| Home | About Us | Resources | Archive | Free Reports | Market Window |

Biotech Is a Screaming 'Melt Up' Buy TodayBy

Monday, November 6, 2017

The biotech sector recently fell by 8% in three weeks.

I believe the bust is overdone. And now is a great moment to swoop in and buy...

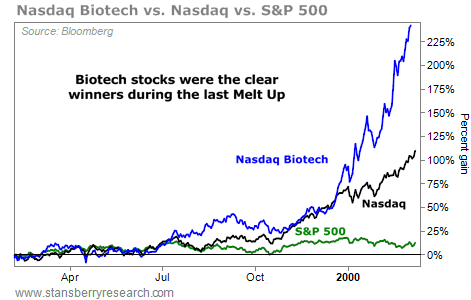

Biotech was by far the best-performing sector in the last great "Melt Up," when stocks soared at the end of the 1990s bull market. And I expect it will perform well again as today's Melt Up starts to pick up steam...

The main thing most people remember from the great dot-com boom is that tech stocks soared.

But take a look at this chart... It shows that biotech stocks (as measured by the Nasdaq Biotechnology Index) dramatically outperformed tech stocks in the final months of the last great Melt Up.

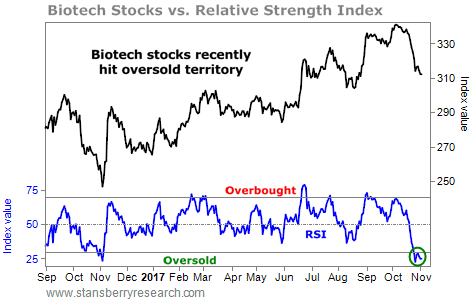

The iShares Nasdaq Biotechnology Fund (IBB) has had a rough few weeks. It's down 8% from its most recent peak. Importantly, that has pushed biotech stocks to an "oversold extreme." We measure "overbought" or "oversold" levels with the relative strength index ("RSI") – the typical indicator that tells us when an investment has moved too quickly to the upside or downside.

Last week, the RSI in biotech stocks fell to its second-lowest level in the last 10 years.

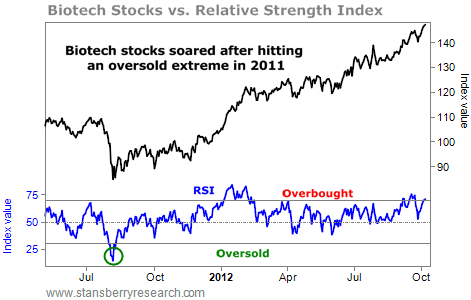

That begs the question – what happened after the MOST extreme level in the last 10 years?

Biotech stocks hit their biggest oversold extreme on August 8, 2011. After that, they shot up by more than 40% in just six months. You can see it for yourself in this chart...

Of course, longtime readers know I don't like to buy into a downtrend. I want to wait for the uptrend to confirm my idea before I get in. Similarly, with the RSI, I don't want to buy when a stock (or fund) is oversold. That tells me it's hated... But the problem is, it can always get a lot more hated!

So I prefer to wait for an uptrend in the RSI, too... to wait for the oversold extreme to go away.

Fortunately, that's what we're seeing today. The oversold extreme appears to be gone in biotech. It looks like the downtrend might be over, and we could be right at the start of an uptrend. This chart shows the details...

This week, our True Wealth Systems computers went against what I'm telling you today. They said to sell biotech – and they're usually right. But there are times when I disagree with our computers. This is one of those times. I'm willing to go against them today because I believe this is the right setup – one that's giving us a huge opportunity.

You know I'm a strong believer in what I call the Melt Up. And you know that biotech was a dramatic outperformer in the last great Melt Up. I expect biotech will be a great performer in this Melt Up, as well. So this mini-bust in biotech stocks gives us a great entry point...

This might be your last – and best! – chance to get into biotech stocks before they take off in the Melt Up.

Take advantage of it...

Good investing,

Steve

Further Reading:

Steve says biotech stocks are a great way to profit as the bull market enters its final innings. Check out his most recent Melt Up essays here:

Market NotesNEW HIGHS OF NOTE LAST WEEK

Wal-Mart (WMT)... discount retailer

Dollar Tree (DLTR)... dollar stores

C.H. Robinson Worldwide (CHRW)... shipping technology

Apple (AAPL)... iPhones, iPads, and more

Intel (INTC)... semiconductors

Adobe Systems (ADBE)... computer software

Match (MTCH)... online dating

Interactive Brokers (IBKR)... online brokerage

Activision Blizzard (ATVI)... video games

Churchill Downs (CHDN)... horse racing and gambling

Madison Square Garden (MSG)... sports and concerts

Vail Resorts (MTN)... ski resorts

Hyatt Hotels (H)... hotels

Marriott (MAR)... hotels

McDonald's (MCD)... burgers, chicken nuggets, fries

Fiat Chrysler Automobiles (FCAU)... cars and trucks

Honda Motor (HMC)... cars and trucks

Toyota Motor (TM)... cars and trucks

Royal Dutch Shell (RDS-A)... oil giant

Rayonier (RYN)... timberland

Deere (DE)... tractors and farming equipment

Owens Corning (OC)... roofing and insulation

Consolidated Edison (ED)... utilities

Exelon (EXC)... utilities

Cigna (CI)... health insurance

Becton Dickinson (BDX)... needles and syringes

NEW LOWS OF NOTE LAST WEEK

GGP (GGP)... mall REIT

JC Penney (JCP)... retail "old guard"

Nordstrom (JWN)... retail "old guard"

Under Armour (UAA)... sports apparel

CBS (CBS)... television

Viacom (VIAB)... television

|

Recent Articles

|