| Home | About Us | Resources | Archive | Free Reports | Market Window |

Should You Buy Last Year's Big Losers?By

Friday, January 10, 2014

So you want to buy "what's on sale," right?

We all do...

Most investors think that buying what's "on sale" from last year is the right thing to do.

The problem is, most investors are wrong...

The historical evidence is clear and brutal: You will underperform the market if you buy last year's big losers.

I know you might not want to believe me... I know you think you want to buy stuff when it's on sale... But stock market history says that you don't want to do that...

History has two very specific conclusions about this topic...

These two conclusions might seem like opposite conclusions at first. But they're not. In short...

You want to buy what has done well recently (over the last 12 months or less). This is because short-term trends that are in place tend to stay in place.

Also, you want to buy what has underperformed over the long run... These stocks often outperform in the next three to five years, because of "reversion to the mean."

So... what do you buy now?

Has anything out there had a bad three to five years... but a good last 12 months? Actually yes, a few markets qualify...

Japan is the top dog in this category... Japan has underperformed not just for five years... but since 1990. However, in 2013, Japan's market soared...

I called Japan my No. 1 investment idea of 2013. I recommended shares of WisdomTree Japan Hedged Equity fund (DXJ) – a Japan exchange-traded fund (ETF) – to my subscribers. DXJ was up 41.5% in 2013.

Could Japan soar more from here? Absolutely!

Europe in general qualifies as well... The benchmark Europe stock market index – the Euro STOXX index – was up just 4.5% annualized over the last five years. That's pretty poor performance, considering the start date was January 2009 – near the beginning of the Bernanke Asset Bubble. But in 2013, Europe was up 23% in U.S. dollar terms.

Could Europe soar more from here? Absolutely!

Europe is CHEAP. I explained the basic story here.

If you're looking for value, you DON'T want to look at what did poorly last year...

Based on history, you want to buy what performed poorly over the last five years but had a good year last year.

Japan and Europe both qualify.

My True Wealth subscribers are already onboard these trends, in shares of DXJ and the SPDR Euro Stoxx 50 Fund (FEZ).

I suggest you join them...

Good investing,

Steve

Further Reading:

Steve says if you missed out on the "Bernanke Asset Bubble," you now have a second chance at big gains. The "Draghi Asset Bubble" – Europe's sister to the Bernanke Asset Bubble – has just begun... "It's free money," Steve writes. "Take it!" Learn how here.

Steve also sees enormous opportunity for investors in China. "I wouldn't rule out that its economy could overtake – even double – the U.S. economy by 2050." Get all the details here: Triple-Digit Upside in this Safe, Simple Trade.

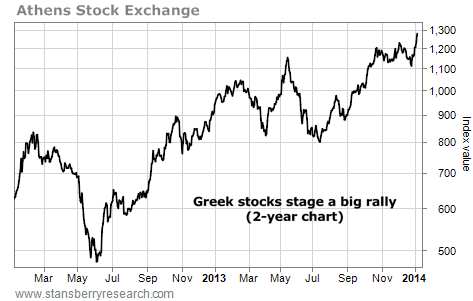

Market NotesYOU CAN MAKE BIG GAINS WHEN THE NEWS IS BAD Today's chart is a reminder that you can make huge stock market gains when the news is bad.

It's tough to find a country with more bad news than Greece. It just went through a huge financial crisis... and the economy is a mess. The country's unemployment rate recently hit a record high of 28%. But sophisticated investors know that stocks often rally in the face of bad news.

You can track Greek stocks with the Athens Stock Exchange General index. It's sort of like the "Dow Industrials of Greece." As Greece went through its economic crisis, this index was a big loser from 2008 through 2012. But the past year has brought the index a big "bad to less bad" rally...

As you can see in the chart below, the Athens index bottomed in 2012... and has rallied more than 100%. Just this week, the index struck a new high. Despite this rally, Greek stocks are still cheap... and still ignored by most investors. That means Greek stocks likely have further to run.

|

In The Daily Crux

Recent Articles

|