| Home | About Us | Resources | Archive | Free Reports | Market Window |

Five Companies That Fit This Billion-Dollar Investment StrategyBy

Wednesday, March 25, 2015

What works on Wall Street?

James O'Shaughnessy literally wrote the book on it – it's called What Works on Wall Street.

Inside, O'Shaughnessy tested hundreds of investing strategies. But one strategy really stood out to us. It turned $10,000 into $1.84 billion from 1927-2009, with relatively low volatility.

Today, I'll share this strategy... along with five companies that fit it to a T.

Let's get started...

To follow O'Shaughnessy's $1.84 billion strategy, all you had to do was own companies that bought back their own shares and were in an uptrend.

Today, I'll show you five companies that fit that criteria... companies that are buying back shares and are also in an uptrend.

But first, let me answer a question you might have... Why are buybacks such a good thing?

Companies can return money to shareholders a few ways. The most common way is through dividends... However, the most powerful way is buybacks.

When a company repurchases (or buys back) its own shares, it shrinks the number of shares outstanding. That means you own a larger percentage of the company. Think of it like this...

Let's say you have 1,000 shares in Company XYZ. And XYZ's total share count is 100,000 shares. This means you own 1% of the total shareholder pie.

Company XYZ then buys back 50,000 shares. That takes the total share count down to 50,000 shares. You still own 1,000 shares. But those shares now represent 2% of the company, twice what they did before. You now own more of the company.

This makes buybacks equivalent to "secret dividends." Buybacks quietly give more wealth to existing shareholders. And according to James O'Shaughnessy, buying a basket of companies that are buying back shares – and are in an uptrend – beats the market.

(This is an idea we've written about many times before – see here and here. There's even a simple, "one click" fund that owns a basket of the best companies, based on buybacks.)

To find a handful of the best buyback companies, I did a simple screen. I looked for companies that are not only buying back their own shares... but that are also in a powerful uptrend.

These companies perfectly fit O'Shaughnessy's billion-dollar strategy. Take a look...

These five big companies have bought back 8% or more of their own shares in the past year. They all trade for below-market valuations. And they've all outperformed the S&P 500 over the past year. Owning companies that are buying back shares and are in an uptrend is a market-beating strategy. And these five companies meet that criteria perfectly.

Now, this isn't a "buy" recommendation for any of these individual stocks. But history shows that owning a basket of companies like these leads to massive, market-beating returns.

It's a strategy worth considering today.

Good investing,

Steve

Further Reading:

According to Steve, buybacks "work almost exactly like a dividend payment... but better." Find out why Steve likes buybacks better than dividends here.

Steve's colleague, Dan Ferris, also likes to invest in businesses that buy back lots of shares. Last year, he shared one of his favorites. "If you want the complete picture of how much cash a business is returning to shareholders, factor in buybacks," he writes. "And use that information to buy elite, high-yielding businesses like IBM." Get the full story right here.

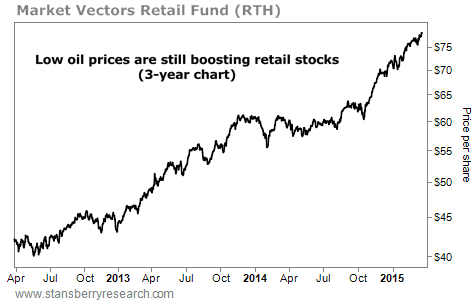

Market NotesLOW OIL PRICES ARE STILL BOOSTING THESE STOCKS A few months ago, we showed you that falling oil prices were boosting retail stocks... That's still the case today.

Read investment newsletters for a week and you're bound to come across people who claim the U.S. economy is in shambles. They say the "consumer is dead." The market is saying that idea is bunk, however...

We can monitor this idea with the Market Vectors Retail Fund (RTH). It's an investment fund that holds a basket of "spending stocks" like Wal-Mart, Home Depot, Macy's, Target, Amazon, and Lowe's. It's a fund that rises and falls with the health of the American consumer.

As you can see below, the American consumer is alive and well. RTH has nearly doubled since late 2011... and is up 30% since oil started plummeting last summer. Because oil's byproduct, gasoline, is a large expense for families, falling oil prices are giving this uptrend a boost. As we often say, with cockroach-like resiliency, the American consumer lives on.

|

Recent Articles

|

|||||||||||||||||||||||||||||||||||||||||||