| Home | About Us | Resources | Archive | Free Reports | Market Window |

The Coming Death of the DollarBy

Wednesday, July 2, 2014

"The Federal Reserve believes that it is managing a reversible process... [but] it is mistaken."

More than anyone I know, Jim Rickards has thought about what the death of the dollar might look like.

Jim literally wrote the book on it... called The Death of Money: The coming collapse of the international monetary system.

Inside, Jim explains (with more thought and detail than anyone before him) exactly how the U.S. dollar could ultimately collapse, and what that collapse will look like.

It all starts innocently enough, with what I've been calling the Bernanke Asset Bubble...

The Bernanke Asset Bubble began when the Federal Reserve cut interest rates to zero and started printing trillions of dollars to prop up the U.S. economy and prevent prices from falling (deflation).

"The fact that central banks are pursuing inflation [by printing money], and cannot achieve it, is a gauge of the persistence of the underlying deflation," Rickards says.

The Fed "believes that deflation can turn into inflation," Rickards explains in his book. But it's a delicate balance – and this is where the trouble can start: "Money printing in the cause of defeating deflation may result in a loss of confidence in the fiat currency system."

Once the confidence is lost, Rickards explains, "there is no way to reconstitute it; an entirely new system must rise in its place... Very likely, a new system will be needed, with a new foundation that can engender confidence."

What path will the demise of the dollar take?

Rickards says "the dollar's demise will take one of three paths"...

1. World money

2. A gold standard 3. Social disorder Let's look at each of these scenarios...

1. World money

A process of creating a "world money" is already underway...

The money is called SDRs – or "special drawing rights" – and it's created and administered by the IMF – the International Monetary Fund. Rickards explains how SDRs could take over, and that the dollar's weight in the SDR "will be reduced in favor of the Chinese yuan."

Rickards suggests that this switch towards SDRs might not be gradual. It could "play out in a matter of months, light-speed by the standards of the international monetary system" in the next crisis.

In his book, Rickards highlights the dangers of this scenario, where much of people's retirement savings could be wiped out.

2. A return to a gold standard

A return to a gold standard "could arise from extreme inflation, where gold is needed to restore confidence... or extreme deflation, where gold is revalued by governments to raise the general price level."

In either case, the price of gold would be much higher than it is today.

3. Social disorder

Reading this section of his book was fairly scary. Rickards says that "social disintegration is not predictable," but "the official response is."

In short, expect government oppression... As Rickards says, "order comes before liberty or justice."

In The Death of Money, Rickards paints a scary picture... I don't know if he will turn out to be right or wrong. But the book is seriously thought-provoking... To me, Rickards paints the clearest picture of what is possible, along with what to do about it.

Today, we quickly covered some possible scenarios from Rickards. Tomorrow, I'll share with you what to do about it...

In the next essay, I'll show you the five things that Rickards says you should do with your money so you can come out ahead in any of his three scenarios.

Until tomorrow...

Good investing,

Steve

Further Reading:

"The good times won't roll forever," Amber Lee Mason writes. "This bull market is already five years old. It's just a fact of life that it will end... And when it does, it will mete out punishment to those who aren't protecting themselves." Make sure you're managing your risk with these simple tools.

With central banks pushing asset prices up, we've got uptrends around the globe. "The big question is... after so many investments have run up so high, is there any value left out there?" Steve says: "In short, YES!" Find out where right here.

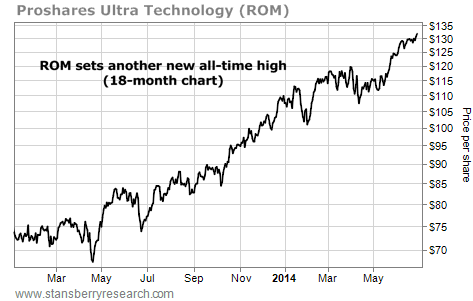

Market NotesSTEVE'S TECH STOCK IDEA CONTINUES TO SOAR If you took our advice to take a "double long" position in cheap tech stocks, you've done extremely well...

Starting back in May 2013, Steve has made a strong case for buying blue-chip technology stocks like Intel, Microsoft, and Google. These companies hold dominant positions in their industries, huge cash hoards, and low valuations.

Steve's favorite way to get exposure to this sector has been the ProShares Ultra Technology Fund (ROM). This fund aims to double the return of a basket of tech stocks.

As you can see from the 18-month chart below, the fund continues to soar... and just set another new all-time high. Since last May, it has gone up nearly 100%. And as Steve wrote just a few weeks back, tech stocks are still cheap, hated, and in an uptrend. The rally in tech stocks is still on!

|

Recent Articles

|