| Home | About Us | Resources | Archive | Free Reports | Market Window |

Bitcoin Investors Are in a Frenzy – Proceed With CautionBy

Tuesday, October 3, 2017

I'm sure Teeka Tiwari was quizzed at the urinal last week...

As I've said before, "When I can't even use the restroom in peace, I know we're at the top of the market." Here's what I mean...

Teeka, editor at the Palm Beach Research Group, held a breakout session on bitcoin and cryptocurrencies at our Stansberry Conference last week. It was standing-room only. (The breakout session, not the urinal...) I never thought I'd see a mania again like I saw in the 1999 dot-com days. But the customers at our conference were in a frenzy for any insights into bitcoin and other cryptocurrencies...

Since I'm about to share my opinion on bitcoin, let me back up for a minute and share my credentials...

I have no expertise in bitcoin, or cryptocurrencies – at all. (I don't even know what a bitcoin looks like... Ha!)

Here's what I do know...

Maybe our customers will get rich. Maybe they won't. I don't know. What I do know is the bitcoin frenzy I saw at our Stansberry Conference sure felt like the mania in the Nasdaq Composite Index in 1998-1999.

Don't get me wrong. I'm not making a judgment on the technology. People I trust on this (like Tama Churchouse at Stansberry Churchouse Research) tell me that the technology is revolutionary... They say, "Basically everything will be blockchain-based in 20 years – if not sooner." I believe them.

So again, I'm not making a judgment on the technology. I am making a judgment on how much money you can make speculating at this point... and on whether it's worth the risk.

I think the dot-com bubble provides us a great script of what could happen...

The Internet really did transform our lives in this century – exactly as we were promised in the late 1990s.

The important thing is, most Internet investors still lost a lot of money, as most dot-com companies ended up falling and never recovering.

In short:

Substitute the word "blockchain" today for the word "Internet" back then – and that sums up my general feeling here. The standing-room only crowds were just the tip of the iceberg. People will swear that "it's different this time." My response is, make sure you don't confuse "a likely certain idea" (like dot-com businesses in 1999) with "a likely certain investment" – regardless of how strongly your friends and peers feel about it.

On a separate (but somewhat related) note, I found it fascinating that we didn't have any gold or gold-stock recommendations at our conference – and nobody cared.

I know that gold has fallen from $1,800 five years ago to $1,250 today... and that gold stocks have struggled... but bitcoin stole all of gold's thunder. More people asked me about bitcoin – by far.

Look, I admit it. I don't understand the tech side of cryptocurrency. I don't claim to be any kind of expert.

I'm just reporting on what I saw at our conference – which was very little interest in gold, and a shocking amount of interest in bitcoin.

I'm afraid that the blockchain frenzy might turn out like the dot-com frenzy.

I think the promise of widespread future use of the blockchain is real. But I think that most people will probably lose money investing in it starting today.

I could be wrong – of course. I'm out of my area of expertise. Teeka has followed this story closely, and he sees more upside ahead in bitcoin.

But to me, it sure feels like 1998-1999 in cryptocurrencies...

If you're going to trade in these things, be very careful.

Good investing,

Steve

Further Reading:

"If I draw a huge crowd right after speaking... then I know we're getting close to the top," Steve writes. Learn more about the sentiment that comes with market peaks – and what investors think of the "Melt Up" in U.S. stocks – right here: Quizzed at the Urinal.

"The most popular investment of the day is rarely the best investment," industry legend Jim Grant says. For more on why investing against the crowd pays off, check out his essay: 'Never Stand in Line to Buy Anything,' and Other Contrarian Investing Lessons.

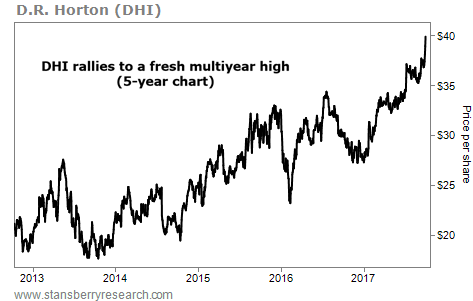

Market NotesTHE BULL MARKET IN HOUSING IS IN FULL SWING Today, we'll revisit one of Steve's favorite sectors this year...

Regular DailyWealth readers know Steve has been bullish on housing since the bottom of the bust. We've been checking in on this idea with homebuilders KB Home (KBH), PulteGroup (PHM), and NVR (NVR). These stocks are soaring this year, riding the tailwinds of tight home inventories, low mortgage rates, and rising consumer sentiment.

Today, we'll look at another winner in the sector: D.R. Horton (DHI). The $15 billion company has been America's largest homebuilder (by volume) for 15 years straight. It operates in 26 states and 79 major markets. Over the past five years, the company has nearly tripled in size. And its sales and profits are up 214% and 256%, respectively, over that span.

As you can see from the chart below, DHI is thriving in today's housing market. Shares are up more than 90% over the past five years... and recently hit a new multiyear high. It's more proof that the housing rebound is going strong...

|

Recent Articles

|