 billion.

And what about Fast Retailing? Will building new retail locations all around the world – as Fast Retailing intends to do – prove to be a wise use of capital? I doubt it.

What will happen around the world as more countries try to emulate Japan? Switzerland, long-known for its currency rectitude, is going to find out...

In 2014, Switzerland's central bank began buying equities, too. But its domestic economy is so small that it decided to invest globally.

Today, the Swiss central bank owns more than $60 billion worth of U.S. stocks, including a huge $1.7 billion position in iPhone maker Apple (AAPL) and $800 million in social-media titan Facebook (FB). The Swiss central bank continues to expand its balance sheet at almost $100 billion a year. Its total balance sheet has now grown to around $700 billion – almost $90,000 in securities per Swiss citizen. And it's growing every year... just by printing more Swiss francs.

Does that make any sense?

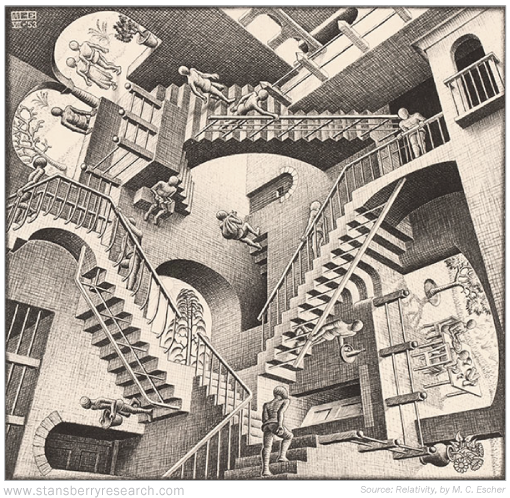

In his painting "Relativity," a maze of stairs interconnects, each with a different gravity orientation. The paths wind and intertwine. There is no "up" or "down"...

When central banks around the world begin to spend trillions on financial assets, the same thing happens to the world's financial markets. When stocks themselves become the basis of our global financial system... when stocks are the money we use... there's no way to exit the risks of the equity markets. There's no up. There's no down. There's no limit to the resulting possible inflation. And there's no way to predict when the value of the currency will collapse. When money has no firm value, it's impossible to know what something's actually worth... or if an investment makes sense... or is safe.

But they will rue them tomorrow. After all, when these investments eventually sour... when inflation forces central banks to stop the inflation and to increase interest rates... how will investors find safety? When the Swiss franc is backed by shares of Facebook... and the Japanese yen is backed by Fast Retailing... and the U.S. dollar is backed by mortgages... what firmament will investors seek in a crisis?

Official currencies? They, too, will be tied to the success (or failure) of Apple's new iPhone... or of Softbank's latest gamble. Like an Escher maze, the next crisis may have no conventional way out. There may be no way to get to level ground.

Like gold, and oil, and perhaps even new forms of money that aren't tied to the financial markets, like Bitcoin. But whatever happens next, just remember... the soaring stock prices you're seeing aren't real.

They're just stairs – in a giant financial Escher painting.

At Stansberry Research, we've been consistently warning about the likelihood of big increases to oil and gas production and falling energy prices since 2006. (Yes, that long.)

We consistently debunked the "Peak Oil" story and explained that huge new investments in domestic oil production would lead to big new supplies – and lower future prices. In 2010, we were among the first people anywhere to write about the Eagle Ford and predict that shale would lead to a new all-time high in U.S. oil production.

Well... guess what? All of those things happened. And now, for the first time in more than a decade, we're beginning to get bullish about oil prices. No, we don't think they're going to bounce back tomorrow. Instead, we believe we're entering into a five- to 10-year period where oil will form a major bottom... before moving much, much higher.

Our long-term prediction is that oil will trade for more than $500 per barrel.

That probably sounds nuts to you. But people thought I was nuts when I told a Casey Research audience that oil would definitely fall to less than $40 a barrel back in 2012 (when oil traded for more than $100).

And now, with major publications talking about "Peak Oil demand" and suggesting the "oil era" is over... well... once again we're taking the other side of that bet. Demand for oil is going to soar – 10 times or more – over the next 20 years. That growth in demand, along with tremendous gains in production, will set the stage for a huge wealth boom in America. American producers and exporters will supply the world's energy tomorrow.

While I'm sure that most subscribers won't take our talk of a bottom in oil seriously, I do believe oil is going to be the best investment you can make over at least the next decade. But the trick to being successful is knowing which assets to buy... and when.

At Stansberry Research, we're building an entirely new team of experts, guys with decades of industry experience, to help our subscribers position themselves for extraordinary long-term results in the next oil boom.

Please join us Wednesday, June 14 for a free webinar where I'll introduce you to our newest analyst, Flavious Smith, and we'll discuss our long-term outlook for the world's most important commodity: oil. Reserve your seat here.

Regards,

Porter Stansberry

Editor's note: As Porter explained, he believes oil could ultimately go as high as $500 per barrel when all is said and done. And on Wednesday night, he and resource guru Flavious Smith are hosting a FREE live event where they will explain how to maximize your gains in this once-in-a-generation bull market. Reserve your spot right here.

|

Recent Articles

|