| Home | About Us | Resources | Archive | Free Reports | Market Window |

Where to Find Big, Safe Dividends in 2015By

Wednesday, February 4, 2015

Right now, an unusual indicator says it's a great time to buy bank stocks.

If you're interested in earning dividends in 2015, it's worth hearing what this indicator has to say. It can help you safely earn a substantial amount of income with one of the market's cheapest sectors.

Let me explain...

Since the 2008 financial crisis, investors have avoided bank stocks. I'm sure you know the reasons why. People say banks are too complicated... they're taking on too much risk... they're vulnerable to financial crisis.

Regular readers of my Income Intelligence advisory know that I think things are getting better for the U.S. economy... and that fears of a financial crisis are overblown.

In fact, financial sector stocks are ripe with value.

Just take a look at bank profits. We can look at what a bank pays for capital and what it earns on it. It's called the "net interest margin." If a bank borrows at 2% (via deposits or in the money markets) and charges borrowers 5%, its net interest margin is 3% (5% minus 2%).

This is the indicator I mentioned above...

Right now, the net interest margin for banks is extraordinarily low at 3.3%. It's reasonable to think that's near a bottom. And when interest rates rise, it boosts the net interest margins for banks.

Remember, we'd rather buy bank stocks when margins are at a low, and then watch them rise. And if you look at the valuations on financial stocks – via the price-to-earnings ratio – they've trailed the overall market since the financial crisis. Put simply, financial stocks are cheaper than the rest of the market.

The finance industry is still changing from the financial crisis of 2008 and 2009. Banks are trying to get stronger and safer while still remaining profitable. But the global economy is built on financing... Whether it's an expanding factory in Vietnam, a major equity offering in Europe, or a small business loan in California, banks can claim to be a vital piece of making all of that happen.

And as the global economy grows... as commerce increases and more money passes back and forth between people, businesses, and nations... these companies will earn higher and higher profits.

If you're looking for safe dividend income over the next few years, take a look at bank stocks today.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig Jr.

Further Reading:

There's another sector Doc believes is a sure bet to keep growing... "It's a sector that has made my readers a lot of money... and will continue to make them money for decades to come." Get all the details here.

Last month, Doc explained what is possibly the most important question in personal finance... How much cash should you hold? "Most people don't spend too much time thinking about their cash..." Doc writes. "That's to your detriment."

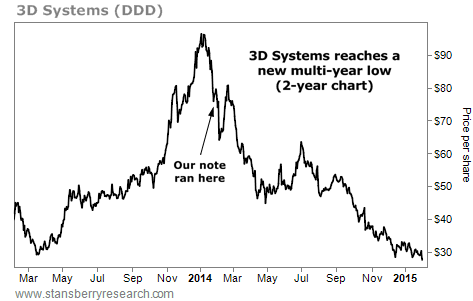

Market NotesAN UPDATE ON A POPULAR "STORY" STOCK Our warning to avoid "3D printing" stocks is still proving to be a heck of an idea...

Last January, we ran a warning on the market's top 3D-printing stock, 3D Systems (DDD). 3D printing is the printing of solid objects... rather than conventional "on paper" printing. The industry uses computers and special materials to "print" things like tools, guns, and toys.

Over the past few years, 3D printing has become one of the world's biggest tech stories. And with good stories come good stock rallies. Printer maker 3D Systems shot from $10 a share in late 2011 to $97 in early 2014. It's one of the biggest stock market winners in recent memory.

In our January warning, we noted that high-growth "story" stocks like 3D Systems often get far too popular with the investment public... and far too expensive. When growth rates slow, these stocks get slammed. Our note was well-timed. Since then, 3D Systems has suffered a huge fall from $76 to $28 (a 63% drop) and just reached a new multiyear low. It's a good case study in avoiding popular investments.

|

Recent Articles

|