| Home | About Us | Resources | Archive | Free Reports | Market Window |

This Hidden Danger Could Be Draining Your PortfolioBy

Friday, July 14, 2017

In 1960, John B. Armstrong made a $5.4 trillion misjudgment.

Armstrong was the father of the modern mutual fund. Today, most people know that mutual funds pool money to manage a portfolio. But at the time, few people had even heard of them. The entire industry only had about $2 billion in assets under management ("AUM") – roughly 1% of total American savings.

Back then, all mutual funds held a collection of securities handpicked by professional money managers. It's what we call "active management" today. And Armstrong, who would go on to be president and CEO of fund company Wellington Management, promoted the strategy wholeheartedly.

But he made one mistake...

He completely dismissed the idea of the "unmanaged" fund – a passive investment designed to track the performance of an entire index.

Armstrong wrote a paper arguing that these funds would always dramatically underperform their benchmark indices. He predicted they would never gain popularity.

As we now know, he couldn't have been more wrong... Passive funds can not only track an index closely, but they have also become immensely popular. Today, U.S. passive funds have a combined $5.4 trillion in assets... That's about one-third of total fund assets in the U.S.

Now here's something that might surprise you... Armstrong wrote under a pseudonym. His real name was John C. Bogle... And he's best known as the father of index investing. Bogle made a 180-degree turn after the 1970s market downturn crushed Wellington shareholders. He started the first index fund in 1975.

Now, more than 40 years later, we're in the midst of a low-cost fund revolution. People are pouring into low-cost passive funds... and out of high-cost active funds.

Like Bogle, investors are starting to figure out the startling truth about active management...

You might expect the average mutual fund to perform about as well as the market. But that's not the case.

Over the past 15 years, more than 92% of U.S. large-cap mutual funds have trailed the S&P 500.

The vast majority of mutual funds underperform because the fees they charge more than negate any outperformance they've achieved by picking high-performing stocks.

Over time, these fees add up...

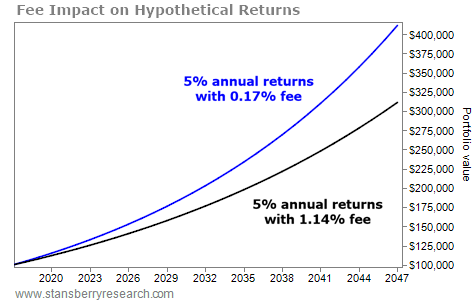

Let's say you have a $100,000 portfolio, and you invest in a low-cost fund that tracks an index with a 5% annual return. This low-cost fund charges a management fee per year of 0.17%, which is the average asset-weighted fee for all passive funds. Your $100,000 would grow into more than $411,000 in 30 years.

Now let's say you had invested in a high-cost fund, instead. This actively managed fund also earns 5% a year. And it charges a 1.14% annual fee, which is the simple average fee across all funds. Your $100,000 would only grow into about $311,000.

In our hypothetical example, the company managing the high-cost fund has essentially siphoned off around $100,000 of your money over 30 years... which is equal to your entire initial investment. By design, passive funds cost less. Vanguard's asset-weighted average expense ratio – its management fee – is just 0.12% per year. That compares with a much higher 0.75% asset-weighted average fee for active funds. And many funds have fees greater than 1%.

Let's be clear... Active management is not necessarily doomed to underperform the market. The issue is that the fees associated with most active funds more than offset any market outperformance.

This mantra has significantly altered the way both Main Street and Wall Street think about investing. More and more investors – both the institutional and the mom-and-pop variety – are realizing that fees are the enemy of high returns. It's also dawning on them that low-cost funds have a much better chance of delivering better returns.

Unsurprisingly, fund companies are creating more passive funds to meet this investor demand. Back in 2000, only about 10% of funds were passive. But passive funds now account for more than 30% of all funds.

And it's not only that there are more index funds. The already lower costs for passive funds are declining further.

The SPDR S&P 500 ETF Trust (SPY) – the largest exchange-traded fund ("ETF") with around $230 billion in AUM – has an expense ratio of just 0.094%. That means for every $1,000 invested, you'll only pay $0.94 each year in management fees.

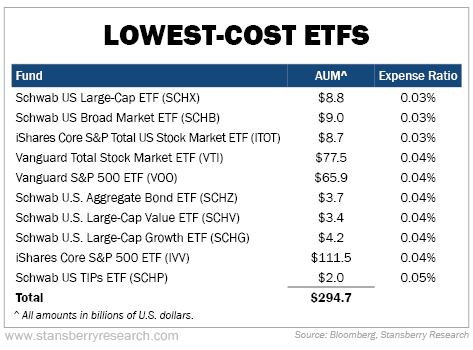

And SPY isn't even among the 50 lowest-cost ETFs anymore. The following table shows the 10 lowest-cost ETFs in the U.S. as of last month:

All of the funds in this list have razor-thin fees of 0.05% or below. This group has a combined $295 billion in AUM... And of course, they're all passive funds. More than $1 trillion is now held in ETFs with annual fees of less than 0.1%... And that level of investment will only grow because the cheapest 20% of funds are receiving the lion's share of inflows.

The investment-management industry is changing. Not only will declining management fees save investors money, but it will also destroy many mutual-fund companies that have failed to adapt.

More and more investors are learning that fees are the enemy... If you haven't already, put your money where it will do you the most good.

Regards,

Porter Stansberry

Further Reading:

Dr. David Eifrig shares another danger to watch out for with mutual funds... plus two more investing mistakes that could be draining your portfolio. If you can avoid these pitfalls, he says, "you'll be on track to save yourself thousands of dollars in the next decade." Learn more here.

One shockingly common piece of advice could ruin your portfolio in a crisis. Dan Ferris explains why, and reveals the "best, easiest, lowest-cost way" to protect yourself from big drawdowns, right here.

Market NotesA MILITARY 'PICKS AND SHOVELS' PLAY Today's chart highlights a company that helps soldiers stay in touch...

Regular readers know one of our favorite ways to profit from any big trend is through "picks and shovels." These companies provide the tools, products, and services that fuel long-term trends. You can see this concept succeeding today with communications-equipment provider Harris (HRS).

The company is the world's leading supplier of secure radio and tactical communication networks. Harris' biggest customer is the U.S. government, but it also does business with allied international forces and commercial clients. Its technologies make sure our troops can communicate securely, even in the most dangerous situations. And the company is growing. After Harris acquired defense company Exelis in 2015, revenues soared, up nearly 50% over the following year.

As the market marched higher this year, so have Harris' shares. The stock is already up more than 35% over the past year... and recently hit a new all-time high. As the U.S. government continues its military spending, its suppliers – like Harris – will continue to thrive...

|

Recent Articles

|