| Home | About Us | Resources | Archive | Free Reports | Market Window |

The Easiest Way to Profit in the Real Estate BoomBy

Monday, July 24, 2017

The real estate boom is nowhere near done yet...

I know what you're thinking... "The housing market has already been booming for a while now. How much longer can it go on?"

A lot longer.

The reason is simple: There's no supply of houses. (It's hard to believe... but it's true.)

With no supply, and a ton of demand, home prices can only go one way – up.

Let me show you how much supply is lagging even after a few years of this boom... And then I'll share the easiest way to make money from this...

Total housing inventory has fallen year-over-year for 24 straight months, according to the National Association of Realtors.

Let's take a closer look at this idea and what it means for us today...

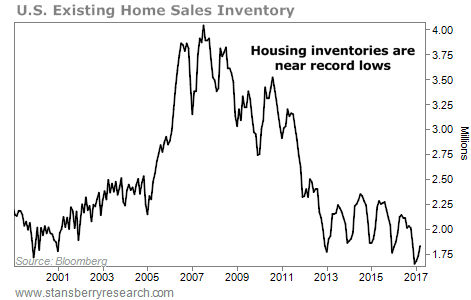

Here's a chart of the housing inventory – existing homes that are currently available for sale in the U.S.

As you can see, inventory hit a record low recently. Take a look...

I want you to notice something else on this chart... Inventory hit a record high in 2007 – at the peak in house prices. The last time housing inventory was at a level similar to today's was in 2001. Back then, you wanted to be a BUYER of real estate, not a seller.

In short, you want to bet on house prices going higher when there's no inventory... And you want to bet on house prices going lower when inventory is at record highs.

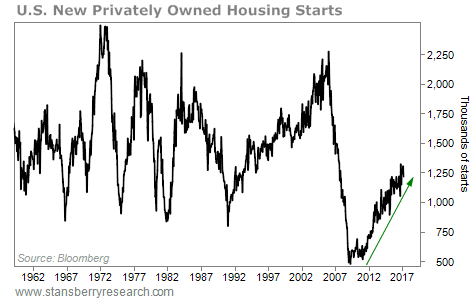

Now let's quickly look at another number: new homes being built...

You'd think homebuilders would be taking advantage of the lack of inventory. You'd think they'd be building a ton of homes. But that's not quite what's happening yet...

After the big housing bust, builders stopped building homes. It has been nearly a decade, and the rate of building is still "below trend." Take a look...

Housing starts have increased dramatically from the bottom... But they're still below average. Building hasn't caught up with demand yet. And that has kept supply low. Today, we have a small number of homes being built, and a record low inventory of homes for sale.

Based on that, I believe home prices will soar.

And if that happens, the big beneficiary will be homebuilders...

Homebuilding is a simple business. Buy land, then build and sell houses. It's highly profitable when housing booms. And I expect the current boom to continue from here.

The easiest way to play this trend is to buy shares of homebuilding companies. And the best one-click way to trade homebuilders is through the iShares U.S. Home Construction Fund (ITB).

ITB holds a basket of homebuilding companies. And I expect it will soar as the current housing boom continues. I urge you to check it out.

Good investing,

Steve

Further Reading:

Florida real estate has been one of Steve's favorite "fat pitch" opportunities. But as we enter the middle innings of this housing boom, the easy money in Florida real estate is going away... Learn more here.

"We have hit a major supply-and-demand imbalance in America," Steve writes. If you think housing is near another bubble, think again. Prices can still go dramatically higher – even in cities like Los Angeles. Read more here.

Market NotesNEW HIGHS OF NOTE LAST WEEK

Amazon (AMZN)... "FANG" stock

Netflix (NFLX)... "FANG" stock

Microsoft (MSFT)... Windows, Office, Xbox

Activision Blizzard (ATVI)... Call of Duty, Guitar Hero, World of Warcraft

The Priceline Group (PCLN)... Priceline.com, Rentalcars.com

PayPal (PYPL)... online payments

American Express (AXP)... credit cards

Mastercard (MA)... credit cards

Brink's (BCO)... money mover

Sotheby's (BID)... auctions

Coach (COH)... luxury purses

Carnival (CCL)... cruises

Live Nation Entertainment (LYV)... concerts

Madison Square Garden (MSG)... sports and entertainment

Constellation Brands (STZ)... Robert Mondavi, Corona

Boeing (BA)... airplanes

Fiat Chrysler Automobiles (FCAU)... cars and trucks

Cummins (CMI)... fuel engines and generators

Rockwell Automation (ROK)... industrial automation

Raytheon (RTN)... "offense" contractor

Lockheed Martin (LMT)... "offense" contractor

Century Aluminum (CENX)... aluminum

Waste Management (WM)... trash and recycling

NVR (NVR)... homebuilder

Aaron's (AAN)... rent-to-own furnishings

Stanley Black & Decker (SWK)... tools and storage

Becton Dickinson (BDX)... needles and syringes

Align Technology (ALGN)... Invisalign

Cigna (CI)... health insurance

NEW LOWS OF NOTE LAST WEEK

Snap (SNAP)... social-media app

AT&T (T)... telecom giant

Harley-Davidson (HOG)... motorcycles

Buffalo Wild Wings (BWLD)... wings, beer, sports

Williams-Sonoma (WSM)... home goods

|

Recent Articles

|