| Home | About Us | Resources | Archive | Free Reports | Market Window |

This Is the PERFECT Time to Generate Big IncomeBy

Friday, February 26, 2016

We get it... you're worried.

The bad news is easy to repeat: The market celebrated the New Year by stumbling down 9% right out of the gate... the worst start to a year ever. And it's still down 5% year-to-date...

It's naturally concerning to get up every morning to see more red (negative) numbers on Yahoo Finance.

But if you only take away one message from today's essay, we want you to understand... Nothing unusual is happening in the market.

Declines of this magnitude don't signal the end of prosperity. They are normal market movements. If you hold high-quality, long-term investments in your retirement accounts... don't worry. Building wealth comes from holding for the long term – including through market dips.

But what about options trading? What does the recent market volatility mean for the kind of short-term trades we open in my newsletter, Retirement Trader?

The good news: Right now is an ideal time to trade options the way we do... With this correction, we have a greater opportunity to profit.

Below, I'll show you exactly what I'm talking about. We'll take a close look at how the market really works. You'll see that even though the news makes it sound like the world is ending, the market is behaving normally...

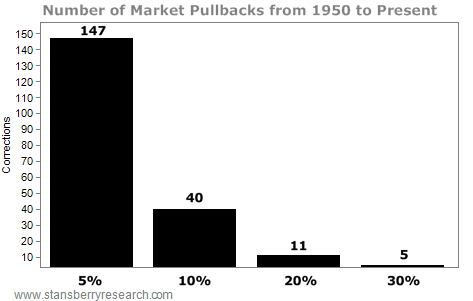

By our count, from 1950 to 2015, the market experienced 47 pullbacks of 5% or more, 40 "corrections" of 10% or more, and 11 "bear markets" of a 20% drawdown. (In the unofficial vocabulary of Wall Street, a "correction" is a 10% fall and a "bear market" is a 20% fall.)

The following chart tells the story:

This tells us a few things. First, the correction that we're experiencing right now is normal. It happens about every 1.6 years (though not on a set schedule, of course). Second, it's extraordinarily difficult to "trade around" these normal market movements.

If the market fell 5% and you sold shares in a panic... you would have been wrong 73% of the time. In 107 out of 147 pullbacks, a 5% fall represents the bottom, and then the market rebounds... So you would have sold low, and the market would have recovered without you.

Say you're a little more stouthearted and you wait until the market falls to 10% to sell. This would mean that you're trying to avoid a bear market drop of 20% or more. Even then, you'd be wrong 72.5% of the time – only 11 out of 40 pullbacks of 10% or more turn into bear markets. And again, the market will rise without you.

Selling in a panic rarely pays off. Don't do it.

As I've told you before, we don't do fear. We do rationality and preparation. We don't trade based on emotion.

That's why we've added defensive plays to our Retirement Trader portfolio to prepare.

And as always, we only trade on stocks that we'd like to own.

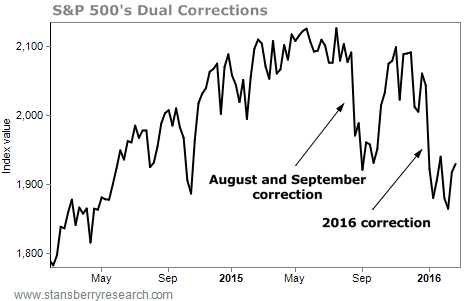

Corrections like these are a part of the business. In fact, we dealt with one in August. Take a look...

As you can see, the market bounced back quickly. That's the norm. But we don't know for sure if that's what will happen in this correction. The market may decline some more. It may stay level for a while.

The important thing is, we know how to take advantage of what's happening.

Remember... options prices are determined by volatility.

When volatility is high, options get more expensive. It's built into the way options are priced. In a simple sense, you can think of those who BUY puts as people buying insurance contracts. Those people are willing to pay a lot more for insurance when they are scared.

For those who SELL puts, this is good. We're like insurance sellers. We can earn more income on the exact same trades simply because people are willing to pay more out of fear.

The recent correction has boosted volatility and options prices, which means the trades we open during market corrections should generate higher returns than we would make by simply buying stocks.

We don't expect you to enjoy corrections like this. They are stressful. It feels like the market is doomed to continue falling.

But that's simply not true. Remember this, and you can profit.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig

Further Reading:

Last month, we shared a special three-part options-selling series from Doc. You can learn more about his strategy below:

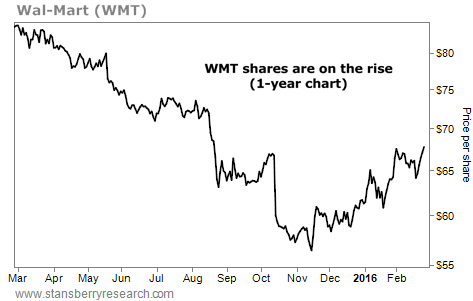

Market NotesA STRONG START TO 2016 FOR THIS WORLD DOMINATOR The World Dominator of retail isn't going away any time soon...

Longtime readers know investing in World Dominators is one of the best, safest strategies for long-term investing success. These businesses sport thick profit margins, consistent cash flows, and relentlessly raise their dividends. Their brand recognition and customer loyalty often make them the No. 1 companies in their industry.

Wal-Mart (WMT) is the world's largest retailer. It has around 11,500 stores in nearly 30 countries. It sells everything from baby clothes to groceries... and it sells them cheap. And like most World Dominators, Wal-Mart constantly finds ways to beat the competition by opening more distribution centers and improving its online presence. The company is even testing drones to improve shipping times.

The stock had a rough 2015, dropping more than 30% from January to November on concerns of shrinking profit margins. But shares have climbed steadily ever since, rising 15% since December. The trend is UP for one of the best businesses in the world...

|

Recent Articles

|