| Home | About Us | Resources | Archive | Free Reports | Market Window |

North Korea Versus the 'Melt Up'By

Tuesday, August 15, 2017

"Steve, I'm worried," a friend said to me over the weekend.

"I'm worried about North Korea," he continued. "Won't all of this North Korea stuff affect your stock market 'Melt Up' thesis?"

"Not at all," I said...

I didn't actually mean it would have no effect at all. I was simply trying to re-calibrate his thinking...

You see, I've seen this type of fear from thousands of investors – going back to when I started as a stockbroker specializing in international stocks a quarter-century ago.

Here's the first thing I've learned:

North Korea is a great reason to worry, if you want one. And it seems most investors (even if it's just subconsciously) want to find a reason not to invest. Of course, if North Korea isn't a good enough reason, I'm sure you'll find another... Which reason not to invest is your favorite? Here are a few for you: Something about Trump... rising interest rates... something about China... something about the national debt... something about, well, you get the idea.

You can always find a reason NOT to invest. My best advice to you is to recognize this about yourself. I think it comes from our primal instinct to protect ourselves and avoid risk. You need to "override" this survival instinct – which is hard to do.

But think about it. Over the last eight years, there was always a reason NOT to invest. Meanwhile, the stock market has gone up every year for the last eight years, based on total return. Your primal instinct would have failed you the entire time.

North Korea might be your reason not to invest today. But I don't think it's a good one. Here's the second reason why:

Here's how to overcome this problem. Ask yourself one question: "Will this event dramatically impact iPhone sales around the world?"

I'm not just talking about the current North Korea threat. I'm talking about any big global event...

For example, does an ISIS attack in the Middle East materially affect iPhone sales? It would unquestionably be tragic... But it probably won't affect the stock markets.

Global news stories MIGHT be big enough to shock the market for a day or two – even if they wouldn't significantly affect global iPhone sales. I'm not saying there's NO impact from big global events like these.

But typically, there's no lasting impact on the market.

Of course, I'm just using iPhone sales as an example here... The bigger point is, if a global event doesn't reach the point where it affects global commerce or the global financial markets, then it is often a "non-event" as far as the financial markets are concerned – and more often than you think.

You might have emotionally charged opinions about the global event. And you might wonder why these powerful opinions are not translating into powerful stock market moves.

To find out why, go back to this question: "Did that global event materially affect iPhone sales around the world?" If not, then you have your answer.

So... do I think North Korea will affect my stock market Melt Up thesis?

No. It's a reason to worry... but not a reason to worry about the stock market.

When we come across a global event that will materially affect iPhone sales, then you can legitimately worry. Until then, don't worry so much about your investments. You'll be better off, I promise.

Good investing,

Steve

Further Reading:

"You don't want to get scared like everyone else today," Steve says. Today's valuations have many investors worried – but signs show the Melt Up is still going strong. Read more here.

During the last big Melt Up, one advance indicator warned that the bull market was weak. Learn what a dying bull market looks like – and check up on what we're seeing today – right here.

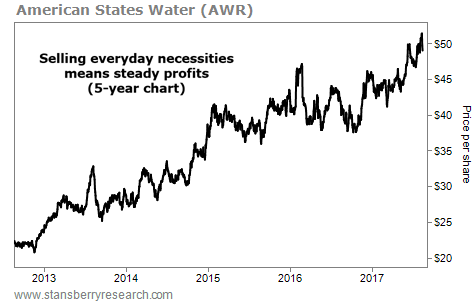

Market NotesEARN STABLE RETURNS IN THIS SECTOR Today's chart highlights a big winner in the utilities sector...

Regular readers know we're longtime bulls on utilities. These companies provide people's homes with water, electricity, and gas. They often enjoy monopoly positions in their markets... And with hundreds of thousands of locked-in customers who count on them for basic necessities, it's no wonder utilities have a long track record of strong, steady performance in the market.

One utility stock that stands out today is American States Water (AWR). AWR is a major provider in California, sending water to about 260,000 people and electricity to about 24,000. The company also helps U.S. military bases build and maintain their water and wastewater systems.

As you can see from the chart below, the company has been a fantastic long-term investment. Shares have risen consistently over the past five years. And the stock continues to outperform in today's market, hitting an all-time high last week. Utilities stocks may be boring... but they're a great place to earn steady returns.

|

Recent Articles

|