| Home | About Us | Resources | Archive | Free Reports | Market Window |

Why Japanese Stocks Could Soar 18% Over the Next YearBy

Wednesday, November 1, 2017

The Japanese stock market finished an incredible streak last week...

It was one of the most impressive runs we've ever seen. And it's been nearly 30 years since the Japanese market has come close to what just happened.

This amazing streak helped push Japanese stocks to multiyear highs. But history says the gains are just beginning.

Japanese stocks could soar 18% – and potentially even more – over the next year, thanks to this rare move.

Let me explain...

Longtime readers know we're bullish on Japan.

Just last week, my colleague Steve Sjuggerud explained that investors have pulled money out of Japanese stocks at a record pace.

That alone is a fanatically bullish sign. We like to buy assets that are "hated" by investors – that's often where you find the biggest winners. But it's not the only reason Japanese stocks are a great opportunity today...

The Japanese market just finished an amazing streak of gains. The last time we saw a streak like this one was in 1988.

Back then, Japanese stocks were in full-blown bubble mode. They had soared for the better part of a decade. But the gains weren't over...

The Japanese market went on to soar 56% over the next 22 months. And in the nearly three decades since that boom ended, the market still hasn't come back to its 1989 high.

So what just happened that rivals 1988?

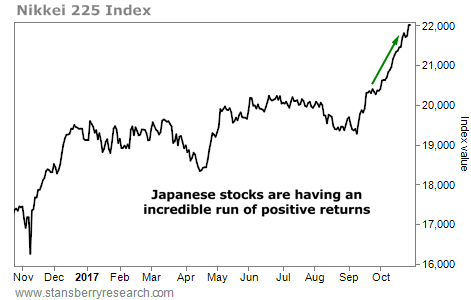

Japanese stocks – as measured by the benchmark Nikkei 225 Index – recently moved higher for 16 straight trading sessions. They didn't have a losing day last month until October 25!

It's an amazing streak. You can see it highlighted in the chart below...

Japanese stocks are up 8% since the streak began. But history says the gains should continue. Obviously, a streak of 16 up days doesn't happen often. So I looked at each time the Nikkei 225 moved higher for 10 or more consecutive trading days.

That has only happened 10 other times since 1970. And Japanese stocks soared after those instances. Here are the details...

A streak of positive days is a fantastic predictor of future returns in Japan. It has led to four times the typical six-month return and more than three times the typical one-year return. And it means gains of 10% in six months and 18% in one year are possible, starting now.

Even more impressive, Japanese stocks were positive 80% of the time both six months and a year after these extremes. So we have a high probability of big gains now.

Combine this with the fact that investors aren't interested... that they're pulling money OUT of Japanese stocks... and it's easy to see why Japanese stocks offer a fantastic opportunity today.

History says we could see gains of 18% over the next year. And that makes now a fantastic time to put money to work in Japan.

Good investing,

Brett Eversole

Further Reading:

Japanese stocks just had an incredible winning streak – but that's not the only reason history says we could see big gains ahead. Prime Minister Shinzo Abe is "back for revenge"... And that means Japanese stocks could soar. Learn more here: Investors Just Bailed on These Stocks – We're In!

"For many people, there's no place like home," Kim Iskyan writes. "But for your portfolio, staying at home means taking on a lot more risk than you might realize." Learn why you should diversify beyond the U.S. right here: Make Sure Your Portfolio Isn't Guilty of This Common Problem.

Market NotesA LITTLE-KNOWN WINNER IN THE GLOBAL BULL MARKET Don't miss this overlooked winner in the global bull market...

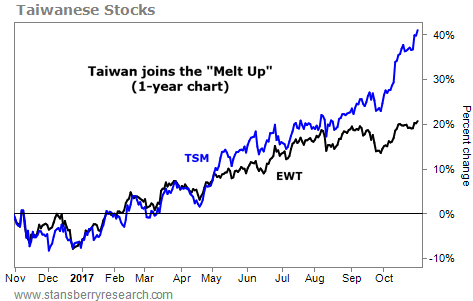

Regular readers know Steve has been bullish on U.S. stocks since the market bottom in 2009. He says we're entering a "Melt Up" phase – which could ultimately take the Dow to 50,000 and push certain sectors, like technology, to incredible heights. But recently, Steve revealed that this isn't just happening in the U.S... In a dramatic shift, the Melt Up has gone global.

You can see this concept at work with the iShares MSCI Taiwan Capped Fund (EWT). The fund tracks a basket of nearly 100 stocks that trade in Taiwan. Nearly 60% of its holdings are in the semiconductor, electronics, and financial-services businesses. But it's heavily weighted toward leading chipmaker Taiwan Semiconductor Manufacturing (TSM) – which makes up nearly 25% of the fund.

As you can see below, TSM shares are up more than 40% this year. And EWT is soaring, too. Shares are up 21% over the past year... And they just hit a new multiyear high. It's more proof that Steve's Melt Up thesis is playing out around the globe...

|

Recent Articles

|