| Home | About Us | Resources | Archive | Free Reports | Market Window |

This Currency Lost a Quarter of Its Value Overnight, and That's GoodBy

Thursday, December 31, 2015

Argentina's currency lost a quarter of its value in one day earlier this month...

And that's a good thing.

How could that be a good thing? Here's how...

Argentina's new President Mauricio Macri said he would make massive free-market changes in the country – including lifting the government controls on the currency – to attract investors and to kick-start the economy.

He has lived up to those promises... In his first two weeks as the country's leader, he has removed most agricultural export taxes, cut personal income taxes, and eliminated farming quotas.

"It's necessary to remove all current conditions that go against transparency, simplicity, openness and reason," the government said this week.

This is actually exciting stuff...

It could be the start of a major turnaround in one of my favorite places on the planet.

Nobody in the investment world is paying attention to Argentina today – and that's something I like to see.

Meanwhile, you have new political leaders in place that have the strength to sacrifice a major short-term loss for a long-term gain. I'm not sure we have any U.S. politicians that would be willing to sacrifice 25% of the people's savings overnight to make things better over the long run.

Buenos Aires, if you don't know, is truly the Paris of the Americas. Bariloche is an undiscovered gem and one of my favorite places to visit. And Cafayate is a little oasis of perfection. I could go on – I love Argentina.

Throughout history, the country has been blessed with great lands... and cursed with terrible politics. The result of poor political policies is clear: Argentina was the picture of success in 1910 – one of the world's top-10 largest economies. Over the last hundred years, it has fallen to 55th on the list – an incredible fall.

The new president is quickly undoing the policies of his predecessor, attempting to reshape Argentina into a more free-market country.

I am hopeful... both as a person who loves Argentina, and as an investor...

You see, often when an emerging-market country makes free-market changes like these, the stock market can rise hundreds of percent. So hopefully, they'll stick.

The simplest way to own Argentina is through the Global X MSCI Argentina Fund (ARGT).

As I write, this fund is still bouncing along near its 2012 bottom. There are no signs of life in Argentine stocks yet. But I suspect there will be. I look forward to seeing an uptrend in shares of ARGT.

Keep an eye on Argentina, and ARGT, in 2016. I know I will...

Good investing,

Steve

Further Reading:

Steve is also keeping his eye on Japanese stocks right now. He says they're a good choice today if you're looking to diversify some of your investments out of U.S. stocks. "We have a lot of things going for us... value, outperformance, and now seasonality..." Read more here: A Crazy Anomaly Is Setting Up Now in This Stock Market.

On Tuesday, Steve told readers that "it would be absolutely foolish for the Fed to raise interest rates very much in 2016..." Steve says the U.S. high-yield bond market is sending serious warning signs today. Get the details right here.

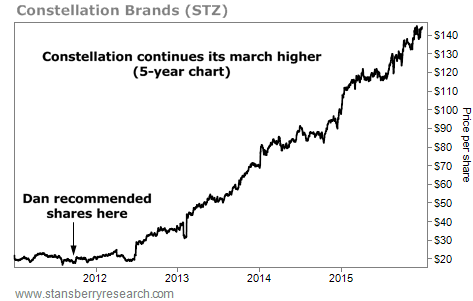

Market Notes2015 YEAR IN REVIEW: MORE BIG GAINS FOR THIS TOP RECOMMENDATION It was a fantastic year for one of the most successful recommendations in our company's history...

As regular readers know, we don't think you need to invest in complicated, "exciting" stocks to make money. Companies that sell things like packaged foods, power tools, cleaning supplies, and cigarettes often make for some of the best investments in the market. Selling booze is another prime example...

Constellation Brands is a World Dominator when it comes to alcohol. It's the third-largest beer supplier in the U.S., with brands like Corona and Modelo. It's also responsible for top-selling wine brands like Robert Mondavi and spirits brands like Svedka vodka. It's the type of company that has major advantages over competitors, brings in stable cash flows, and offers shareholders a "worry-free" way to safely compound wealth in the stock market.

Constellation is a longtime favorite of Extreme Value editor Dan Ferris. Readers who took his advice and bought shares back in 2011 have made more than five times their original investment. And the huge uptrend has continued in 2015... shares are up 40%-plus and just hit a new all-time high...

|

Recent Articles

|