| Home | About Us | Resources | Archive | Free Reports | Market Window |

House Prices to Soar AFTER the Fed Raises RatesBy

Friday, August 29, 2014

"Steve, you know the housing boom will end when the Fed raises interest rates, right?"

Oh really? What makes you so sure about that?

"Steve, you know that mortgage rates are going up, right? And you know that when mortgage rates rise, house prices will fall – or at least stop going up – right?"

I just learned that people really don't think that house prices can go a lot higher...

I just gave a few speeches to investors in California. And it seems people are unanimously worried about higher interest rates.

Yes, the Federal Reserve should raise interest rates next year. But no, that does not mean that the housing market is doomed.

In fact, the opposite is true, based on history...

Contrary to popular opinion (and based on data going back 46 years), home prices tend to do better when the Fed is raising interest rates.

This is counter-intuitive. But it's absolutely true.

Housing rises faster than normal when the Fed raises rates. And it rises slower than normal when the fed cuts rates. Take a look...

Since 1968, the average one-year gain on U.S. housing was 5.3%. If you'd bought when the Fed started raising interest rates, you'd dramatically improve on that number. This relationship is consistent across time frames, as the table shows. And the numbers are similar during all periods of tightening and easing, as well.

Simply put, buying as tightening begins (and during tightening in general) beats the average gain on housing – even over the next two years.

Of course, these aren't "get rich"-type returns. But if you're buying a home with a mortgage, these numbers could make a big difference.

Say you put 10% down on a $100,000 home. If you see the typical 13.3% historical two-year gain after the Fed starts raising interest rates, then your property would now be worth $113,300.

You put up $10,000, and now you're sitting on a $13,300 profit... or a 133% return. (Of course, this doesn't include closing costs, etc. This was just to show that the gains can be significant.)

And I predict home prices could go much higher than these numbers suggest. I'm not just saying this – it's what I'm doing with my real dollars... I have much more money in Florida real estate (even outside of my own home) than I do in the stock market today. I believe in it that much.

Regardless of what the Fed does, all of the driving factors of the housing recovery are still in place. Mortgage rates are low. Houses are extremely affordable based on history. And there's not enough new supply coming on line yet. Prices could continue higher for at least a few more years.

You may agree with "the crowd." You may think that once the Fed raises rates, it's over...

You may think that... but I'm telling you, you are wrong...

History shows that house prices perform their best when the Fed starts raising interest rates. Use that knowledge of history to your advantage... and make sure you stay in real estate even after the Fed raises rates...

Good investing,

Steve

Further Reading:

Housing isn't the only thing Steve expects will go up when rates start to rise. "Logically, gold should do well when interest rates are near zero – not when the Fed is raising interest rates," Steve writes. "But history shows that's not actually the case." Get the full details right here.

Steve is also very interested in a special type of real estate. In fact, it's what he's buying right now with his own money. "Timberland is a fantastic asset to own at the right time... and now is the right time," Steve writes. Find out why right here.

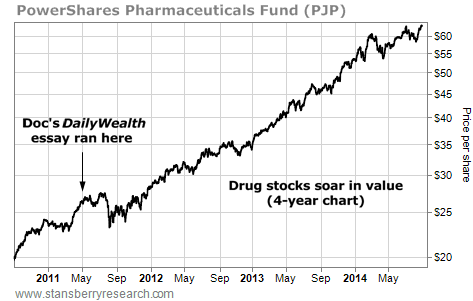

Market NotesAS EXPECTED, DRUG STOCKS SOAR IN VALUE Dr. Eifrig wrote it. Did you take action on it?

Longtime DailyWealth readers are familiar with Dr. David Eifrig's urging to take a position in big drug stocks like Pfizer, Abbott Labs, and Eli Lilly. For years now, "Doc" has noted how aging Baby Boomers are driving more health care consumption. Plus, government programs like "Obamacare" will drive increased demand for drugs.

An easy way to track (and invest in) this idea is the PowerShares Dynamic Pharmaceuticals Fund (PJP). It's a "one click" way to own a diversified basket of big drug makers.

As you can see from the chart below, Doc was dead on with his call. PJP has climbed from $25 per share to more than $60 per share (a 150% gain). This week, the fund struck a new high. As Doc expected, it has been a big bull market in drug stocks.

|

Recent Articles

|