| Home | About Us | Resources | Archive | Free Reports | Market Window |

Exactly What I Do With My Own MoneyBy

Tuesday, March 1, 2016

"How do you invest your own money, Steve?"

People ask me that all the time...

Some of these folks are looking for a very technical answer (like what percentages I invest in stocks and bonds, and how I come up with those).

Others are actually just looking for a hot tip. (The best hot tip is this: There is no such thing as a hot tip!)

I will share with you what I do with my own money today...

Upfront, you need to know that what I do with my money is probably NOT the right thing for you to do with your money.

I break "the rules"...

However, if you know the rules, and if you are strong enough to cut your losses when necessary, you can consider doing what I do...

I can sum up what I do with my own money very simply:

I wait for the fat pitch.

I am often "under-invested." I don't typically own a lot of stocks just because "I'm supposed to." Instead, I wait for an extraordinary situation – a fat pitch.

The idea of "the fat pitch" comes from the most successful investor of all time... Warren Buffett. He said:

Fat pitches don't happen often. Sometimes you have to wait years for them to appear. For example, I thought my fat-pitch opportunity in U.S. real estate would never appear...

I'd been an investor for decades, but I'd never bought U.S. real estate as an investment.

It was never cheap enough for my standards. It was never a fat pitch.

I thought I'd gotten it wrong. Plenty of people around me had gotten rich through real estate. But I had an aversion to borrowing money... And I didn't see the dramatic upside potential.

Then it happened... We had the worst real estate bust in generations. And mortgage rates hit their lowest levels in generations. I got my fat pitch. And I swung, starting in 2011.

Before the "great bust" in the U.S. real estate market, I had never bought any property in the U.S. (except for my home) – because I never saw my fat pitch. Now, Florida real estate is the biggest part of my investment portfolio, by far.

Fat pitches like the great real estate bust don't come along every day. Personally, I have been very patient...

I swung the bat just three times in the last 10 years.

Here's what I did:

Fat Pitch No. 1: In late 2008, I saw a fat pitch coming in stocks. I bought all I could – and I even took out a home-equity loan to buy even more. That's the only time I've ever done that. I was a bit early – the real bottom was March 2009. But it worked out fantastically... I paid off the home-equity loan a little more than a year later out of my profits.

Fat Pitch No. 2: In 2011, I started buying Florida real estate heavily. I may have gone overboard... but the fat pitch was too good. In one deal, I bought a couple hundred acres for 90% less than they were worth under contract just two years before. And just last week, I signed a contract to sell a condo for twice what I paid for it – less than three and a half years ago.

Fat Pitch No. 3: Late last year, I started building up a portfolio of microcap gold-mining stocks. This sector had lost more than 90% of its value in the previous four years. It was the cheapest it had been in a generation, at least.

Like U.S. real estate a few years ago, I had never invested a significant chunk of my money in gold stocks – until now.

By buying small gold stocks late last year, I was a full three months early... Fortunately, I didn't lose much. Importantly, I cut my losers when they hit new lows, and I added to my winners. Then the last month hit... and gold stocks soared!

I am up dramatically... and I plan to stay in for a while.

Waiting on "the fat pitch" works for me...

It is challenging.

I think about life in a unique way... I think that 98% of the time, life is ordinary. The other 2% of life is extraordinary moments...

If you are capable of recognizing those "2% moments" and acting on them to the fullest extent possible, then you can potentially generate extraordinary returns.

I am constantly on the lookout for those extraordinary moments in life and in investing, and I try to make the most of them.

Whether this way of thinking is right or not doesn't actually matter... I believe it – and it works for me!

Again, I am not suggesting that you follow my "fat-pitch" way of investing. But if you want to know what I do with my own money, and how I think about it... now you know...

Good investing,

Further Reading:

Yesterday, Steve showed readers that things are actually better than people think right now. But most investors don't see it this way... And this fear is creating an opportunity. "Are you bold enough and contrarian enough to pull the trigger?" Steve asks. Get the full story here.

"Everyone wants to be the hero and call the bottom," Steve says. "But the bottom doesn't happen until everyone gives up." Right now, investors are still trying to perfectly time the bottom in oil and energy stocks. Instead of betting on a recovery, learn what you should be doing right here.

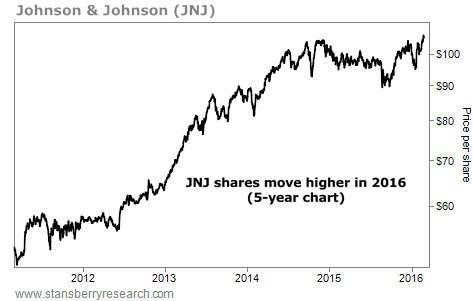

Market NotesTHIS HEALTH CARE GIANT PUSHES HIGHER Another one of the world's best businesses is jumping higher...

Last week, we highlighted the uptrend in World-Dominating retailer Wal-Mart (WMT). As we mentioned, investing in these kinds of companies is one of the safest investing strategies on the planet. These companies have great brand recognition and customer loyalty and sit at the top of their industries. Today, another one of these elite businesses is thriving... health care giant Johnson & Johnson (JNJ).

Johnson & Johnson has been a leader in consumer health care products, medical devices, and pharmaceuticals for decades. The company's brands include more than 275 products, like Band-Aids, skin-care brands Neutrogena, Clean & Clear, and Aveeno, mouthwash Listerine, pain reliever Tylenol, sinus/congestion reliever Sudafed, and allergy medicine Benadryl. There's a good chance you'll find Johnson & Johnson's products somewhere in your medicine cabinet.

Best of all, Johnson & Johnson's business thrives in good times and in bad... and it has a long, profitable history. Shares are up more than 70% over the past five years. And now the stock is gaining momentum again, hitting a new 52-week high last week. Investing in businesses that can weather any economic environment continues to be a winning strategy...

|

Recent Articles

|