| Home | About Us | Resources | Archive | Free Reports | Market Window |

The Mental Model That Will Protect You in a Crisis... and Make You a Fortune AfterwardsBy

Wednesday, November 19, 2014

Today's idea is a little different.

It's not a trading strategy... an investment idea... or a personal wealth tip (Although, as you'll see, it can help with all of those things).

Rather, it's a way of looking at the world – and more specifically at how people behave. Sharing this concept is Brian Hunt, Editor in Chief of Stansberry Research. Below, he explains how this simple mental model can help relieve stress... protect you from a crisis... and make you a fortune in the aftermath...

Stansberry Research (SR): Brian, you often you say if investors realize people are crazy, they'll see a big improvement in their performance. What's the story?

Hunt: One of my top guidelines for investing – and life – is that "people are crazy and life is absurd."

Knowing this can help you reduce stress. It can give you a great new perspective on life. It can also help you become much better at navigating the financial markets.

Know this concept and you're ahead of most every investor in the world.

SR: How so?

Hunt: The biggest reason is that you learn not to be surprised by market events that seem crazy or unusual to a lot of people.

"Crazy" market events happen far more often than you might think. They happen far more often than finance professors tell you they can.

When you approach the market with this in mind, you don't expect the market to behave rationally... which is a huge advantage for you.

You learn to prepare for what seem like crazy events, rather than get blindsided by them. You profit from these events, rather than get bankrupted by them. It can be a transformational realization for people. Believe it or not, this flies in the face of popular belief.

SR: How so?

Hunt: In the 1960s, prestigious universities began promoting an idea called the "efficient market hypothesis."

The efficient market hypothesis proposes that the stock market is made up of rational people who make rational decisions. What follows from this belief is that all those rational people making all those rational decisions always lead to rational stock market prices.

It sounds clean and orderly. And for years, this was academic gospel. Anyone who said otherwise was attacked by an army of professors spouting lots of convincing statistics. These academics declared that market prices always reflect everything that is known about stocks and bonds. So, trying to "beat" the market was futile.

However, this popular theory is a load of manure. The academics missed a key aspect of human nature: People tend to do crazy stuff from time to time. Even rational people do crazy stuff. It's just human nature.

Because I know this, I stay prepared for all kinds of market outcomes. I'm not surprised by market moves that catch other people off guard. If something crazy happens in the market, I just think, "Well no wonder that happened, people go crazy from time to time."

SR: How about some proof that people can go crazy?

Hunt: We could talk for weeks... but World War I comes to mind.

You had the countries of Europe filled with people who generally just wanted to enjoy life and mind their own business. And then, a small conflict erupted into a huge war that killed more than 15 million people.

There were guys fighting in that war who had no idea who they were fighting... or what they were fighting for. They were just there because some king or bureaucrat told them it was the right thing to do. It was insane.

Another reason I can say human nature has a "crazy" streak is our tendency to self-destruct. It's not rational.

Destroying your life with drugs, or alcohol, or gambling isn't rational. Punching a wall and breaking your hand isn't rational. Staying with a spouse that beats you isn't rational.

Yet, humans do those things thing all the time. It's part of who we are. So, don't be surprised when you see people doing crazy things. Take note, protect your family, and don't be surprised.

If you have a sense of humor and a safe place to stand, you might even learn to get a laugh out of it. Laugh at the absurdity of life.

SR: How does this relate to making investment decisions?

Hunt: Many people invest huge sums of money with the idea that markets are rational. That leads to huge mistakes.

Markets are rational most of the time. Stocks and bonds usually trade for approximately rational prices. But often, the people who make up the markets go berserk. At times, they'll buy assets for absurdly high prices. At times, they'll sell assets for absurdly low prices.

Markets can stay in these absurd, irrational states for a long time. There's a quote from the great investor Jim Rogers that captures this idea. He said, "Markets often rise higher than you think is possible, and fall lower than you can possibly imagine."

If your investment approach is based on the belief that people always make rational decisions, or that irrationally-priced markets are sure to quickly get back to rational pricing, you're bound to suffer terrible losses. When you know that people tend to go crazy – and stay crazy for a while – you can keep your capital safe.

On the other hand, knowing that people go crazy from time to time will help you take advantage of great opportunities. It will help you stay patient and buy assets only at bargain prices. You'll realize you don't always have to be doing something. You can be patient and wait to buy during periods of irrationally low prices. They will eventually come around.

SR: How about some real-life examples of these ideas at work?

Hunt: A good recent example is the tech stock craze of 1998 – 2000.

From early 1996 to early 1999, the Nasdaq tech stock index climbed from 1,000 to 2,500. That's an increase of 150%. It's an extraordinary move for just three years.

After this big move, many tech stocks traded for very expensive prices. So, some smart traders bet against stock prices rising. They put on trades that would profit if stocks fell, but would lose if stocks rose.

Part of their thinking was sound. Back then, stocks were trading for 50, 100, even 300 times earnings. Those are absurdly expensive valuations. It was only reasonable to expect those expensive stocks would decline and trade back down to rational prices.

But a lot of those bets turned out to be losers because the market kept going up and up and up. From early 1999 to late 1999, the Nasdaq gained another 40%. Stocks that were trading for crazy prices started trading for crazier prices. Traders bet even more on a market fall. Then, from late 1999 to early 2000, the Nasdaq gained another 42%. It was truly insane.

Eventually, stocks crashed, but they rose for a long time before rationality sank in. The people who stuck with bets on prices becoming "rational" got killed.

SR: You also mentioned the "people will go crazy" realization helps investors stay patient and wait for bargains.

Can you talk more about that idea?

Hunt: Sure.

One of the biggest things investors struggle with is the impulse to "do something." It's a natural tendency to want "action." Both amateurs and professionals struggle with this.

This tendency is dangerous because it leads folks to buy assets just to feel like they are doing something.

When you buy assets just to fill a psychological need – instead of an actual good reason – it leads to poor outcomes. It's like marrying the wrong person just because you're in a hurry to get married.

What you want to do is stay patient, knowing the market will eventually offer up bargains, and only buy when great bargains appear.

The great investor Ben Graham encouraged folks to think of participating in the stock market as if you were a partner in a business. Your hypothetical partner is a crazy guy Graham called "Mr. Market."

Mr. Market goes through big mood swings.

Each day, he offers to buy your share of the business or sell you his share of the business at a given price. The decision to buy or sell is up to you. You can sell your share of the business to Mr. Market, buy Mr. Market's share, or just do nothing.

Some days, Mr. Market is on an even keel. He offers to buy or sell at a reasonable price. Some days, Mr. Market is in a wildly optimistic mood. He offers to buy your share at a price that is much higher than the real worth of the business. Some days, Mr. Market is in a terrible mood. On those days, he offers to sell you his share for a very low price.

I think Graham nailed it with this stock market analogy. He knew people tend to go crazy from time to time. And he knew it presented opportunities to make incredible investments.

Mr. Market's crazy behavior turns up in both individual stocks and broad market sectors. If you can stay patient and wait for Mr. Market to offer shares at very low prices, you can snap up great bargains.

For example, after the 2008/2009 credit crisis, some of the world's greatest businesses were available for bargain prices.

The blue-chip industrial giant 3M traded for a P/E of around 8 and offered a 4.9% dividend yield. 3M is one of the world's safest companies. It has raised its dividend for more than 50 consecutive years.

Altria, the dominant company behind Marlboro cigarettes, got so cheap that it offered investors a near-9% dividend yield. Disney, the premier entertainment company, sold for a P/E of less than 10, which is extremely cheap for an elite business.

Elite businesses often trade for at least 15 times earnings. But during the market panic, you could buy many great businesses for less than 10 times earnings. It was an amazing bargain to buy the likes of Disney and 3M for less than 10 times earnings.

Nobody can tell you exactly when the next crisis will strike a given market sector, but you can bank on it eventually happening.

After all, people tend to go crazy from time to time. Mr. Market will sell assets for pennies on the dollar.

If you know this, it will help you stay patient and wait for the next fire sale.

SR: Good points. Any parting ideas?

Hunt: I'll sum up by saying I believe most people are generally good. People are mostly rational. But we're all human. It's in our nature to do crazy stuff from time to time... especially when it comes to money and investments.

If you operate under the assumption that people are crazy and life is absurd, you're able to imagine almost any type of market environment. And you'll be a better investor because of it.

You'll never stubbornly stick to a losing position with the belief that it has to go your way because your way is the "rational" one. If a stock can trade for the crazy price of 100 times earnings, it can trade for a crazier price of 200 times earnings. A market with 50 years of regular pricing tendencies can go completely nuts in 50 seconds.

Because you know anything can happen, you stay cautious toward the market.

You're also able to stay patient because you know somewhere, in some asset class, people will go nuts. That's just what they do from time to time. And you can be there to buy bargains from crazy Mr. Market.

SR: Thanks for your time.

Hunt: My pleasure.

Further Reading:

You can find more timeless investment advice from Brian here:

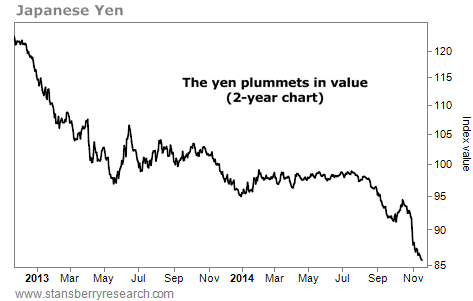

Market NotesA MAJOR CURRENCY IS PLUMMETING Today's chart is another installment in our "currencies are volatile" series. In the chart below, we focus on the Japanese yen.

Japan is the world's third largest economy... and the yen is its widely traded currency. In a desperate effort to stimulate the country's economy, Japanese leaders have enacted a huge "E-Z Credit" program to devalue the currency and stimulate the economy.

You can see the yen's price action in the 2-year chart below. The value of the yen has fallen from 120 to about 86... a 28% decline. That might not sound like much, but it's a gigantic move for a major currency in just a few years.

This price action shows that yes, currencies can be very volatile. It also shows that politicians may not be good at much, but they sure can devalue a currency when they put their minds to it.

|

Recent Articles

|