| Home | About Us | Resources | Archive | Free Reports | Market Window |

|

Editor's note: The idea in today's DailyWealth is a timely one. Stocks are up more than 40% over the past two years... and we haven't seen a correction of 10% or more in three years. We don't know when we'll see the next correction, but we know it WILL happen. That's why, today, we urge you to set aside some time and start practicing the simple exercise outlined below...

A Simple Way to Drastically Improve Your PerformanceBy

Thursday, September 18, 2014

In this interview, Editor in Chief of Stansberry & Associates, Brian Hunt, discusses "a little-known secret that virtually guarantees you'll make money in the market."

It involves closely examining every holding in your portfolio, and then asking yourself, "If I wasn't in this position already, would I take it now?"

Read on to learn how this simple exercise can drastically improve your trading performance...

Stansberry & Associates: Brian... you're a believer in a rarely used trading strategy that can drastically improve a trader's performance. Something you call a "position audit."

Can you talk about this idea, and how our readers can start using this to make more money?

Brian Hunt: Sure... A position audit is something everyone with money in the market should do at least once a year. And if you're a trader who typically holds positions from two months to two years, you should do this exercise every month.

The exercise is taking a hard look at every position you have – long or short – and asking yourself, "If I wasn't in this position already, would I take it now?"

If the answer is "no" on any position, sell it immediately.

S&A: So the trader forces himself to be objective with his holdings on a regular basis.

Hunt: Exactly.

You see, lots of investors and traders struggle with admitting mistakes and taking losses early. Rather than cut losing positions early, they tend to hold onto them and say something like, "it will come back."

Or just as bad, they ignore the loser. They'll ignore a loser that is down 20% or 30% until it grows into a giant 60% or 80% loser. And of course, it's the giant losers that ruin your year... or your trading career.

It's simple human nature to try to forget your mistakes. Life is easier that way. And in many cases, forgetting painful memories and mistakes is a good thing.

For example, if an NFL quarterback has a horrible Sunday and throws five interceptions, he'd better get over it quickly... because he'll need his self-confidence to be effective in the next game.

But with trading, ignoring a mistake is like ignoring cancer. If you catch it early, it's not going to destroy you. But if you ignore it for months or years, it's going to be fatal.

Your goal with regular position audits is to force yourself to confront your mistakes... and root them out of your portfolio before they become big ones.

S&A: Do you recommend this for trades based on fundamentals or based on technical analysis?

Hunt: Both.

Let's say you buy company ABC because you think it's going to come out with a new tech gadget that will sell millions of units. If that gadget comes out and isn't a hit – let's say it only sells 20,000 units – the reason for owning that stock doesn't exist anymore. It's time to sell.

Or, let's say you buy a big dominant company, like phone maker Nokia used to be.

You think to yourself that it's going to be a good long-term holding. But, if Apple comes along with a game changing product like the iPhone that starts eating into Nokia's market share, the reason you bought that stock no longer exists. It's time to sell.

Those are two fundamental examples. Of course, a company has lots of moving parts you have to analyze. I made those examples very simple... but you get the idea.

S&A: OK, how about a technical example?

Hunt: Let's say you short a company or a commodity because you think it has reached a top. Maybe it has bumped against a particular price level and cannot break through it... it suffers high-volume selloffs. It cannot rally on great news. Those are technical reasons that cause some people to go short.

But let's say that after a few months, the trader goes short and the stock manages to break through to a new high on strong trading volume.

Your whole case for going short months ago is no longer valid. It's staring you right in the face. But most traders just won't admit it.

They won't confront the mistake and cover the position. Inertia and denial take over at this point... and you're now holding onto a position simply because you took it a few months ago, which is a terrible reason to be in a position.

If the reason you took the position in the first place isn't there, or has drastically changed, while you are doing your audit, get rid of the thing.

S&A: I have a feeling we'd have record-breaking trading volume next week if every investor or trader decided to sell old losing stocks they've been ignoring for a long time.

Hunt: Oh, wow... Yes, you'd see an unbelievable dumping of stocks.

I've talked with folks at investment conferences who tell me they own more than 100 different stocks. That's crazy. There's no way one individual can keep track of that many companies and do a good job of it. Those kinds of portfolios probably have 80 or 90 stocks where the original reasons for buying the shares are no longer there. They're simply being ignored.

Most people would rather ignore their mistakes than take steps to confront problems and become winners. But that's between them and their therapists.

Successful traders have to constantly confront – and admit – their mistakes. They have to be objective reviewers of their ideas.

S&A: There's an extra problem with holding onto losers that is worth mentioning... It ties up money that could be deployed into new, better ideas.

Hunt: Absolutely.

For example, take someone who bought a bundle of tech stocks back in 1999 or 2000. By 2003, after years of a bear market, the trader or investor who didn't cut his losses has what's left of his money tied up in some garbage "dot-com" companies.

That's money that can't be deployed in an emerging bull market, like commodities were back then. It's a double whammy. That trader is holding crap and missing out on a promising trend. It's the complete opposite of the golden rule of trading, which is "cut your losers short and let your winners ride."

S&A: OK... so how can a trader perform this kind of audit without dumping his winners as well? Wouldn't you cut your winners short in a lot of situations?

Hunt: That's a great question. One has to be careful here. It's key to ask yourself what your original reason was for entering the position, and what your goal with the position is.

For example, let's say you're a trader who bought Intel months ago because it was super cheap at, say, eight times cash flow, and you expected the stock to pop because you thought the market would soon be willing to pay 12 times cash flow for the stock. This is a shorter-term idea for you.

Now, let's say you were right... Let's say Intel has popped higher and is trading for 10 times cash flow, now. While performing your audit, you'd note that your original bullish argument is still intact. You wouldn't buy more of this position, but you wouldn't sell it. You'd hold it, and look to take profits once it hit your objective... the 12 times cash flow objective.

But let's say someone else bought Intel at the same time with a long-term holding goal of at least five years. That person would simply periodically check out Intel's position in the market and make sure the fundamental case is still solid. If it were, that person would hold the stock and look to compound for a long time.

For traders, it really does come down to holding winners when your plan is working out. Not necessarily buying more, but holding it because the trade is working out according to your plan.

The key here is placing most of your audit's focus on the losers. Those are the potential cancers in your account.

They need to be placed in an interrogation room and given the third degree. Is the fundamental story here still in place? If it's a stock that you're long, is it still a great value? Has management done anything stupid that is wrecking the company? Is the company's new gadget selling well? Is the technical picture still the same?

If the fundamental picture or technical picture has changed on one of your losers, chances are very good you'll be better off dumping it and moving that capital into cash, or another promising idea.

S&A: So how often do you conduct an audit?

Hunt: I do one at the end of each month. I typically trade with an intermediate time frame... like one to six months, so a monthly audit works for me. I usually hold four to six positions at any one time, and I'm very quick to cut losers. Oftentimes, the losers aren't around at the end of the month.

S&A: Sounds great. Thanks for talking with us, Brian.

Hunt: You're welcome.

Further Reading:

Brian also recently shared another great investment secret in an interview with DailyWealth. "I often tell people that if they only knew this secret of investing, they could ignore just about everything else," he writes. "It's that powerful." You can get all the details right here.

According to Steve Sjuggerud, another great way to limit your losses and improve your performance is having an exit strategy. "The important thing is to have a plan," he writes. "Just about any plan is better than no plan at all." Learn Steve's favorite exit strategy here.

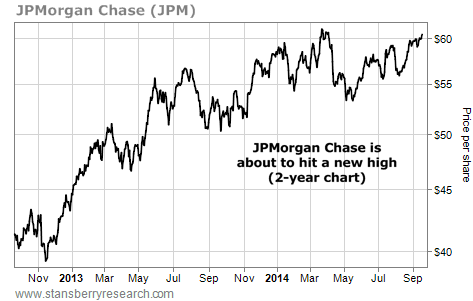

Market NotesTHE MOST IMPORTANT PRICE ACTION NOBDOY IS TALKING ABOUT The most important price action nobody is talking about: JPMorgan is about to break out to a new 52-week high.

Regular DailyWealth readers know we monitor America's big banks, like JPMorgan, Bank of America, and Citigroup. These firms are the "financial backbone" of America. They rise and fall with America's ability to make money, save money, service debts, and generally "just get along."

Like most stocks, the big banks suffered a crash in 2008/2009. Since then, they have worked their way into a bull market you almost never hear about.

The chart below shows this market at work. It displays the price action in megabank JPMorgan over the past two years. You can see that JPMorgan is enjoying a series of "higher highs and higher lows"... and is on the verge of breaking out to a new 52-week high. It's a bull market in American banking... Stay long or get long!

|

Recent Articles

|