| Home | About Us | Resources | Archive | Free Reports | Market Window |

Today's Record-High Optimism Doesn't Mean You Should SellBy

Wednesday, January 10, 2018

Today, I'm going to blow your mind...

I will go against just about everything I've taught you in my decades of writing to you.

As regular DailyWealth readers know by now, I always say that if you really want to succeed as an investor, you must buy what's hated and sell what's loved.

This is absolutely correct – almost all of the time.

When stocks were hated in 2008 and 2009, I bought more than I ever have before. In 2011, when U.S. housing was more hated than ever, I loaded up.

If you are smart enough to wait for an asset to become hated... and then you can wait for the trend to turn "up" and confirm your idea... then you should end up as a super-successful investor.

You won't get it right every time, of course. But you will outperform just about everyone over time... I'm certain of it.

That part is not in question. That isn't the "blow your mind" part. That's just the "buy" side of the trade. Buy when an asset is hated and has started an uptrend. Simple.

But what about when an asset becomes overly loved?

Almost all of the time, the same rules apply. When investors become irrationally exuberant about an asset, we're getting close to time to sell.

But not always...

There are rare instances in the markets when exuberance gets extremely strong. But instead of causing a crash, it's actually an indicator of a market on the verge of breaking out much higher.

I haven't shared this idea with you in the past. I didn't want to confuse you.

But this is happening today. Even though exuberance is high, history shows it could actually lead to a "blast off" in the markets – a "Melt Up."

Let me give you two examples...

Bloomberg published an article this week titled, "Equity Euphoria Grips the Entire World." Essentially, the article said that global stocks are more "overbought" than at any time since it began tracking this data in 1988.

The obvious conclusion from this would be that stocks should pull back.

But don't be too hasty in drawing your conclusions...

Jason Goepfert of the excellent SentimenTrader website ran the numbers on previous overbought extremes like this. After doing his homework, his conclusions were surprising...

I don't want to steal Jason's thunder. The simple conclusion is that global stocks performed somewhat poorly over the following couple weeks. But from a slightly longer-term viewpoint – three and six months later – global stocks were solidly higher. It's not just stock momentum, either... Today, we're also seeing record-high optimism from the National Association of Active Investment Managers ("NAAIM") Exposure Index.

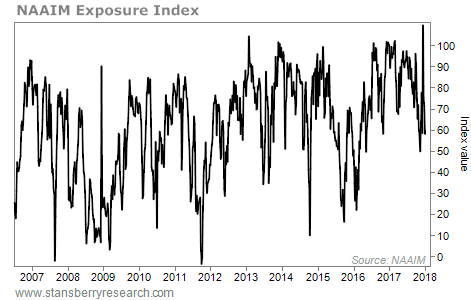

Each week, NAAIM surveys hedge-fund and mutual-fund managers to see how they feel about the market... and what percentage of their portfolios they have currently invested in stocks.

A rating of zero means these folks own no stocks. And a rating of 100 tells us that managers are fully invested.

The index hit a record level of 109 in late December. (Before that, this index had only broken above 100 five other times since 2006.) That means not only are investment managers fully invested... they're also buying with leverage. Take a look...

This tells us that investors are getting more bullish... And investment managers specifically are putting money to work in a big way right now. You might think that based on what I've preached for decades, buying stocks when investment managers are overly optimistic is a bad idea.

It turns out, buying stocks when this index was above 100 would have led to double-digit gains in a year or less, on average. (The caveat here is that we have very little historical data.)

So... that's two examples of how profitable it can be to buy when we are at an extreme in optimism.

Most of the time, the old rules apply. Buy what's hated. Sell what's loved.

But on rare occasions... only when you see an extreme extreme (and I mean an extreme extreme)... we could actually be on the verge of higher highs in the stock market – a Melt Up, as I call it.

I hesitated to write this to you today. You see:

Stocks are overly loved today to a degree we haven't seen in years. Because of that, they could see a couple bad weeks. But that doesn't mean you should sell. History suggests this will simply be a "head fake"... and stocks will move higher over the next three to six months.

This could be that 1% of the time when the extreme extreme is a good thing. The head fake will scare a lot of people into selling. And then I expect us to enter the "blast off" stage of the Melt Up.

Don't take this as gospel, of course... I'm just spit-ballin' here, based on historical precedent. I can't be 100% certain that stocks will have a couple bad weeks or enter a blast off stage after that. But this is the script I'm working with.

Remember, almost all of the time, I tell you to buy what's hated and sell what's loved. But today, we're in an extreme situation... and history says the rules might be different with such an extreme. Let's hope so!

Good investing,

Steve

Further Reading:

"In recent weeks, many famous Wall Street experts have started calling for a Melt Up in stock prices," Steve writes. Find out which legend is jumping on board Steve's Melt Up thesis here: The Stock Market 'Melt Up' Chorus Grows.

One indicator has predicted the end of every stock market boom over the last three decades... And Steve is certain it will predict the end of this boom, too. Learn what will cause the next stock market peak here.

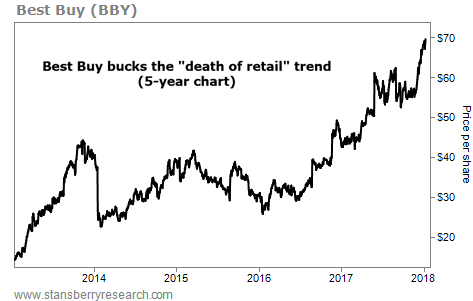

Market NotesTHIS COMPANY IS BUCKING THE 'DEATH OF RETAIL' TREND Today's chart highlights a retailer that's surviving the e-commerce assault...

Longtime readers know that people aren't shopping the way they used to... Mall traffic is steadily declining as more folks do their shopping online. We've seen this big trend with stocks like mall operator Tanger Factory Outlet Centers (SKT), jewelry store Signet Jewelers (SIG), and big-box retailer JC Penney (JCP). But some retailers are handling the shift well...

Best Buy (BBY) is a $20 billion consumer-electronics retailer. It's a go-to spot for big-screen TVs, laptops, and tablets. But about four years ago, Best Buy realized it had to change the way it did business. It slashed Internet pricing, boosted its online presence, and reorganized its stores to feature the most popular products first. These changes are working...

As you can see below, Best Buy shares have been in a big uptrend since early 2016. Over the past five years, they're up about 500% and are now trading at all-time highs. For now, Best Buy is successfully fighting the "death of retail" trend...

|

Recent Articles

|