| Home | About Us | Resources | Archive | Free Reports | Market Window |

Profit From the 'Melt Up' and Prepare for the 'Melt Down'By

Thursday, September 7, 2017

What happens after the "Melt Up"? And how do you make money?

David Tice knows better than anyone...

Tice delivered a 150% return to investors in his Prudent Bear Fund from March 2000 to October 2002. That was during the last great "Melt Down" in stocks – when tech stocks lost 77% of their value.

What happened back then is important – because I think we're setting up for a similar situation again.

I expect a huge run-up in stock prices (the Melt Up), followed by a long period of tough times in stocks – a "David Tice time."

My advice to you today is to "make hay while the sun is shining." Be bold now. Then be safe later.

Let me explain...

Porter Stansberry and I got to know Tice back in the late 1990s, during the last great Melt Up. We often spoke at the same conferences.

Tice was one of the only guys – on TV and in print – loudly sounding the alarm that the late 1990s tech-stock Melt Up would have to come to an end. He was also putting his money where his mouth was, betting against the flimsiest companies and buying precious metals in his fund.

But what happened to Tice after that?

Porter and I didn't hear much from him in the last decade or so.

It turns out, he sold his money-management business in the 2000s. And he spent his time doing completely different things – like becoming the lead investor in the movie Soul Surfer.

Fast-forward to today... With the emergence of a possible "Melt Up/Melt Down" scenario like we saw in 2000, Tice has returned to the markets – to once again sound the alarm.

I got an e-mail from him recently... after not hearing from him in years. "I think you're going to be right, Steve, about the Melt Up," he said. "Good job."

Tice was on TV recently as well. On the CNBC show Trading Nation, he told host Brian Sullivan, "Frankly, I think it's still going to end very, very badly."

Sullivan pressed Tice on when the end will finally arrive...

If you're a longtime reader, you know my Melt Up thesis... It's what I've been calling the final stage of the stock market boom, where the biggest gains usually happen – like we saw with the Nasdaq Composite Index in the Melt Up that ended in 2000. The Nasdaq soared 75% in the final five months of that bull market!

The Melt Up is also the final stage of the big-picture story I've been telling for many years.

My main thesis since the beginning of this bull market has been this:

This thesis has been exactly right. It has been a fantastic rise so far. And as you know by now, I believe it still has plenty of room to run.

We are in the final stage of this great stock market boom right now – the Melt Up stage. This is where the biggest gains are made. And I urge you to stay invested right now to take advantage of it.

But be cautious as well... This won't last forever. And a "David Tice time" will follow, with a potentially massive Melt Down.

Stay long. But watch your stops. That's the key to profiting in the Melt Up – and protecting yourself from the Melt Down.

Good investing,

Steve

Further Reading:

"What should you do to participate in the Melt Up – and limit your downside risk in the Melt Down?" Steve writes. Read his essay to learn from the last great tech-stock boom – and crash – right here: 'We Expect Over 100% Gains per Year.'

"There's a difference between volatility and risk," Steve explains. The high upside of volatile stocks can help you take advantage of the Melt Up – and with a simple investing tool, you can limit your risk. Learn more here: Clearing Up Some Confusion About the 'Melt Up.'

Market NotesTHIS WINNING STRATEGY CONTINUES TO PAY OFF Today, we check back in on one of our favorite business models...

Longtime DailyWealth readers know that when it comes to investing in precious metals, we're big fans of royalty companies. Instead of exploring, operating, or developing mines, they finance hundreds of early stage projects and collect money when they work out.

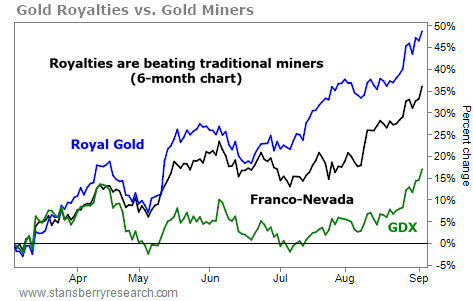

Two of the biggest names in the industry are Royal Gold (RGLD) and Franco-Nevada (FNV). Rather than betting the farm on a single project as many traditional miners do, Royal Gold and Franco-Nevada have invested in around 200 projects each. That kind of diversification makes royalty companies far safer than gold miners themselves.

As you can see from the following chart, that has translated to big outperformance of late. Over the last six months, Royal Gold (blue line) is up nearly 47%, while Franco-Nevada (black line) has risen more than 35%. Meanwhile, the big gold-miners fund GDX (green line) is up a little more than 15%. It's yet another reminder why royalties are a great – and safe – way to invest in precious metals...

|

Recent Articles

|