| Home | About Us | Resources | Archive | Free Reports | Market Window |

How to Build a Fortress Portfolio Right NowBy

Saturday, October 15, 2011

Last month, we showed you how strange things can happen in a currency crisis.

For one, the most conservative portfolio we've ever recommended returned 32% in about 18 months.

That portfolio was just half cash and half gold. It's the perfect "defensive" position. Your gold protects you from a currency collapse. Your cash mitigates gold's volatility. You have no exposure to a big stock crash.

We heard from readers who loved the idea – but still wanted to collect a little income and profit if stocks ended up moving higher from here. Can you risk exposure to stocks... and still protect yourself? You can with the portfolio we've been recommending to our most elite subscribers...

The Stansberry & Associates "Alliance" group is made up of subscribers who receive almost all of our research, for life. Stocks, bonds, options, real estate... they get it all. They also receive a quarterly "model portfolio," which is a diversified portfolio of our favorite ideas.

About three months ago, we introduced our third-quarter portfolio. Back then, we told readers the chance of a big debt blowup in Europe made it too risky to own lots of stocks, commodities, and conventional income investments.

We placed half the portfolio in cash. One quarter went into the cheapest dividend-paying blue-chip stocks we could find. And the last quarter was placed in gold and "short sales," which profit when assets fall.

We were in stocks and earning a bit of yield on our blue chips. But it was still an EXTREMELY conservative "defensive" portfolio.

As you know, the big blowup came in August. Greece defaulted on its debts in all but name. Even the bluest of blue-chip European banks plunged. Commodities crashed. The euro crashed. Gold soared. Stocks suffered one of their worst quarters ever. The benchmark S&P 500 fell 18% in less than two months.

Now remember... strange things happen in a currency crisis. While most everything crashed, our portfolio actually gained in value. It's up about 3% from early July to this week. Our short sales jumped higher. Our blue chips climbed a bit. And most importantly, our cash held steady.

This portfolio is just three months old. And there's no guarantee it will gain 3% every quarter. But its performance during the crash shows you how powerful the idea of "staying defensive" can be. It shows you how powerful the idea of holding a large cash position can be when there are tremendous "big picture" risks to conventional investments.

Many investors can't stand the idea of holding a large cash position – or staying defensive. They feel like they always have to be "doing something." They don't like to have cash just sitting there, "doing nothing." But as you can see, it's often a wonderful idea.

Last week, we told our Alliance members that there is still a shortage of great "growth" ideas in the market. Big, safe, dividend-paying stocks are still your best bet. Europe is still in danger of sliding into a bigger debt/currency crisis. And cash is still a great idea.

Remember... strange things happen in a currency crisis: Even super-conservative, cash-rich portfolios can produce excellent results.

Regards,

Brian Hunt

Further Reading:

"I've been telling investors for years that if they are unable (or unwilling) to hedge their portfolios by shorting fraudulent or highly indebted companies," Stansberry Research founder Porter Stansberry says, "the best thing to do is split your savings between cash and gold."

He expects the currency crisis to escalate... But this strategy is proven to protect (and even grow) your capital throughout the crisis. Read more here: How to Make a Safe 32% Gain in a Monetary Crisis.

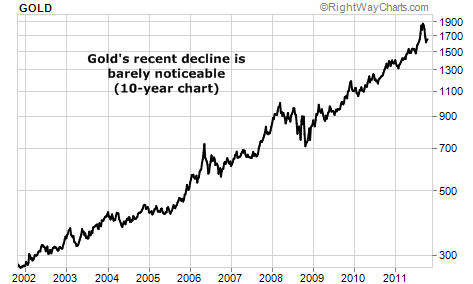

Market NotesCHART OF THE WEEK: AN AMAZING LOOK AT THE GOLD CORRECTION With this week's chart, we once again take the "long view" of gold... and see just how insignificant the recent correction has been.

To recap, DailyWealth has been bullish on gold for more than eight years. We've published hundreds of essays on the right ways to own it. We even published a book on the stuff. But we know it can be one of the most volatile assets in the world. After all, you can't value gold like a rental property and say, "I'll pay eight times rent for gold." You can't value it like a stock and say, "I'll pay 10 times earnings for gold."

Instead of an annual rent or cash earnings, gold owes its price action to waves of worry toward the global paper money system, which is in crisis. This crisis has sent gold more than 100% higher in just the past three years. And it sent gold from $1,350 in February of this year to $1,900 in August.

Since that August high, gold has taken a much-needed "breather," trading down to the mid-$1,600 level. The decline has many latecomers scared to death. But when you take the "long view" of gold, as we do, this decline is barely noticeable. Stay long.

|

Stat of the week

0%

Gain in the benchmark S&P 500 stock index since December 22, 1998.

In The Daily Crux

Recent Articles

|