| Home | About Us | Resources | Archive | Free Reports | Market Window |

Where Interest Rates Are ACTUALLY HeadedBy

Monday, February 2, 2015

Who are you going to believe? The "King of Bonds" or your mortgage broker?

For years the experts have said interest rates HAVE to go higher. Your mortgage broker probably spent most of the last five years telling you that NOW is the time to refinance.

But interest rates keep heading lower... with mortgage rates following in their footsteps.

Instead of listening to your mortgage broker, let's listen to the "King of Bonds," Jeff Gundlach...

Jeff's the founder of DoubleLine Capital and earned his "King of Bonds" title by heading the TCW Total Return Bond Fund – one of the best-performing bond funds of the last decade.

Jeff's been adamant that interest rates will continue heading lower...

"The 10-year Treasury could join the Europeans and go to 1 percent. Why not? The European rates are at 1 percent. France is below 1 percent right now," he said recently.

That might seem crazy. But it's entirely possible. It matches the working script I've written about for years...

So far, my script has been so right that's it's actually approaching the point of ridiculousness... For example, earlier this month, for the first time ever, the Japanese government wasn't paying any interest on five-year Japanese government bonds.

No, the Japanese government didn't default on its debts... That was simply the interest rate on a five-year bond in Japan. Yes, it was zero. No, I am not kidding.

It's not just Japan... You are welcome to lend your money to the German government for the next five years for no interest. Heck, if you live in Switzerland, you'd consider yourself lucky to earn 0% interest. Five-year bonds in Switzerland have a negative interest rate.

Even worse, the Swiss government's short-term interest rate is now set at negative 0.75% – meaning that YOU have to pay THEM interest to keep your money in the bank!

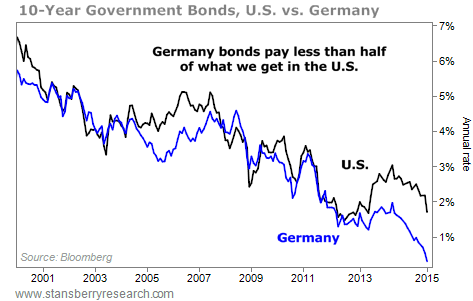

Here in America, we think earning 1.70% on a 10-year Treasury bond is terrible... But America is the "outlier." Take a look...

Most Americans think interest rates in America have to go up to go back to "normal." Your mortgage broker certainly thinks so... The average investor expects U.S. 10-year bond yields to soar back to 3% by the end of 2015. But we are not in "normal" times...

We have serious "deflationary" forces out there... The crashing oil price is just one example. The world economy is simply not doing that well. Governments around the world are trying to fight those deflationary forces by printing money and keeping interest rates low.

The "King of Bonds" thinks this is going to continue. He expects interests to continue lower. And I agree with him.

Who are you going to believe?

Good investing,

Steve

Further Reading:

Steve also thinks the soaring U.S. dollar will soon run out of gas. "Even if I'm wrong on timing, the dollar decline WILL start," he writes. "And that means now is the time to prepare your portfolio." Get the full story here.

Market NotesNEW HIGHS OF NOTE LAST WEEK

Blackstone Group (BX)... private equity

Home Depot (HD)... home improvement

Lowe's (LOW)... home improvement

Celgene (CELG)... biotech

CVS Health (CVS)... pharmacy

Anheuser-Busch (BUD)... beer

Constellation Brands (STZ)... wine and spirits

Altria Group (MO)... cigarettes

Wendy's (WEN)... fast food

Kraft Foods (KRFT)... food and beverage

Booz Allen Hamilton (BAH)... "offense" contractor

Boeing (B)... airplanes

Southwest Airlines (LUV)... airline

American Airlines (AAL)... airline

Toyota Motors (TM)... auto maker

Starbucks (SBUX)... expensive coffee

Sony (SNE)... electronics

Electronic Arts (EA)... video games

Waste Management (WM)... garbage men

NEW LOWS OF NOTE LAST WEEK

Credit Suisse (CS)... European bank

Bank of Montreal (BMO)... Canadian bank

Qualcomm (QCOM)... Big Cheap Tech

Mattel (MAT)... toys

Caterpillar (CAT)... heavy equipment

Joy Global (JOY)... heavy equipment

Arch Coal (ACI)... coal stock

Peabody Energy (BTU)... coal stock

U.S. Steel (X)... steel production

Range Resources (RRC)... natural gas production

Cameco (CCJ)... world's largest uranium miner

|

Recent Articles

|